Mexico became the latest country to cross 1,000,000 confirmed COVID-19 cases and the eleventh most-infected country globally. Latin America continues to struggle as the second wave of the pandemic sweeps across the globe, with Brazil, Argentina, and Columbia in the Top Ten list and Peru behind Mexico. Bolivian President Luis Arce and Mexican Secretary of Exterior Relations Marcelo Ebrard called on international organizations and developed economies to reactivate the global economy. The USD/MXN took a small pause after correcting into its support zone, but more selling is favored.

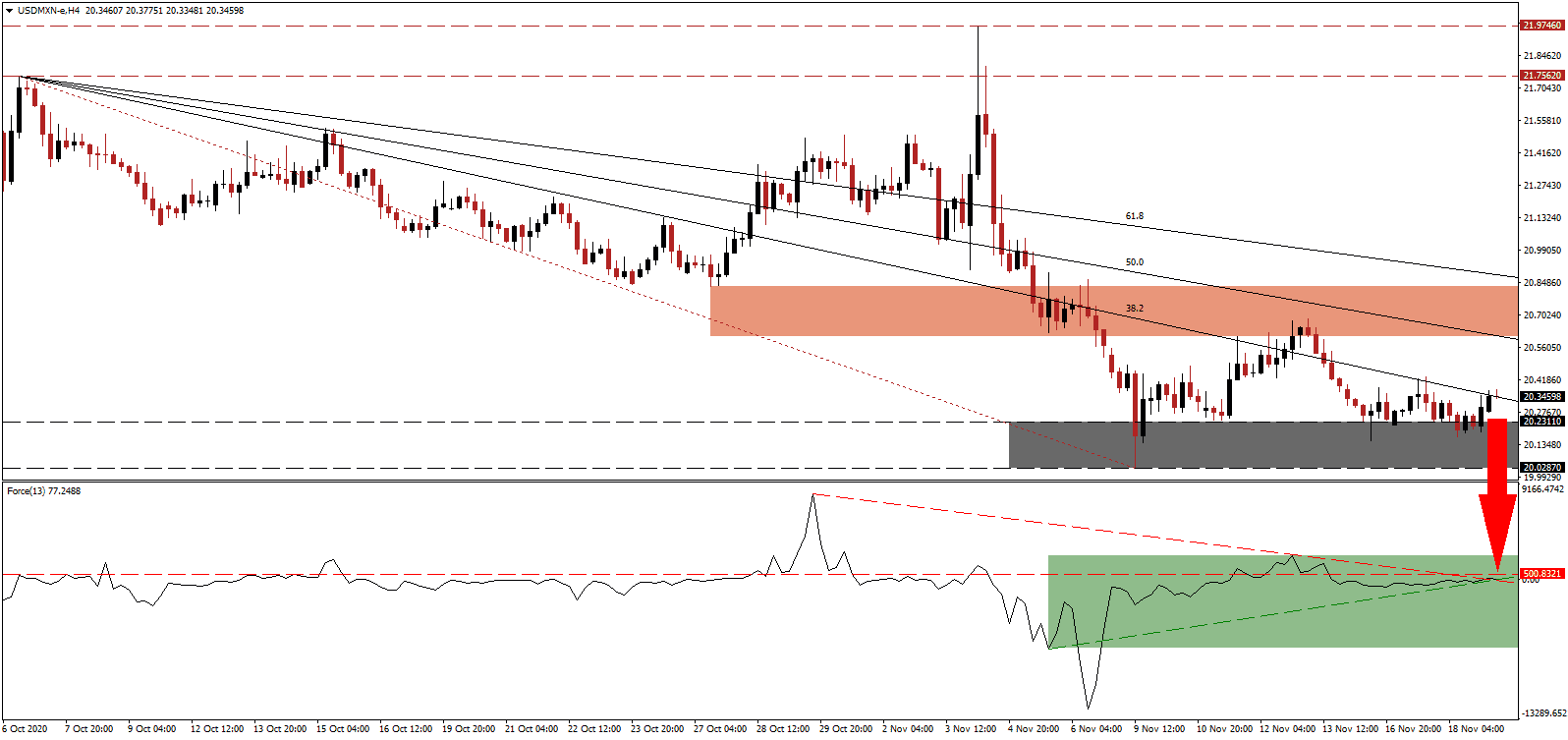

The Force Index, a next-generation technical indicator, retreated from a brief advance above its horizontal resistance level and is now challenging its ascending support level. Magnifying downside pressures is the descending resistance level, as marked by the green rectangle. This technical indicator is on course to move below the 0 center-line, granting bears complete control over the USD/MXN.

Alejandro Diaz de Leon, the Governor of Banco de México, explained the decision to keep interest rates unchanged last week at 4.25%, while markets priced in another cut. It was the first time the central bank did not lower borrowing costs since June 2019. Inflationary pressures remain high, crossing above 4.00%, well above the upper tolerance band of 3.0% set by the central bank. After a short-covering rally in the USD/MXN was rejected by its short-term resistance zone between 20.6106 and 20.8286, as identified by the red rectangle, breakdown pressures accumulated.

Mexican President López Obrador introduced an initiative to Congress to reform the sub-contracting sector, following a speech a few weeks earlier with this intention. It will prohibit sub-contracting, which President López Obrador compared to the exploitation of low-income workers. It will also reign in employer substitutions. The descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/MXN below its support zone located between 20.0287 and 20.2311, as marked by the grey rectangle. Price action will face its next support zone between 18.9748 and 19.2602.

USD/MXN Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 20.3450

Take Profit @ 18.9950

Stop Loss @ 20.5950

Downside Potential: 13,500 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 5.40

In case the ascending support level can spark the Force Index higher, the USD/MXN may attempt a second breakout. The upside potential remains reduced to its intra-day high of 21.2298. With the medium-term outlook for the US dollar increasingly bearish due to the COVID-19 pandemic, monetary policy, and debt, Forex traders should take advantage of any price appreciation with new net sell orders.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 20.7950

Take Profit @ 21.0950

Stop Loss @ 20.5950

Upside Potential: 3,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.50