The US dollar has been selling off in the Forex market, as investors abandon it as a safe haven amid news of coronavirus vaccines and Trump’s initiation of a transition to Biden. By the end of last week’s trading, the USD fell against the JPY, moving towards the 103.90 support, before closing the week's trading around 104.09. The USD has fallen along with US government bond yields this year, but the drop slowed through November. The creeping instability and uncertainty resulting from the US presidential election - which helped stem rallies in pairs such as GBP/USD, EUR/USD and AUD/USD - have coincided with a sharp increase in some bond yields, including the US 10-year which could soon become a target for the Fed.

The USD/JPY currency pair is now settling below the 100-hour moving average and the smooth 200-hour moving average lines. The early rebound in early last week's trading pushed it away from the oversold levels of the 14-hour RSI, before returning to the normal trade area.

The Tokyo CPI for November came below expectations of -0.6% with -0.7% (year-on-year), while the CPI excluding food and energy decreased by -0.1%, and -0.2% on an annual basis. On the other hand, the Fresh Food Consumer Price Index matched expectations (year-on-year) at -0.7%.

The Thanksgiving holiday was an important barrier to the lack of investor interaction with important economic data, such as the announcement of the third-quarter GDP growth, which came below expectations of 33.2% with a growth rate of 32.1%. October's durable goods orders exceeded expectations by 0.9% with a reading of 1.3%, while previous non-defense capital goods orders for aircraft beat expectations by 0.5% with a rate of 0.7%. On the other hand, previous durable goods orders were impacted by a shift of 1.3% versus the forecast of 0.4%, while the initial and continuing jobless claims were missing estimates.

New home sales in the United States fell unexpectedly in October. The US Commerce Department said that new home sales fell 0.3 percent to an annual rate of 999,000 in October, after rising 0.1 percent to a rate of 1.002 million in September. Economists had expected new home sales to jump 1.1% to a rate of 970,000 from the 959,000 originally reported for the previous month.

The unexpected drop in new home sales came as sales in the South and West fell by 2.0% and 1.5%, respectively. New home sales in the Midwest rose 11.2 percent, and new home sales in the Northeast increased 5.1 percent. The report stated that the average selling price of new homes sold in October was $330,600, down 0.3 percent from $311,600 in September, but up 2.5 percent from $ 322,400 in the same month last year.

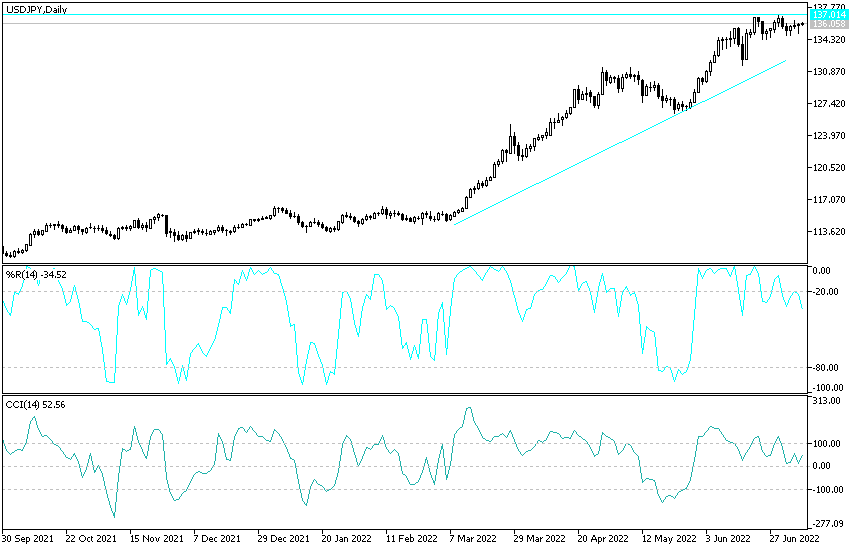

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading in a volatile pattern formation. Therefore, both bull and bear speculators may look to dominate the pair. So far, it appears that the bears have a relative advantage in the battle, so they will target short-term profits at around 103.70 or less at 103.45. Bulls will target short-term rally gains around 104.266 or higher at 104.543.

In the long term, and based on the performance on the daily chart, it appears that the USD/JPY is trading within a downtrend channel. This indicates a significant long-term bearish bias in market sentiment. The pair has now declined to trade above the 76.405 Fibonacci level. Bears will look to extend the current declines towards support at 102.61 or less at the 100% Fibonacci level of 101.17. Bulls will target profits at 61.80% and 50% Fibonacci at 105.178 and 106.410, respectively.

Today's economic calendar data:

In Japan, industrial production, retail sales, and housing starts data will be announced. The pair may also be affected today by the announcement of the manufacturing PMI reading from China. Regarding the US dollar, the Chicago PMI reading and then the pending US home sales will be released.