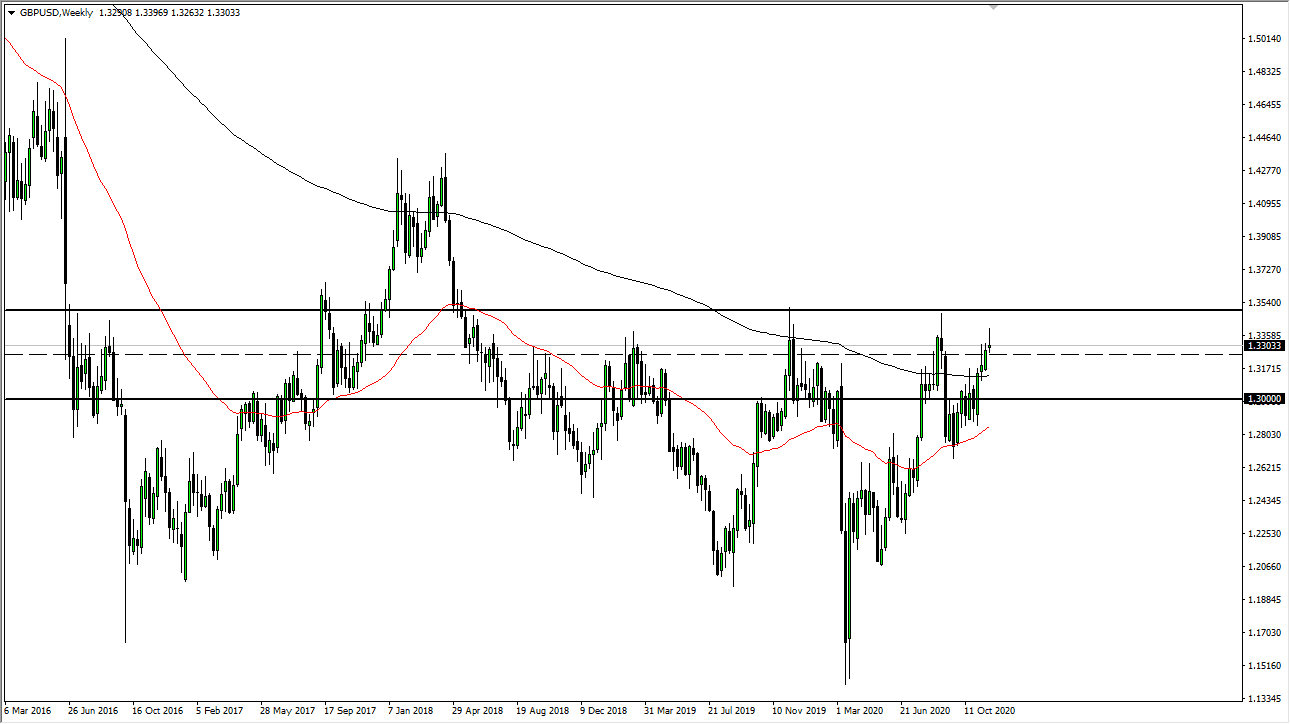

GBP/USD

As usual, the market is watching the British pound with great interest, as we continue to hear noise surrounding Brexit. Unfortunately, the market is likely to fluctuate when it comes to the overall attitude, and Friday saw a significant amount of selling. However, there are still plenty of buyers underneath, so if you see a significant pullback you should be looking to take advantage of signs of support. Yes, Brexit drags on ad infinitum, but most participants still believe a deal is in the pipeline.

