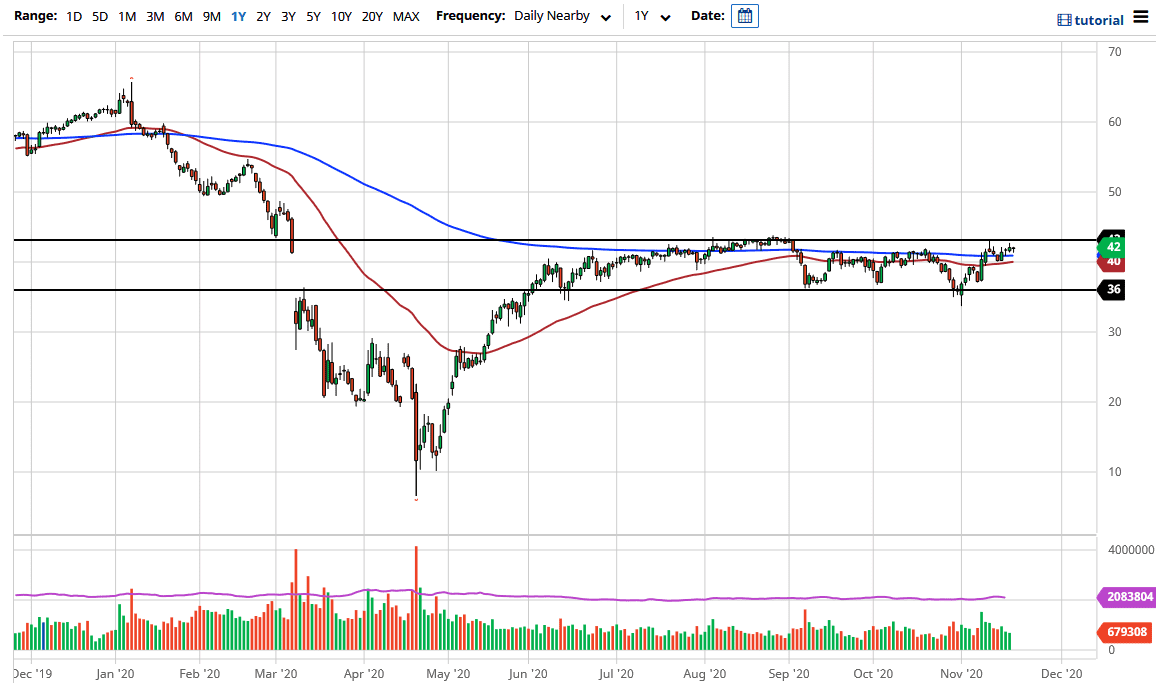

That being said though, this is a market that continues to see a lot of volatility, but I think that this is a market that we are getting very close to the top of the overall range and therefore I think it is only a matter of time before we pull back just a bit.

If we break above the $43 level, then the market is likely to go towards the $45 handle, and then possibly even the $50 level. All things being equal, this is a market that I think will eventually try to make a bigger decision but it is difficult to imagine that the crude oil demand is going to be strong due to the fact that global economies are starting to lock down. That being said, the demand for crude oil will probably fall as a result and quite frankly we have far too much in the way of supply out there to run out of it anytime soon.

The 200 day EMA sits just below, just as the 50 day EMA does. The moving averages are flat, so essentially, they are telling us that the market is still stuck in this range and momentum has not picked up yet. That being the case, I think we probably will be able to slice through them going lower without too many issues so I would not look for them to offer too much in the way of support, lease not something that can withstand a major selloff. It should be noted that some of the inventory number lately have been dismal, so I do think it is only a matter of time before we roll over again. However, if we were to break above the $43 level, then you will see a major short covering rally based upon the levels I mentioned previously. At this point, I think it is probably more or less going to be a short-term back-and-forth trading scenario, just as we have seen for the last several months. Keep an eye on the US Dollar Index because it does have a certain amount of negative correlation to this market.