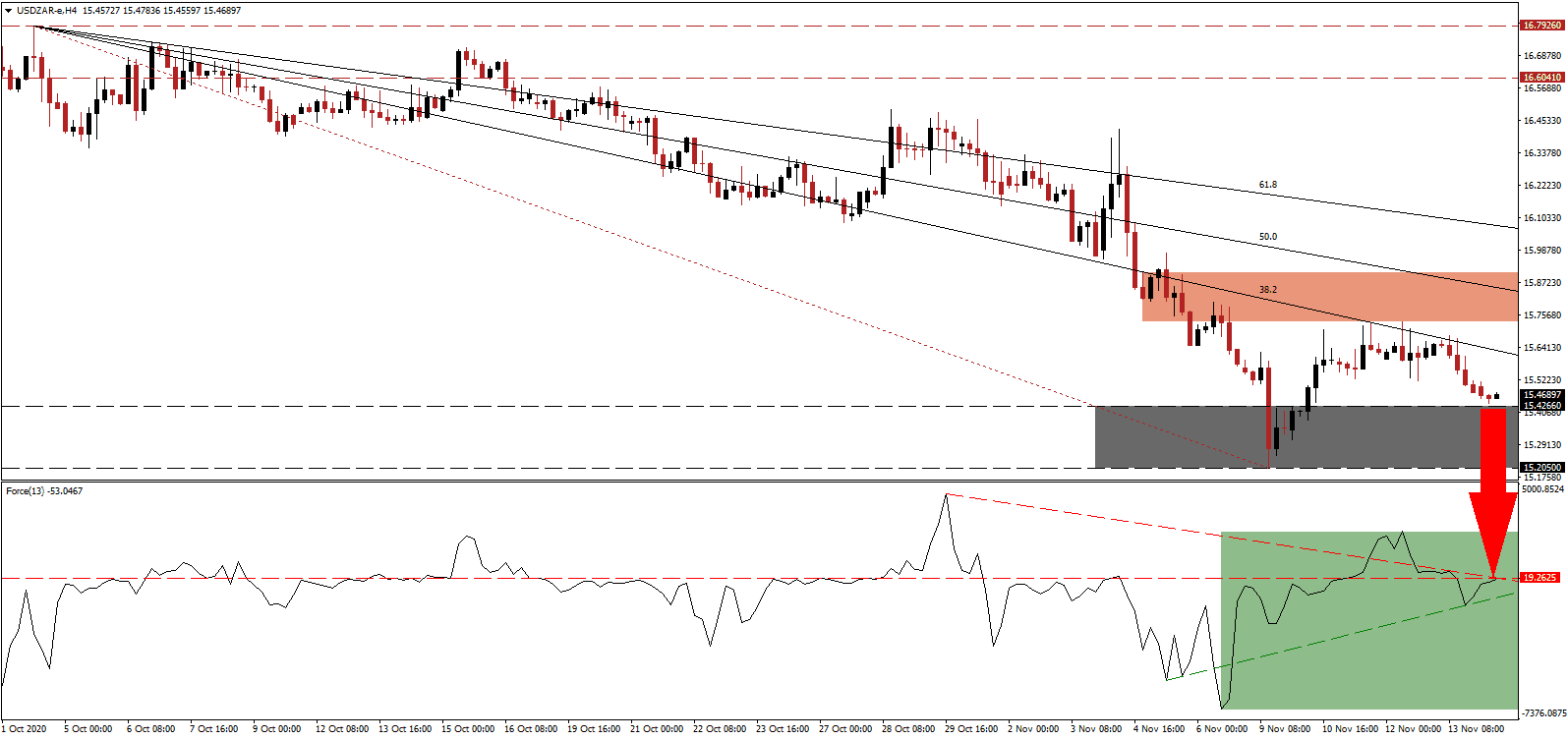

Before the COVID-19 pandemic forced the global economy into a recession, the labor market in South Africa was depressed. During the first wave of infections, President Cyril Ramaphosa implemented one of the toughest nationwide lockdowns, resulting in millions of job losses in the world’s most unequal society. Given intensifying US dollar weakness, the intact bearish trend in the USD/ZAR is favored to extend to the downside with a breakdown below its support zone.

The Force Index, a next-generation technical indicator, retreated from an advance into a lower high, which took it below its horizontal resistance level, as marked by the green rectangle. Adding to bearish pressures is the descending resistance level, expected to pressure this technical indicator below its ascending support level into negative territory. It will ensure bears regain complete control over the USD/ZAR.

Ebrahim Patel, the Minister of Trade, Industry, and Competition believes his country will attract R1.2 trillion in investment, as he promotes South Africa as an attractive business destination. The most likely source may come from ASEAN, which just signed the Regional Comprehensive Economic Partnership (RCEP), creating the world’s largest trade bloc. South Africa became the third African economy to sign the ASEAN Treaty of Amity and Cooperation (TAC). The downward revised short-term resistance zone between 15.7317 and 15.9070, as marked by the red rectangle, enforces the bearish chart pattern in the USD/ZAR.

European companies note the inadequate electricity infrastructure as the most significant obstacle for investments. While the signing of the RCEP dominates headlines, South Africa inked a trade deal with Malawi, while Kenya overtook South Africa as the top tourist destination. The descending 38.2 Fibonacci Retracement Fan Resistance Level is well-positioned to take the USD/ZAR through its support zone located between 15.2050 and 15.4266, as identified by the grey rectangle. An extension into its next support zone located between 14.5932 and 14.7294 remains a distinct possibility.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 15.4700

Take Profit @ 14.6200

Stop Loss @ 15.6900

Downside Potential: 8,500 pips

Upside Risk: 2,200 pips

Risk/Reward Ratio: 3.86

Should the Force Index sustain a breakout above its descending resistance level, the USD/ZAR could attempt a reversal. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders should consider any advance as a selling opportunity amid a worsening economic outlook for the US due to the out-of-control second wave of the COVID-19 pandemic.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 15.8700

Take Profit @ 16.0700

Stop Loss @ 15.6900

Upside Potential: 2,000 pips

Downside Risk: 1,800 pips

Risk/Reward Ratio: 1.11