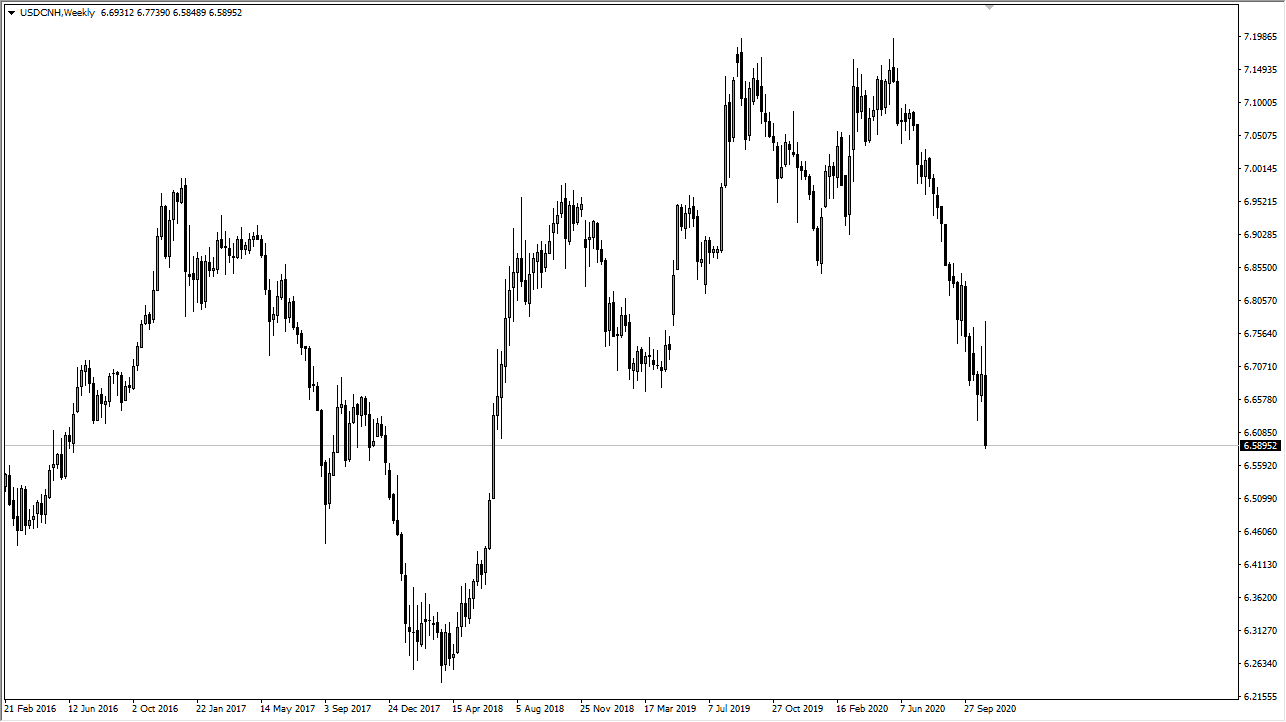

EUR/USD

The Euro exploded to the upside during the trading week, reaching towards the 1.19 level before stalling on Friday. This is a continuation of the overall choppiness that we have seen, and now that the election looks like it still hangs in the balance as far as legal challenges are concerned, we are probably stuck in this range. With the potential for explosive news coming out on the weekend, any failure at the 1.19 level should be watched closely, as it could lead right back towards the 1.16 level. As far as breaking out is concerned, we need to get above the 1.20 level.

