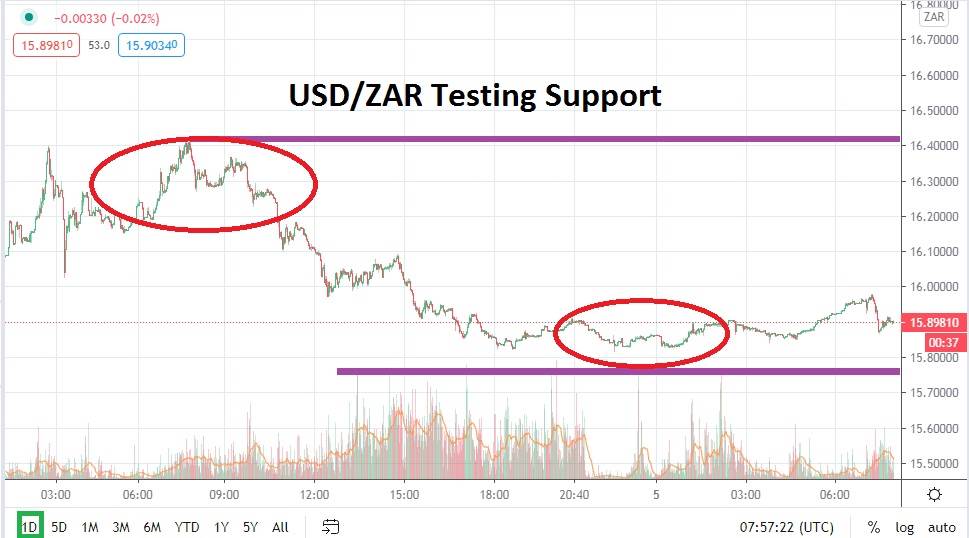

The sustained range of the USD/ZAR delivered a near perfect technical scenario yesterday. In early trading, as the outcome of the US election proved questionable and financial institutions became nervous, the USD/ZAR ignited a bullish trend which tested resistance levels near the 16.40000 level. But when clarity began to emerge regarding the projected result of the US vote, the forex pair promptly reignited its bearish stance.

Important support levels are now being tested early this morning within the USD/ZAR and the forex pair appears to be sustaining trading below the 16.00000 mark, which has certainly proven to be a key psychological battleground previously. If the USD/ZAR can maintain its current values and establish a comfortable trading range below the 16.00000 near term, it may signal that the forex pair is ready to approach price action not fully traded since early March.

The current support level of 15.81000 is almost a superficial measurement. The value of 15.81000 was last seen in March, but this happened when the USD/ZAR was in the midst of a fast bull run higher as coronavirus fears began to hit the financial landscape and cause worries regarding the potential economic impact from the virus.

If the 15.81000 level can be broken lower, traders may look for the 15.67000 target below as the next logical juncture to try and engage. Trading conditions could become quick today not only because crucial support levels are being tested by the USD/ZAR, but also because of developing news from the US regarding the election outcome. Financial markets do seem to be displaying some risk appetite in early trading today, which may help the USD/ZAR find an additional swell of bearish momentum. However, speculators may also be asking themselves justifiably if the bearish move lower has been overdone short term.

The USD/ZAR will prove an interesting battleground the next few days because it certainly has proven it has the capability of sustaining its bearish trend even as global risk appetite displayed nervousness the past week. This may signal the South African rand has the strength to muster more downward momentum. Selling the USD/ZAR and looking for additional support levels may prove to be worthwhile for speculators near term.

South African Rand Short Term Outlook:

Current Resistance: 15.97000

Current Support: 15.81000

High Target: 16.10000

Low Target: 15.67000