More COVID-19 infections are on the rise in South Africa, as are inflationary pressures. While the CPI remains near the bottom of the 3.0% to 6.0% inflation target set by the South African Reserve Bank (SARB), policymakers will monitor data to assess the trend moving forward. An already divided monetary policy committee (MPC) could remain on hold after lowering interest rates to 3.50% in 2020. The USD/ZAR extended its breakdown sequence, prompting a downside adjustment to its support zone.

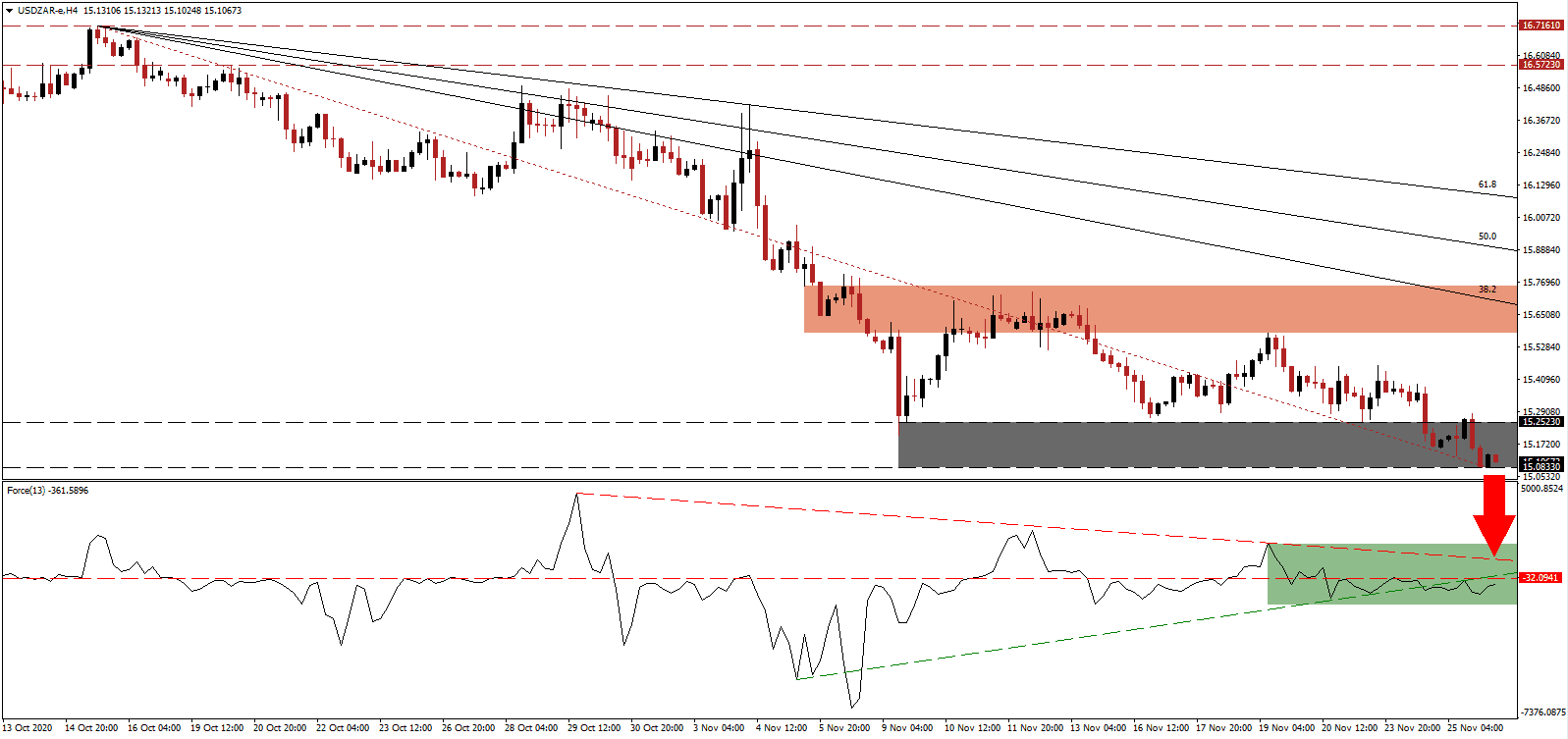

The Force Index, a next-generation technical indicator, was rejected by its horizontal resistance level and moved below its ascending support level, as marked by the green rectangle. Adding to downside pressures is the descending resistance level. Bears remain in control with the USD/ZAR below the 0 center-line and on track to correct farther into negative territory.

Government initiative Proudly South African urged consumers to buy local products during the holiday shopping season. It follows similar calls by other governments to support domestic companies. Besides contributing to a decrease in the trade deficit by slashing imports, it will contribute to strengthening the labor market. The latest breakdown in the USD/ZAR resulted in a downward adjustment of its short-term resistance zone as well. It is now located between 15.5805 and 15.7539, as identified by the red rectangle.

After Fitch Ratings downgraded South African debt with a negative outlook, Moody’s Investors Service followed suit. It prompted criticism from the African Peer Review Mechanism (APRM) of the African Union (AU). The descending Fibonacci Retracement Fan sequence keeps the well-established bearish chart pattern intact, and rising breakdown pressures can force the USD/ZAR below its support zone between 15.0833 and 15.2523, as marked by the grey rectangle. The next one awaits between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 15.1000

Take Profit @ 14.6000

Stop Loss @ 15.2500

Downside Potential: 5,000 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.33

Should the Force Index push through its descending resistance level, the USD/ZAR may enter a brief short-covering rally. Forex traders should consider any advance as a selling opportunity amid disappointing US economic data. Initial jobless claims, personal income, and advanced third-quarter GDP were lower than forecast. The upside potential remains reduced to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Short Covering Scenario

Long Entry @ 15.5000

Take Profit @ 15.8500

Stop Loss @ 15.2500

Upside Potential: 3,500 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 1.40