Since Pakistan lacks proper COVID-19 testing capabilities, the official statistics place the world’s fifth-most populous country further down the list than actual conditions warrant. It presently displays less than 375,000 confirmed infections, less than 3,000 new daily cases, and fewer than 37,000 active cases. On paper, it suggests Pakistani Prime Minister Imran Khan brought the pandemic under relative control, considering the size of its population. Hopes for an economic boost almost entirely rely on the success of the China Pakistan Economic Corridor (CPEC). Retreating bullish momentum in the USD/PKR can spark a new sell-off after reaching its short-term resistance zone.

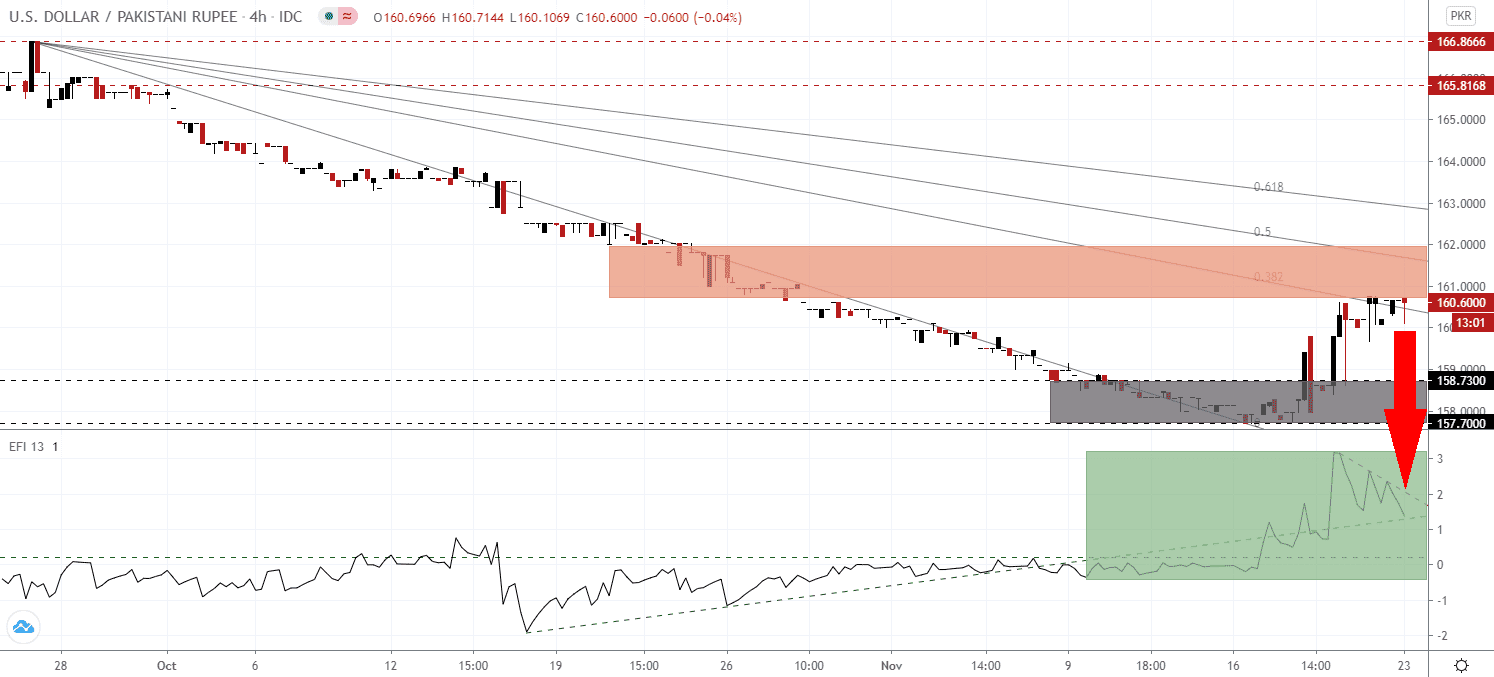

The Force Index, a next-generation technical indicator, accelerated to a new multi-week peak but reversed to create three lower highs. It resulted in a new descending resistance level, as marked by the green rectangle, which is well-positioned to pressure for a breakdown below its ascending support level. Bears wait for this technical indicator to move below the 0 center-line to regain complete control over the USD/PKR.

Pakistan needs to adjust its economy to regain the traction it enjoyed between 1960 and 1990, where it was Southeast Asia’s fastest-growing economy for all but five years. Between 1990 and 2020, it merely took the number one spot twice, confirming that Pakistan struggled with economic issues before the COVID-19 pandemic. Nusrat Wahid, a member of the National Assembly of Pakistan and politician from the ruling Pakistan Tehreek-e-Insaf (PTI) party, vowed that the benefits of CPEC would reach every Pakistani. After the USD/PKR reached its short-term resistance zone between 160.7144 and 162.0000, marked by the red rectangle, breakdown pressures expanded.

Aside from optimism over CPEC, which continues to overcome hurdles, Dr. Abdul Hafeez Shaikh, Prime Minister Khan’s Advisor on Finance and Revenue, credited the implementation level of the World Trade Organisation’s Trade Facilitation Agreement (TFA) with strengthening the economy and labor market. The descending Fibonacci Retracement Fan sequence is on track to pressure the USD/PKR into its support zone between 157.7000 and 158.7300, as identified by the grey rectangle. Price action will challenge its next support zone between 153.6500 and 154.3000.

USD/PKR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 160.6500

Take Profit @ 153.6500

Stop Loss @ 162.0000

Downside Potential: 70,000 pips

Upside Risk: 13,500 pips

Risk/Reward Ratio: 5.19

Should the Force Index eclipse its descending resistance level, the USD/PKR could attempt a breakout. Given the ongoing bearish developments across the US, from an economic, fiscal, and healthcare perspective, Forex traders should sell any rallies. The upside potential remains reduced to its intra-day high of 163.8441, from where a more significant profit-taking sell-off can materialize.

USD/PKR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 162.6500

Take Profit @ 163.8000

Stop Loss @ 162.0000

Upside Potential: 11,500 pips

Downside Risk: 6,500 pips

Risk/Reward Ratio: 1.77