The West Texas Intermediate Crude Oil market rallied again during the trading session on Wednesday as traders started to focus on the holiday. This market will continue to go a bit higher, because many people are trying to price on the prospect of a post-vaccine world. The iddea is that there will be more demand for energy, despite the fact that there is almost none now. In addition, there was a significant lack of demand pre-coronavirus, so we will likely see more disappointment eventually.

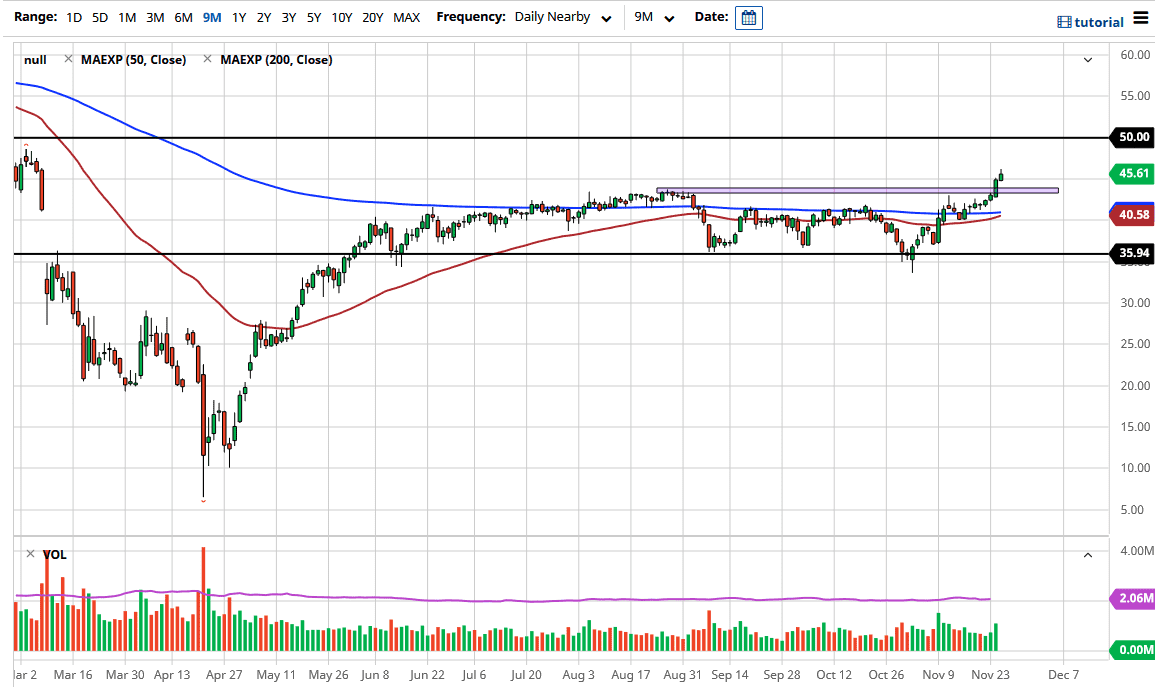

In the meantime, however, it looks like the market is ready to go higher and you certainly cannot argue with price. Longer-term trading opportunities differ greatly from short-term ones, as we still have a lot of “exuberance” out there. In the next two days, though, there will be serious issues when it comes to liquidity, because as Thanksgiving becomes the focus of the biggest players in North America, trading will be done electronically overseas. We may see erratic movement on short-term charts, but it looks like energy will try to go higher over the next couple of weeks, perhaps with an eye on the $50 level.

If we were to turn around and break down below the 50-day or 200-day EMA indicators, that would be very negative. But right now, short-term pullbacks will continue to attract attention, because people will be looking for a way to join what has been a very obvious break above significant resistance. The market will continue to go higher, but we will get the occasional short-term pullback and you should take advantage of those. As long as the market continues to focus on the good news, crude oil will continue to go higher, despite the fact that there is still way too much in the way of supply.