With South Africa trying to tackle its massive army of unemployed, President Cyril Ramaphosa readies his South African Economic Reconstruction and Recovery Plan. It focuses on infrastructure programs with private sector participation. The widely-accepted plan also calls for reforms to increase competitiveness, boost growth in the small business sector, and fight crime and corruption. Following a US election-related price spike, which took the USD/ZAR into its short-term resistance zone before being rejected, bearish pressures remain dominant with a renewed push to the downside favored.

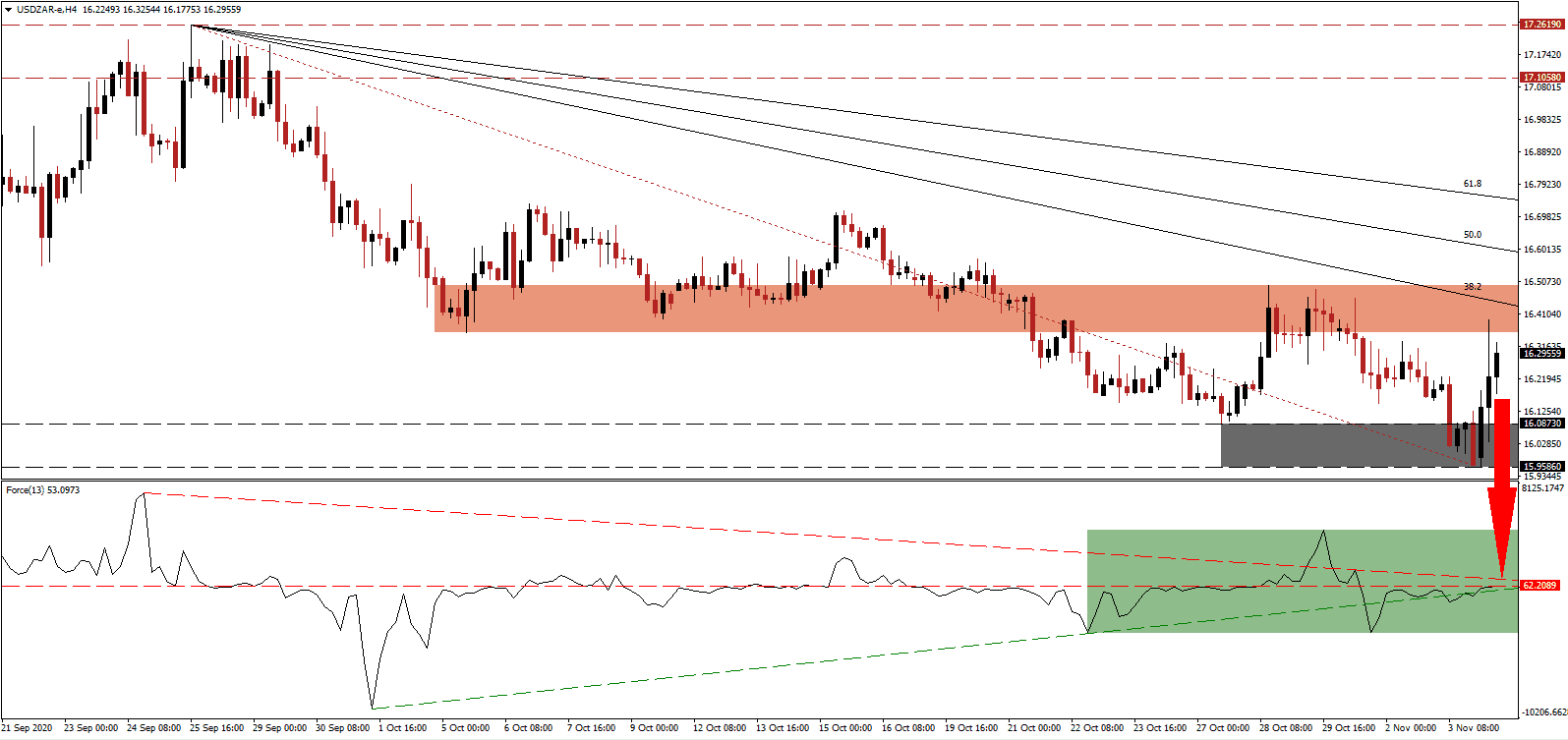

The Force Index, a next-generation technical indicator, moved above its ascending support level but maintained its position below the horizontal resistance level, as marked by the green rectangle. Magnifying downside momentum is the descending resistance level, while this technical indicator remains on course to move below the 0 center-line into negative territory. Bears expand their control over the USD/ZAR.

Aside from the ambitious infrastructure program, tourism is essential to the post-COVID-19 economy in South Africa. Over the past ten years, this sector outperformed, adding much-needed diversification to the mining-heavy export-dependent economic model. Plans focus on domestic tourism before branching out regionally, with international one the final step. After the USD/ZAR was rejected by its short-term support zone located between 16.3571 and 16.4938, as identified by the red rectangle, a breakdown extension may follow.

South Africa took steps to strengthen its mining sector, and Gwede Mantashe, the Minister of Mineral Resources, announced plans to prioritize exploration. A distinct focus on the junior mining industry, expected to lead the sector into the next growth phase, was also announced, together with regulatory and electricity certainty. While volatility remains high amid the US election vote counting, the descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/ZAR into its support zone located between 15.9586 and 16.0873, as marked by the grey rectangle. A collapse into its next support zone between 15.4844 and 15.7308 is possible.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 16.2950

Take Profit @ 15.4850

Stop Loss @ 16.4850

Downside Potential: 8,100 pips

Upside Risk: 1,900 pips

Risk/Reward Ratio: 4.26

In case the ascending support level pressured the Force Index higher, the USD/ZAR could seek more upside. The official results of the 2020 US election, where US President Trump is on track to secure his second term, can spike volatility in the short-term. Forex traders should take advantage of any secondary price spike with new sell orders amid a worsening outlook for the US Dollar. The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 16.5850

Take Profit @ 16.7350

Stop Loss @ 16.4850

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50