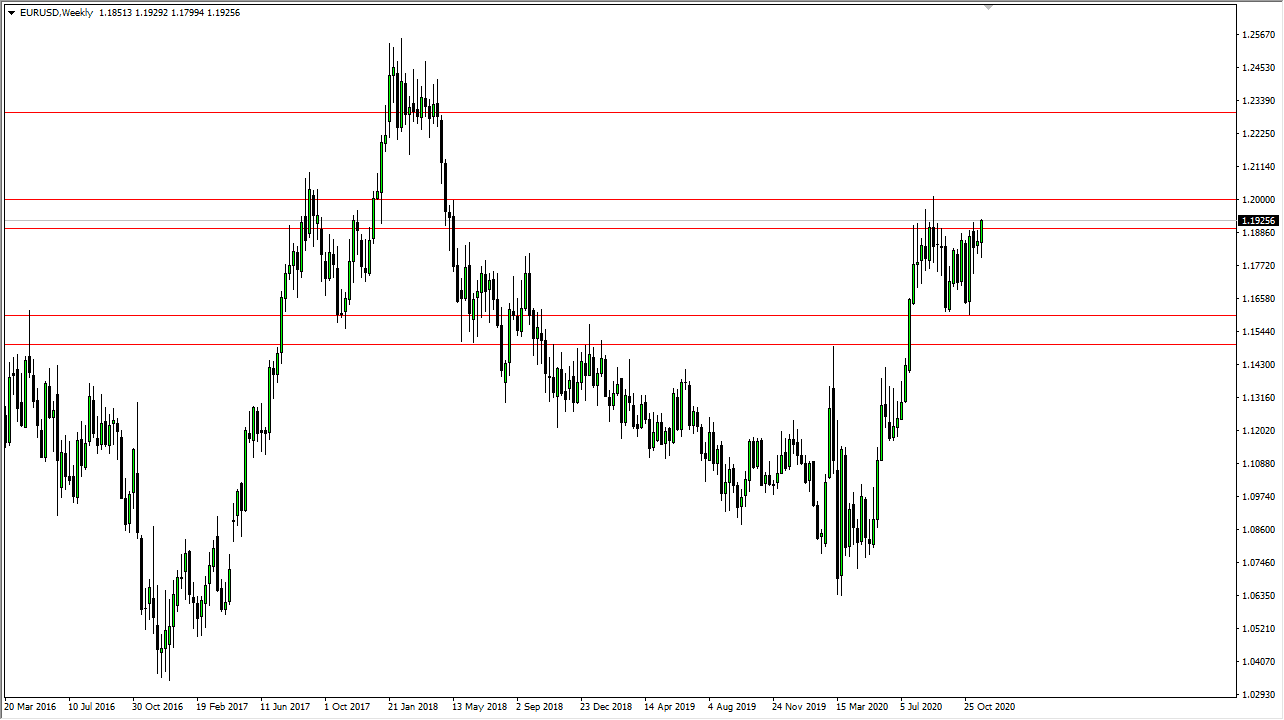

EUR/USD

The euro initially fell during the week but had a couple of strong days towards the end of the week in what might have been thin volume. If we can break above the 1.20 level, it is likely that the market will finally break out and go looking towards the 1.23 handle. In the meantime, short-term pullbacks will probably continue to attract a bid, so looking for value continues to be the best way to trade this market. I do not expect an easy path forward, but it certainly looks as if the euro is trying to take off.