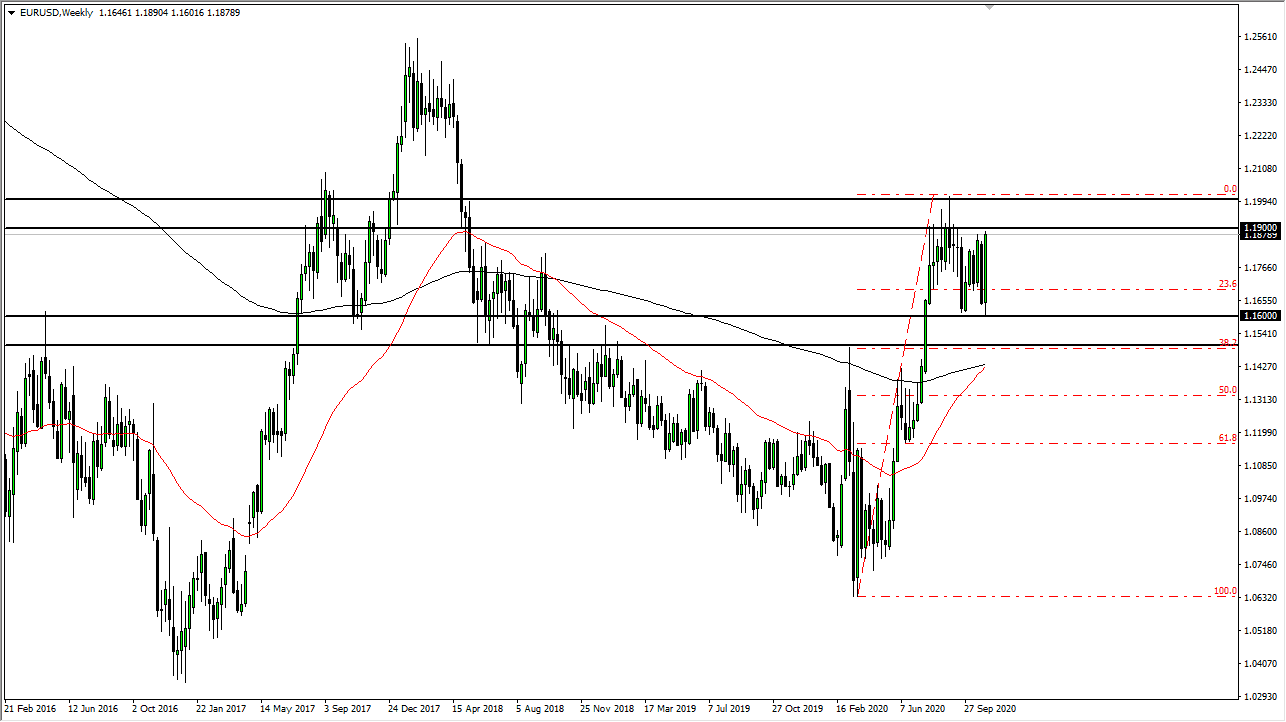

AUD/USD

The Australian dollar has also rallied significantly during the course of the week, but looks as if it is stalling just below the 0.73 level yet again. The market looks as if it is simply trying to kill time in order to decide where to go next. It looks like stimulus may be smaller than anticipated, in which case that may actually provide a boost for the US dollar. The Reserve Bank of Australia is going to be offering more quantitative easing, so that could but downward pressure as well. It still looks as if we are in a range.

