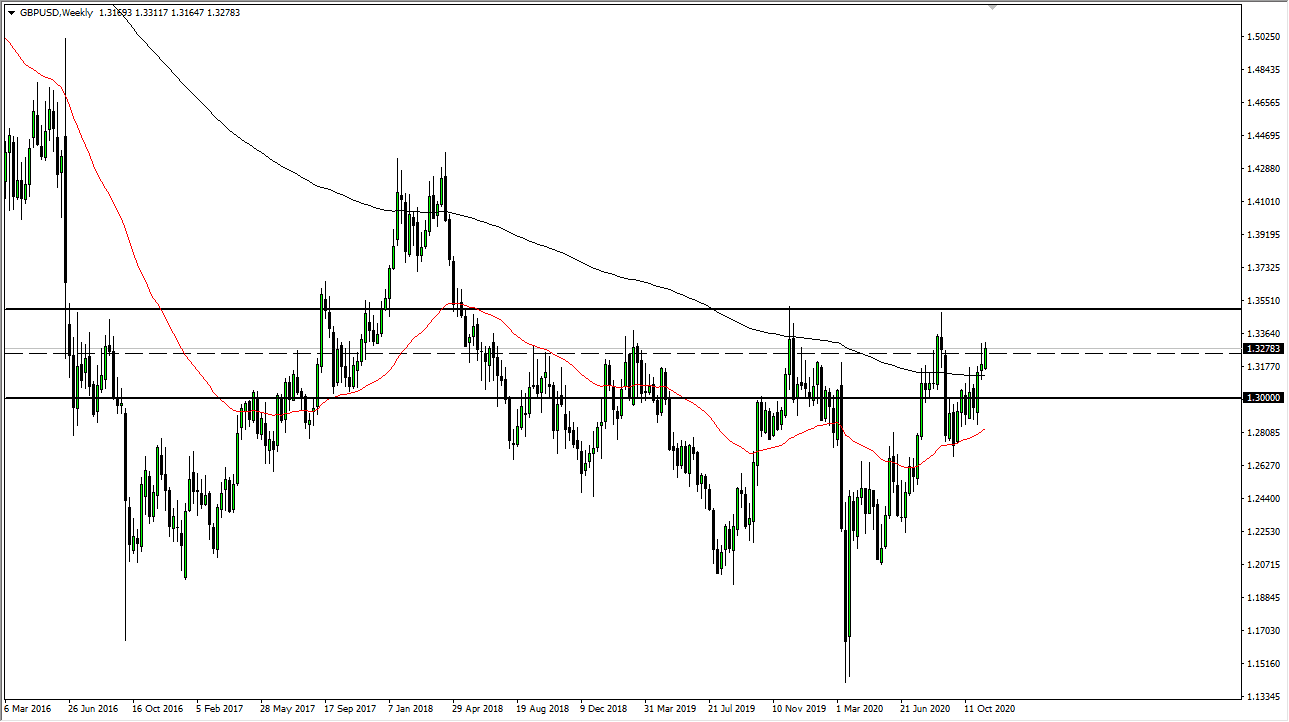

AUD/USD

The Australian dollar spent most of the week trying to rally but continues to struggle with the 0.7350 level. The market has pulled back a bit to show signs of exhaustion. We continue to try to break out, but a short-term pullback should be an opportunity. If we break above the 0.7350 level on a daily close, then the market will go looking towards the 0.75 handle. There is a lot of noise in this area because the Reserve Bank of Australia is likely to keep loose; but then again, so does the Federal Reserve. I see massive support underneath at the 0.71 handle.

