With the second wave of the COVID-19 pandemic intensifying, more countries announced nationwide lockdowns to avoid the total collapse of an ill-equipped healthcare system that struggled with the seasonal influenza virus in addition to the coronavirus. Mexican President López Obrador has not suggested restrictions across Mexico, the eleventh most-infected country globally. Testing remains a significant issue, but Mexico is more healthy financially amid the lack of costly bailouts. The USD/MXN presently challenges its support zone from where a breakdown can accelerate the correction.

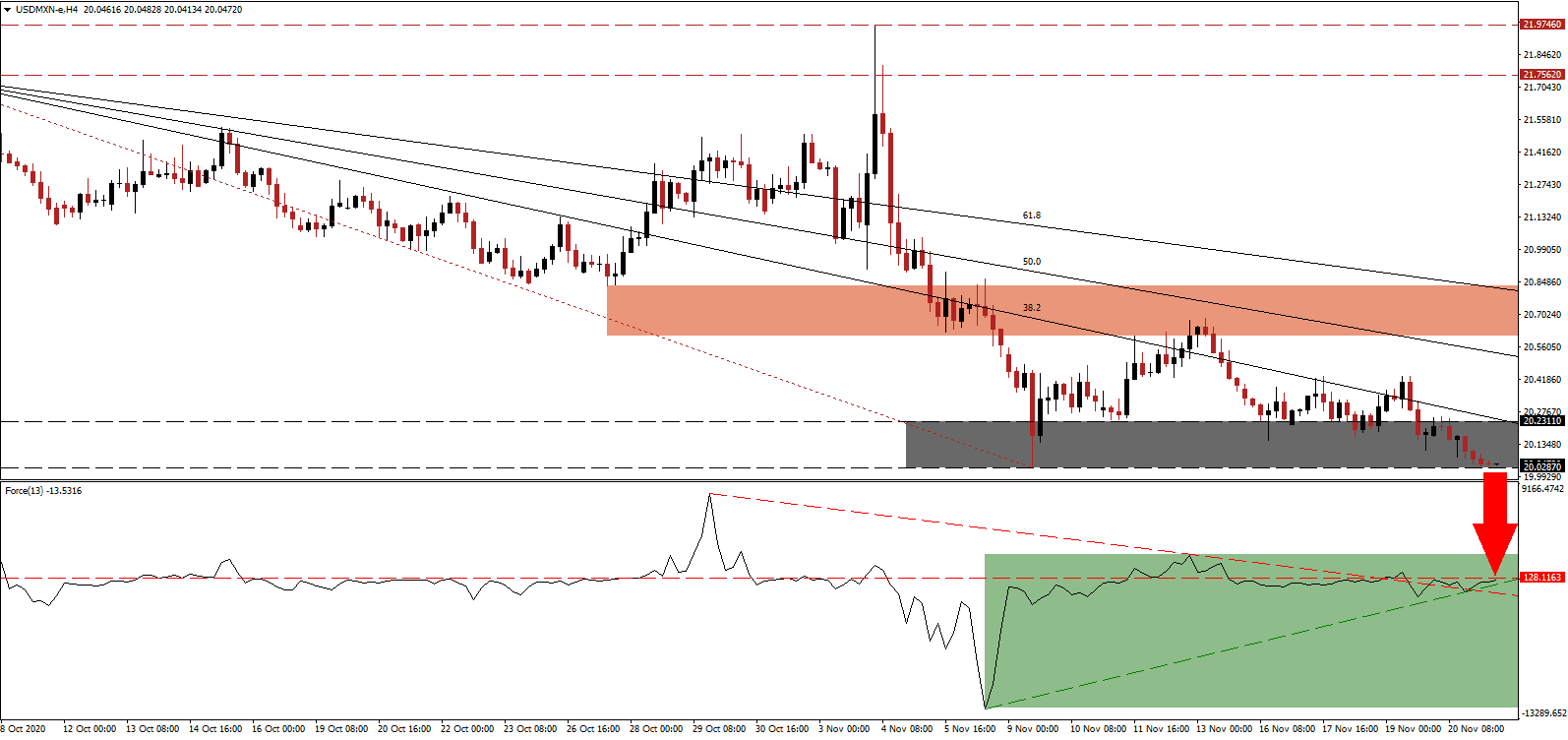

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level but was able to move above its descending resistance level. A retreat below its ascending support level, as marked by the green rectangle, is pending due to dominant bearish pressures. With this technical indicator in negative territory, control over the USD/MXN remains with bears.

President López Obrador urged the G20 to avoid taking on debt to bail out companies and supplement wages for employees. Global debt levels spiked to new all-time highs, threatening the global financial system. Unlike most countries, Mexico avoided the debt trap, placing it in a superior post-COVID-19 position. Despite heavy criticism, the economy started to recover. Following the breakdown in the USD/MXN below its short-term resistance zone between 20.6106 and 20.8286, as marked by the red rectangle, bearish pressures magnified.

Boosting the financial condition of Mexico was the approval of the extension of the flexible $63.4 billion credit line of the International Monetary Fund (IMF). Sources suggested a reduction to $50.7 billion, but the risks of the COVID-19 pandemic warranted the additional cash buffer if needed. Mexico plans to phase out the credit line as conditions allow. The descending Fibonacci Retracement Fan sequence can force a breakdown in the USD/MXN below its support zone located between 20.0287 and 20.2311, as identified by the grey rectangle. The next support zone awaits between 18.9748 and 19.2602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 20.0300

Take Profit @ 18.9800

Stop Loss @ 20.3800

Downside Potential: 10,500 pips

Upside Risk: 3,500 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index, initiated by its ascending support level, may ignite a brief short-covering rally in the USD/MXN. Forex traders should take advantage of any advance from present levels with new net short positions. The outlook for the US dollar continues to deteriorate, and the COVID-19 pandemic will result in more debt in the US with a soft labor market. The upside potential remains limited its intra-day high of 21.0405

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 20.6300

Take Profit @ 21.0300

Stop Loss @ 20.3800

Upside Potential: 4,000 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 1.60