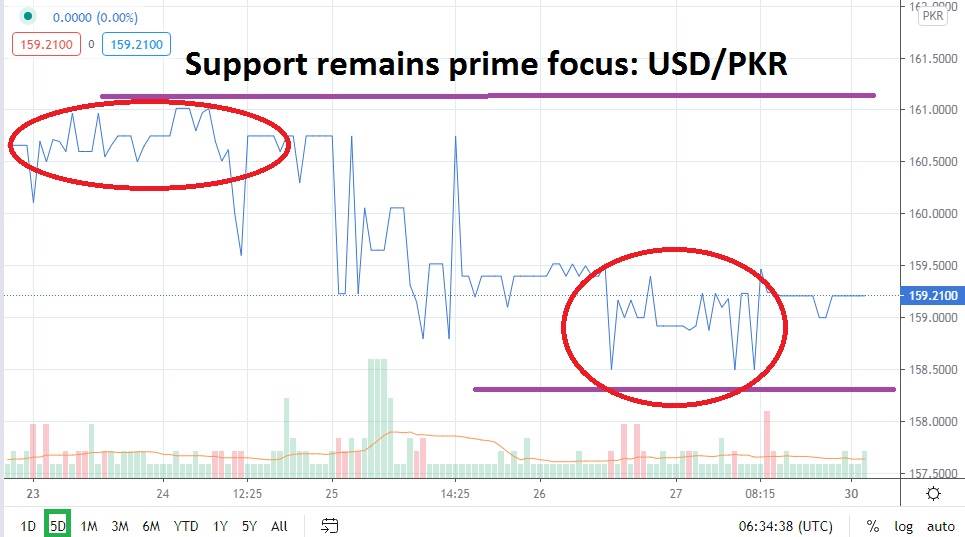

The USD/PKR remains slightly above key support levels as the week begins and speculators weigh their perceptions. After the Forex pair did manage to challenge resistance levels early last week, the USD/PKR has shown an ability to trade in a rather comfortable price range. Traders should not be fooled too much by the rather polite price band the USD/PKR has established, and need to acknowledge there is always a threat of volatility lurking within this Forex pair.

However, the ability of the USD/PKR to remain below the 160.0000 level and seemingly hover over the 159.0000 support juncture may prove enticing for speculators who want to continue to pursue what is starting to become a rather considerable mid-term bearish trend within the USD/PKR. The inability of the USD/PKR to power through resistance last week near the 161.1000 level and then reestablish a normal reversal downwards is intriguing.

The USD/PKR doesn’t trade within a framework of great transparency, but it does seemingly abide by risk appetite factors which dominate the financial landscape. The USD/PKR continues to trend towards important support levels which, if proven vulnerable, could ignite another test of values below.

On the 12th of November, the USD/PKR touched the 157.6000 mark. This support level proved crucial and demonstrated a test of the low value for a few days until a reversal emerged, which culminated in a high of nearly 161.1000 on the 24th of November. Taking into consideration the USD/PKR’s inclination to be volatile and not enjoy a great amount of trading volume, this climb towards higher Forex values was not overtly extravagant. Traders using limit orders within the USD/PKR, which is the only way to really trade this pair, were likely surprised by the rather muted rise and its sudden demise.

The display of a bearish reversal last week and the ability to sustain values below the 160.0000 mark may signal that further tests of support levels will occur. Global risk appetite will certainly be important in the coming days, and December is likely to see a large amount of international political antics because of the impending transition of power in the US; meaning, Asia will react to the news which will affect financial markets. However, selling the USD/PKR remains technically a rather logical outlook to pursue.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 159.6000

- Current Support: 159.0000

- High Target: 160.2000

- Low Target: 158.3000