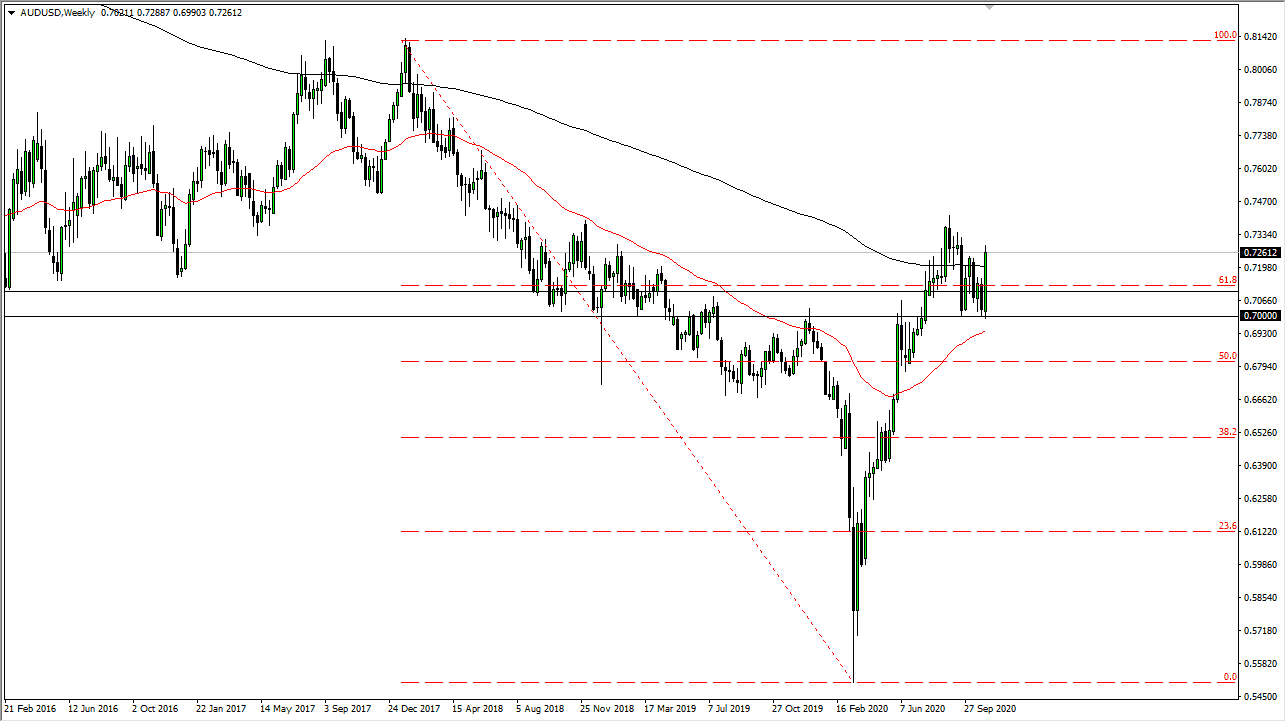

GBP/JPY

The British pound initially tried to rally during the course of the week but continues to find the ¥138 level as resistance. Underneath there, the ¥135 level offers support, so we are still stuck in the same situation. However, if we break down below the candlestick for the previous week, we could go down towards the ¥133 level. To the upside, if we were to break above the ¥138 level, then the market goes looking towards the ¥140 level above. Remember, this pair is sensitive to risk appetite and all things Brexit related.

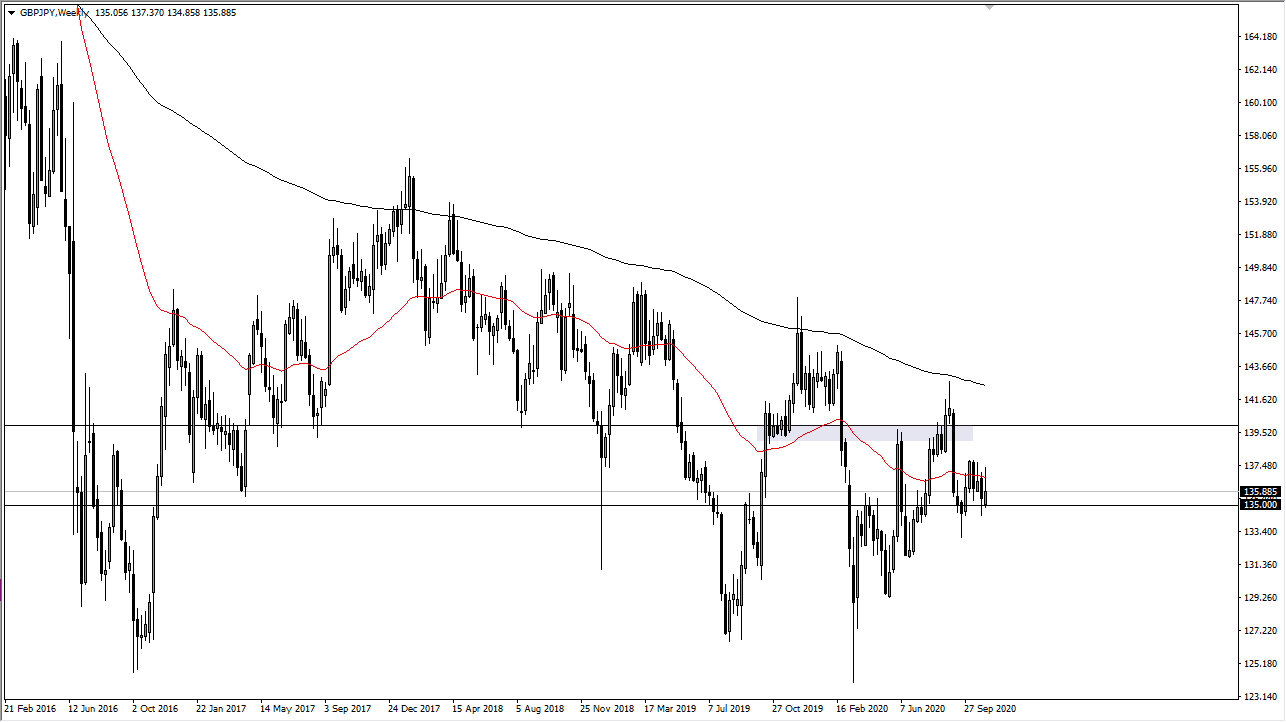

USD/CNH

The US dollar initially surged higher against the Japanese yen when it looked like Donald Trump would win the presidency. But the market looks very likely to continue going lower, as we have crashed over the last several sessions of the week. We are now approaching the 6.5850 region, and it is likely that we could continue to go lower. However, one has to wonder how much longer the Chinese will put up with this? Right now, this is a play on the COVID-19 situation, as China seems to have everything under control. Fading rallies probably continue to be the way forward.