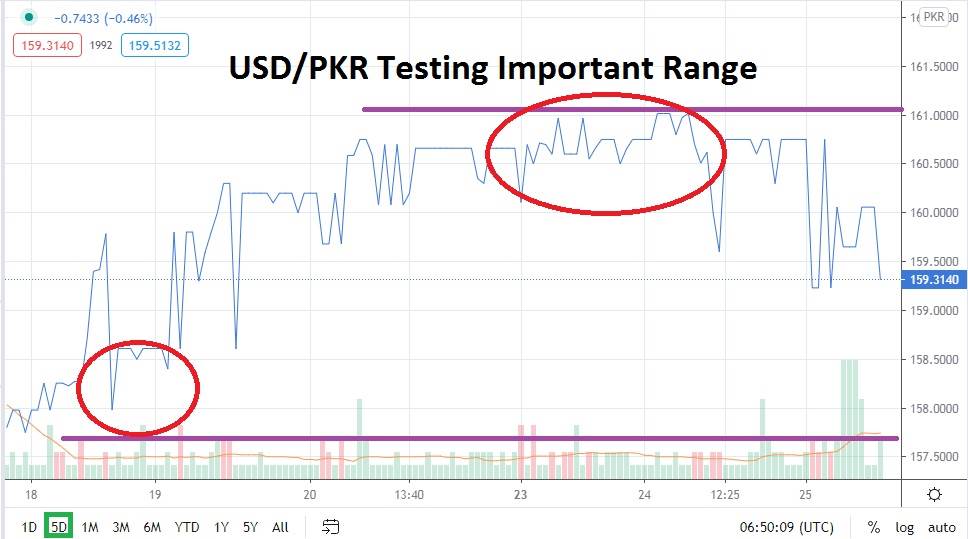

The USD/PKR has enjoyed a solid bearish trend, but after hitting key support levels last week, the Forex pair did reverse higher. Luckily for speculators of the USD/PKR, they are used to the threat of volatility and may actually look at the slight reversal higher which took place the past couple of days as a trading opportunity to sell.

In early trading today, the USD/PKR has come off short-term highs and maintained the stronger values of its bearish stance. Importantly, after hitting the 161.0000 level higher yesterday, the Forex pair showed the capability to reverse lower and, as of this morning, the USD/PKR is trading comfortably below the 160.0000 mark. If the Pakistani rupee can sustain its values below the 160.0000 level near term, it may be a rather strong signal that further bearish momentum will reignite.

Yes, the USD/PKR trades without a great deal of transparency and speculators are likely maneuvering in waters in which technical charts are their only navigation tools. However, the trend remains speculatively in favor of pursuing downward price action via the USD/PKR.

Global risk appetite could prove to be rather interesting over the next twenty-four hours. Important equity indices are challenging highs and traders are exhibiting optimistic sentiment. The USD/PKR does trade in what may be considered an isolated manner; nonetheless, Pakistan is an emerging market which is affected by international financial winds and policies. The USD/PKR has been able to muster a significant bearish trend since late August and speculators should not give up on the downward cycle after only a couple of slight bullish moves higher. In fact, the current price range of the USD/PKR may prove to be an important pivot point, which proves the direction of the Forex pair’s bearish trend remains healthy.

Selling the USD/PKR remains a speculative position which may look particularly attractive based on the recent values the Forex pair achieved early last week. Traders should not get too greedy, but it may be legitimate to target support levels which have been tested recently. First, the USD/PKR will have to prove it can sustain its value below the 160.0000 level today. If this is achieved, speculators may decide to use limit orders and pursue the 159.0000 to 158.5000 marks while practicing the art of risk management.

Pakistani Rupee Short Term Outlook:

- Current Resistance: 159.6600

- Current Support: 159.0000

- High Target: 160.2100

- Low Target: 158.3700