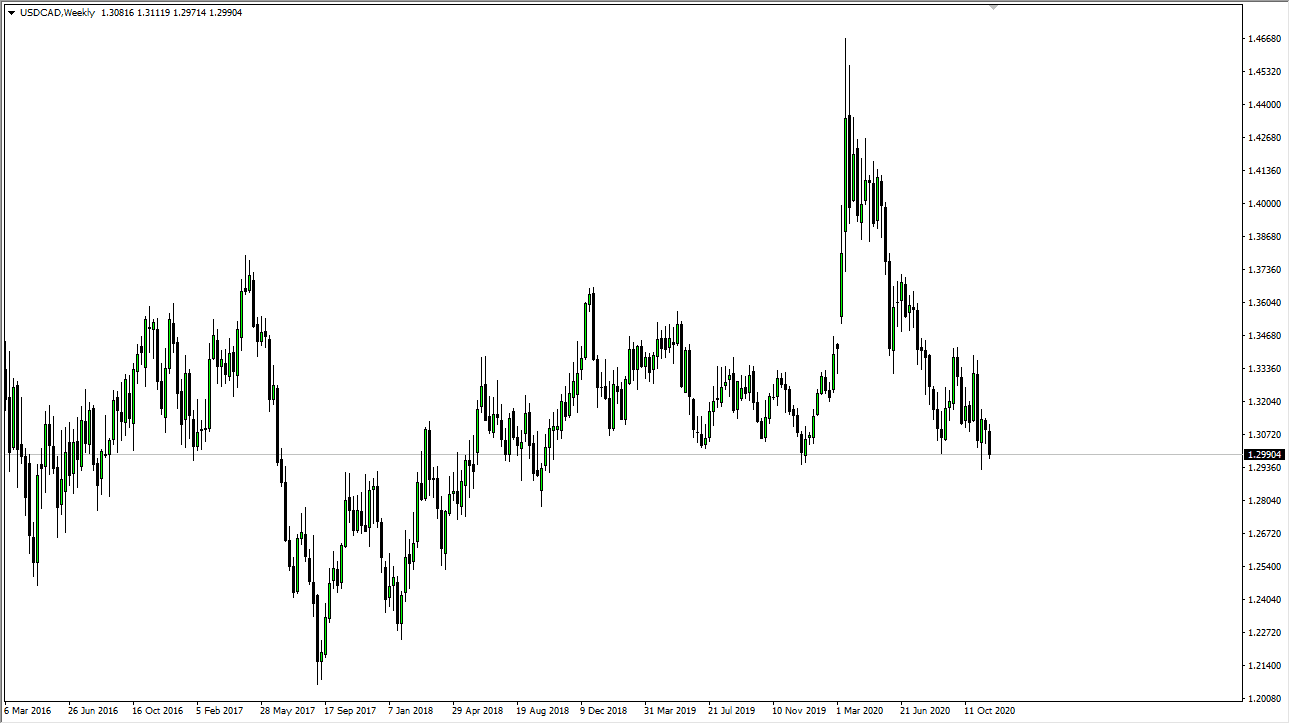

USD/CAD

The US dollar sits on the precipice of a fairly significant break down against the Canadian dollar. The region between 1.29 and 1.30 has been crucial more than once in this pair, so I think this week could be rather tough. Obviously, if you look at a very extreme long-term chart, you can see that there is plenty of support underneath. However, if we were to break down below the 1.29 level, the “bottom would fall out.” In the meantime, fading short-term rallies probably continues to work, but a break above the 1.3150 level could turn things around for a bigger move.

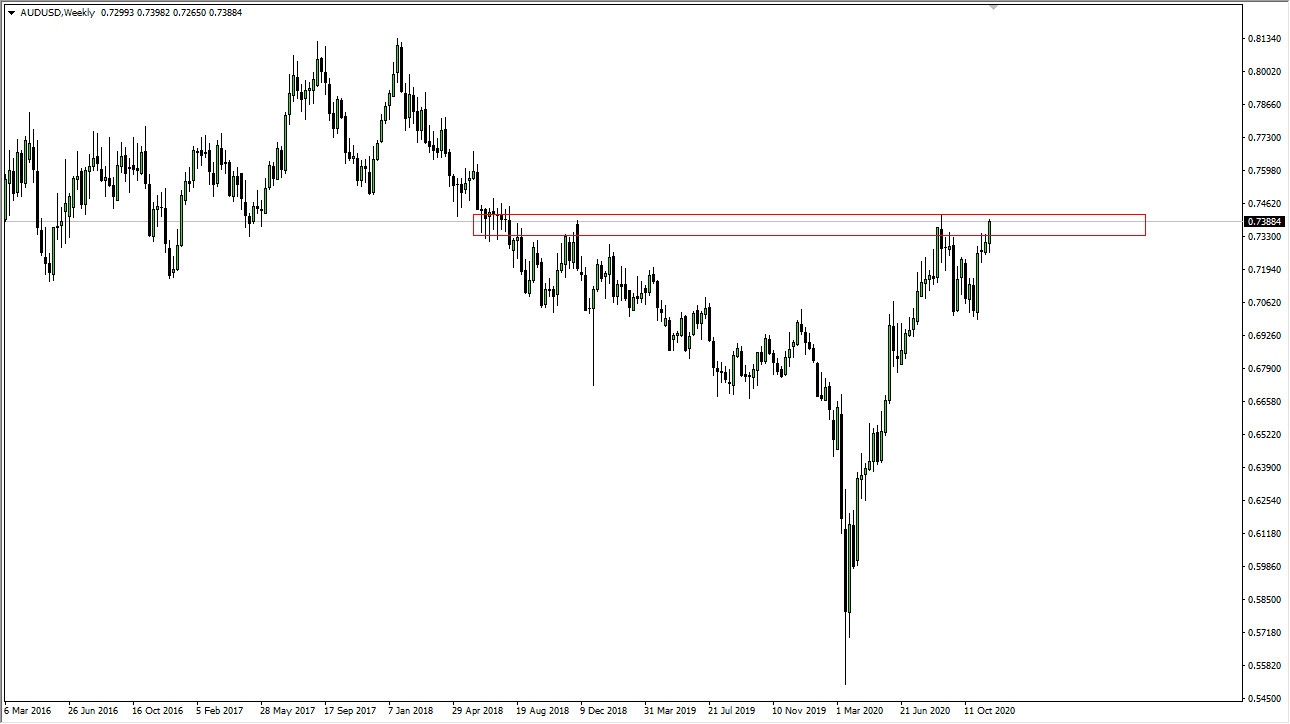

AUD/USD

The Australian dollar continues to rally, and it now looks as if we are trying to break above the 0.74 handle. The market is likely to go to the upside and perhaps finally break out. I believe this is a sign of things to come, so short-term pullbacks will continue to be bought into as traders around the world are trying to price on a post-COVID-19 world. This should drive up demand for commodities, and therefore demand for the Aussie dollar. However, if we were to break down below the 0.7250 level, then we will have to “reset” closer to the 0.71 handle.