While South Africa has not witnessed the second COVID-19 wave of infections, the lack of adequate testing could be partially responsible for the lack of official detection. Despite the uncertainty, President Cyril Ramaphosa noted that the country is transitioning from relief to recovery. He praised the progress of his government and the expanded social programs while he continues to make promises to rebuild the economy. The USD/ZAR is presently challenging its support zone from where more downside is likely.

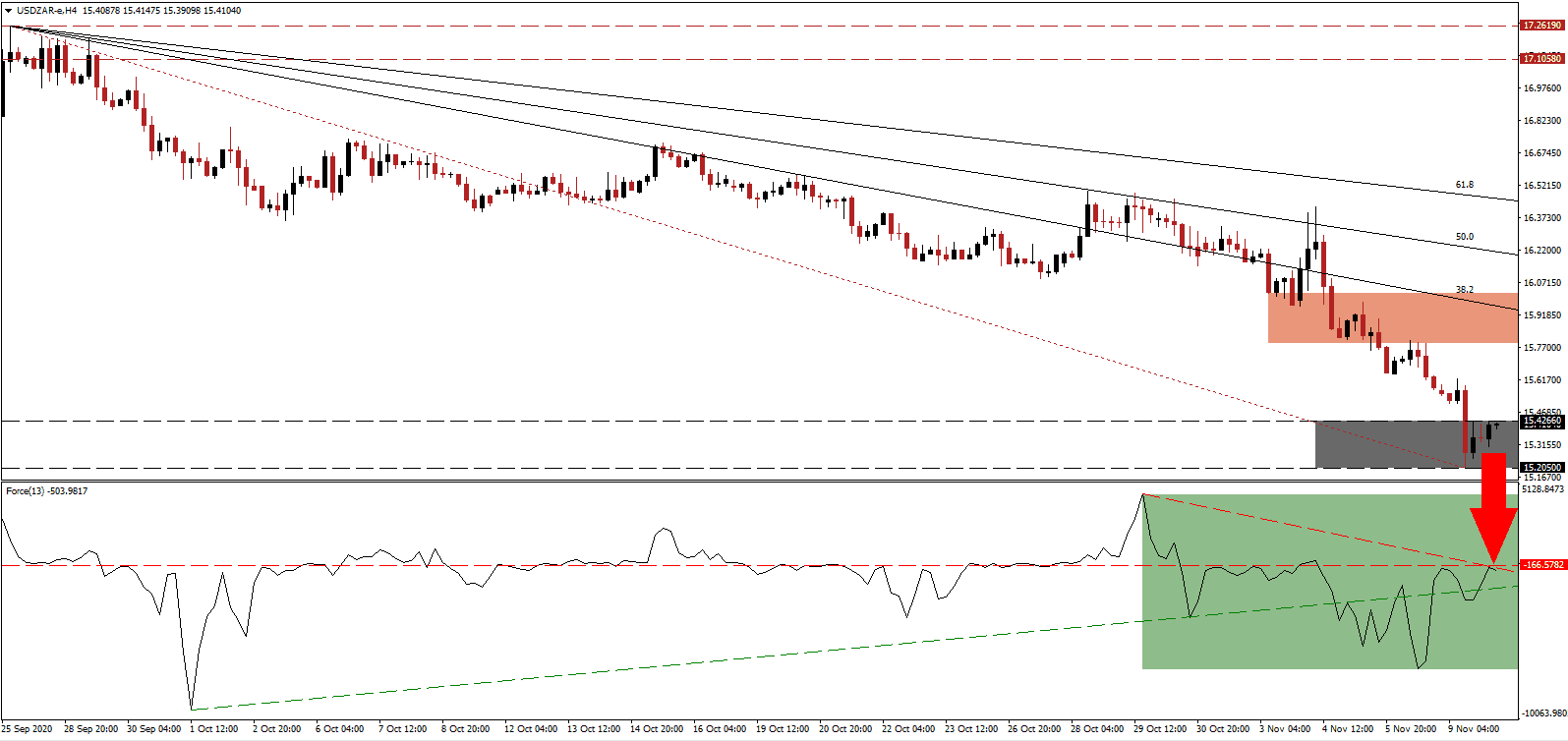

The Force Index, a next-generation technical indicator, recovered from a multi-week low and reclaimed its ascending support level before being rejected by its horizontal resistance level. Maintaining downside pressure is the descending resistance level, as marked by the green rectangle. This technical indicator remains in negative territory, granting bears control over the USD/ZAR.

Former South African President Thabo Mbeki criticized the ambitious infrastructure and energy program presented by President Ramaphosa amid a lack of funding details. He added that until the government publishes a way to finance them, they are nothing more than a vision. Following the breakdown in the USD/ZAR through its short-term resistance zone located between 15.7846 and 16.0205, as marked by the red rectangle, downside momentum expanded and has more room to extend the correction.

Adding to positive developments for the South African economy is the signing of the ASEAN Treaty of Amity and Cooperation (TAC) today by the Minister of International Relations and Cooperation Naledi Pandor. It will make South Africa the third African country, behind Morocco and Egypt, to do so, which opens business and trade opportunities. It supplies ongoing bullish pressure on the South African rand. The descending Fibonacci Retracement Fan Resistance sequence keeps the long-term bearish trend intact, and the USD/ZAR is positioned to move below its support zone between 15.2050 and 15.4266, identified by the grey rectangle. Price action will face its next support zone between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 15.4250

Take Profit @ 14.6250

Stop Loss @ 15.6250

Downside Potential: 8,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 4.00

Should the ascending support level pressure the Force Index higher, the USD/ZAR may attempt a temporary reversal on the back of a minor short-covering rally. Forex traders should consider this as a selling opportunity amid increasing bearish pressures on the US dollar. More debt is likely to follow, adding to downside progress, while the upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 15.8250

Take Profit @ 16.2250

Stop Loss @ 15.6250

Upside Potential: 4,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.00