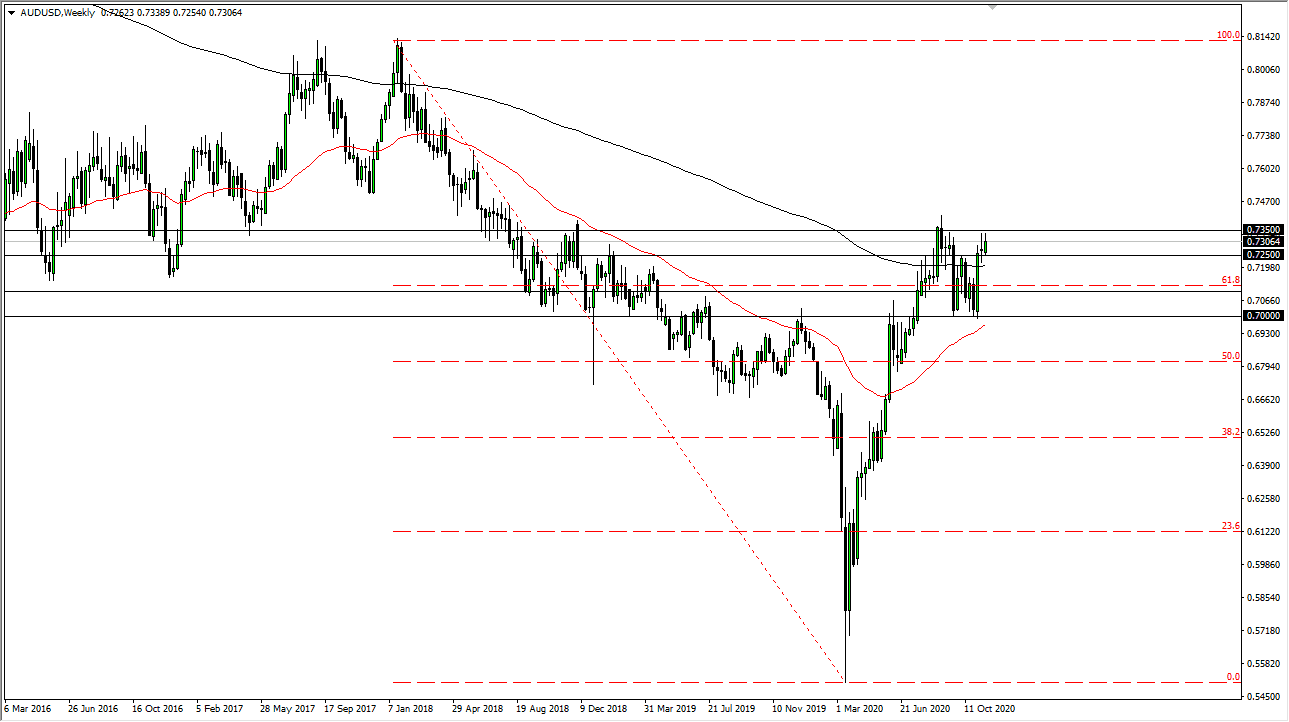

EUR/USD

The euro initially tried to rally during the course of the week, reaching towards the 1.19 level. That is an area that has been massive resistance which extends to the 1.20 level above. It looks as if we are going to stick to the same range, between the 1.15 handle and 1.20 level over the longer term. The next week will probably see some pullback, but this is a market that continues to be very noisy in general. However, if the market were to break above the 1.20 level, then we have the “green light” to go towards the 1.23 handle.

