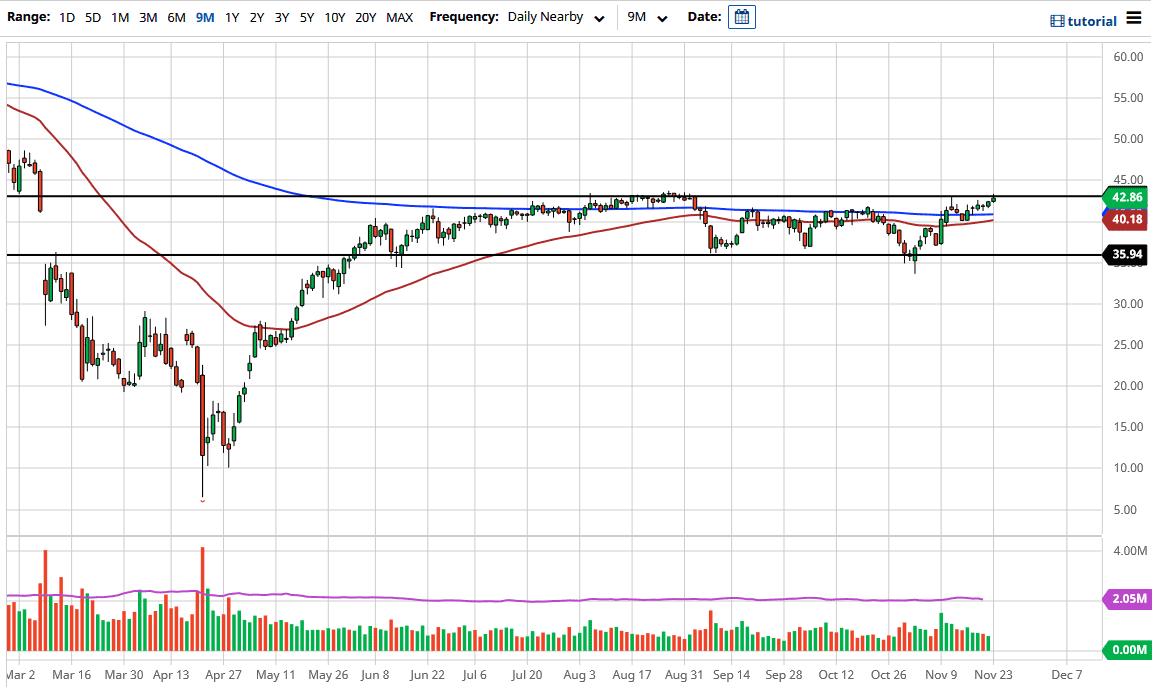

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Monday as we returned to work. However, the market is likely to be a bit thinner than usual as we have the Thanksgiving holiday this week. That can cause rapid movement, so it may not be as reliable as it typically would be from a technical analysis standpoint.

Looking at this chart, the $43 level is a massive level that we should be watching, because we have seen a lot of selling in this area towards the beginning of September. It is the top of the overall consolidation area, so if we do pull back from here it would simply be a continuation of what we have seen for a while. However, a lot of traders are out there trying to figure out whether or not there is going to be a move based on perceived demand going forward, as the coronavirus vaccine coming next year could drive up demand in general. I do not totally buy this theory, mainly because we had already seen an oversupply of crude oil prior to the coronavirus outbreak. Nonetheless, price is truth; so if we break out above the $44 level, the $45 level would be targeted, followed by a potential break out towards the $50 level.

On the other hand, if we turn around and break back down, we could make a move towards the $41 level initially, as the 200-day EMA sits there. After that, we have the 50-day EMA sitting closer to the $40 level. I suspect that signs of exhaustion will be jumped on by sellers, because we have a lot of oversupply out there. Pay attention to the US Dollar Index, because it will have a major influence on commodity markets in general. It should be noted that the dollar got a huge push in the middle of the New York session, but it did not have as much of an effect on the crude oil market as we had seen previously. You are probably better off waiting 24 hours to see what the next daily candlestick brings, as we are at such an inflection point.