After eight trading sessions in a row, the USD/JPY pair remained stable below the 105.00 support with strong bearish momentum. That pushed it towards the 104.02 support, the lowest level in five weeks. The pair got upward momentum that pushed it towards the 105.35 resistance in early trading today amid a state of investors’ risk appetite, with the beginning of votes counted in the US presidential election. Markets are hoping that Democrat Joe Biden - if he manages to oust President Donald Trump - will pressure a greater fiscal stimulus to revive the US economy along with a freer approach to trade.

Biden is said to be leading in national opinion polls and is also leading in several major swing states in the race to defeat Trump. There is optimism that the election results will be announced at the end of the night without the need for lawsuits and a recount.

In contrast, the Fed, which starts its monetary policy meeting on Wednesday, is likely to keep interest rates unchanged.

Data released by the US Commerce Department showed that new orders for manufactured goods showed a significant increase in September, rising 1.1% after seeing a 0.6% (revised) increase in August. Economists had expected factory orders to rise 1% in September compared to the 0.7% increase originally registered from the previous month. The report mentioned that durable goods orders increased 1.9%, while non-durable goods orders increased 0.3%.

Many investors have taken the so-called "blue wave" forecast of a Democratic victory as an indication that the US economy may soon get big, new help. But as the race approaches, analysts said they may also be reassured that Trump's pro-market stance may continue. Investors are hoping that the end of the bitter US presidential campaign will lift the intense uncertainty that has caused market volatility recently. So far, Trump and Biden have won the states they were expected to win and no state has been determined on the battlefield. Early results in Florida point to a tight race in that major state.

Markets around the world were shaken in 2016 as the presidential election results indicated that Donald Trump was ahead of Hillary Clinton. Accordingly, the S&P 500 fell early the next day, but ended the trading 1.1% higher. The outcome of the presidential election may not be known for days due to the large number of Americans who voted early. What investors are hoping for from the election is a clear winner, even if it takes time.

The biggest concern for markets and investors is that disputed elections may drag on, adding to the uncertainty in markets that have been ravaged this year by bouts of volatility amid the coronavirus pandemic.

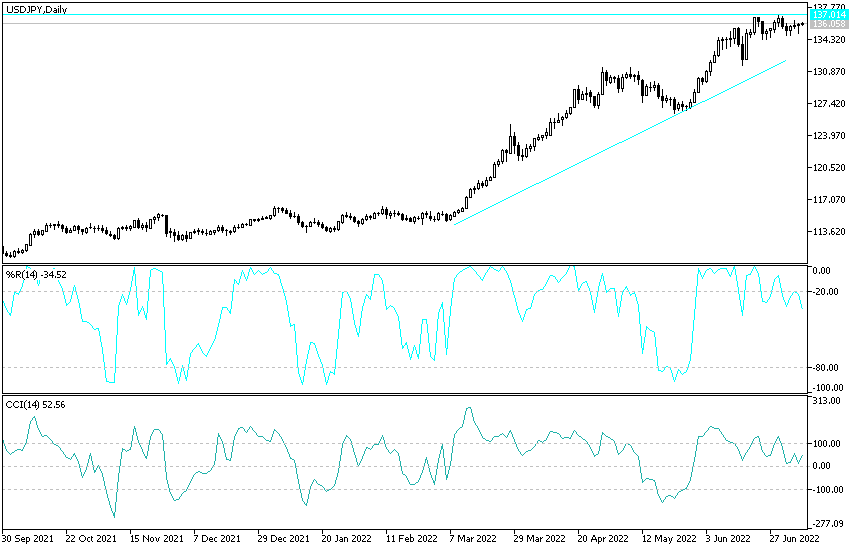

Technical analysis of the pair:

Until now, the bearish momentum is still dominating the USD/JPY performance, and stability below the 105.00 support will support the move towards stronger support levels, the closest of which are currently 104.40, 103.80 and 102.00, respectively. Technical indicators are still pointing to oversold areas, but the market lacks the opportunity to take risks. On the upside, the bulls still need to breach the resistance levels at 106.00 and 108.00 to trigger a long-awaited change in performance.

In addition to the extent of the risk appetite, the pair will be affected by the announcement of the ADP reading of the change in non-farm payroll numbers and the US trade balance, followed by the ISM US services PMI reading.