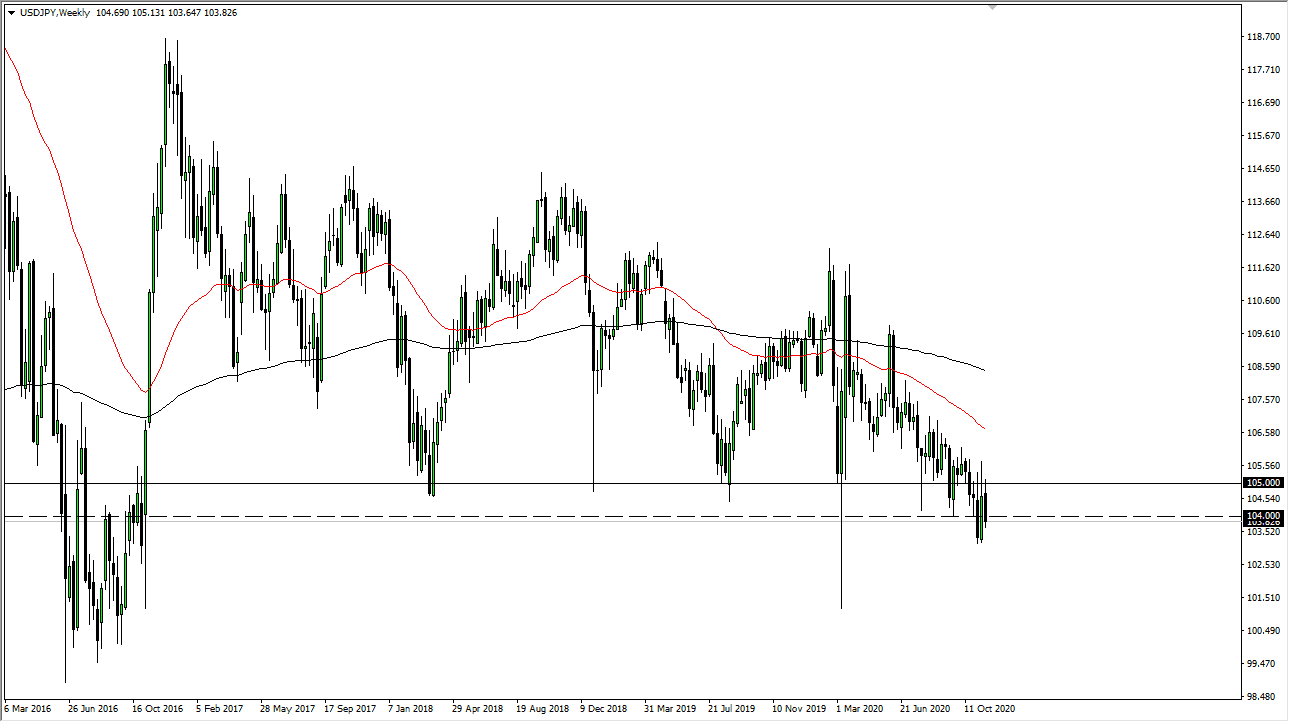

USD/JPY

The US dollar initially tried to rally during the course of the week but found the ¥105 level to be too expensive. The market pulled back and crashed through the ¥104 level. We will eventually continue the downward pressure though, as the US dollar is getting beaten up by the Federal Reserve and the world at large. Furthermore, the Japanese yen is considered to be a safety currency, something that many people will be looking towards. I think short-term rallies continue to be selling opportunities.

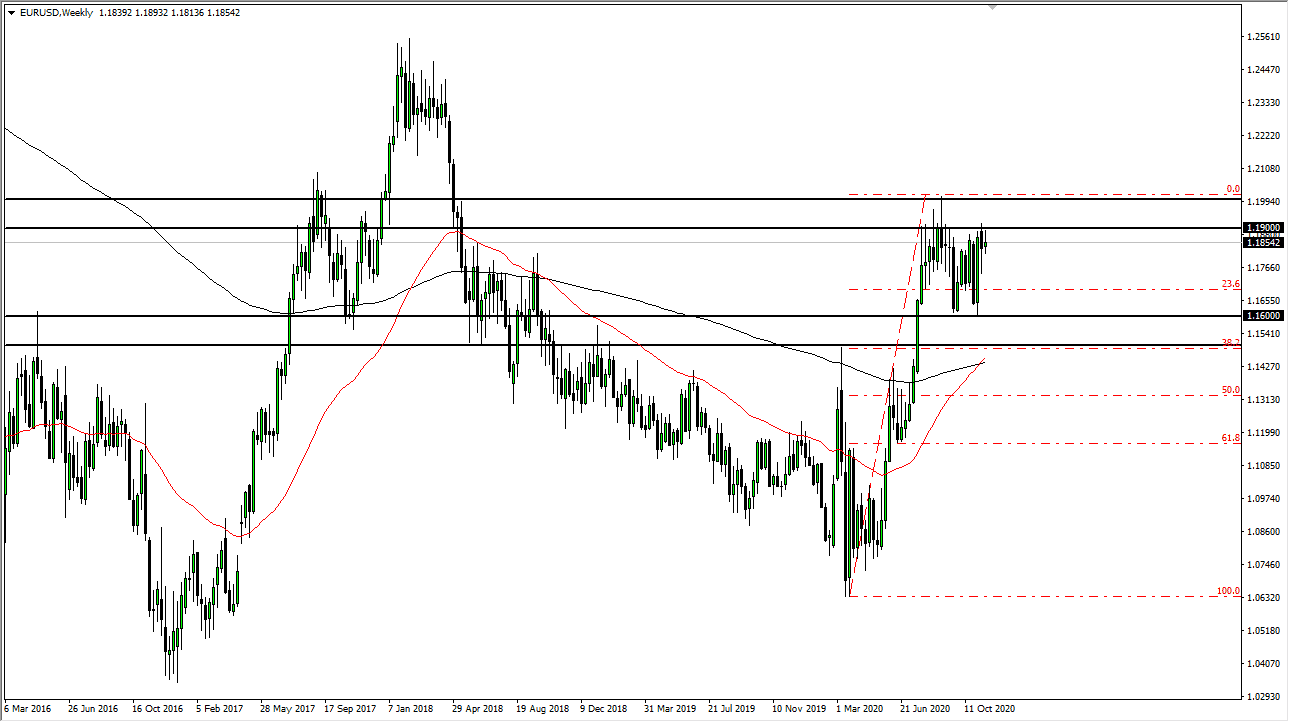

GBP/USD

The British pound rallied during the course of the week, testing the very top of the previous week’s shooting star candlestick. That is a very strong sign and you need to keep looking at the British pound through the same lens of “buying on the dips.” Obviously, Brexit can cause a lot of trouble, but it is only a matter of looking for value and taking advantage of it as traders are pricing in the idea of a deal.