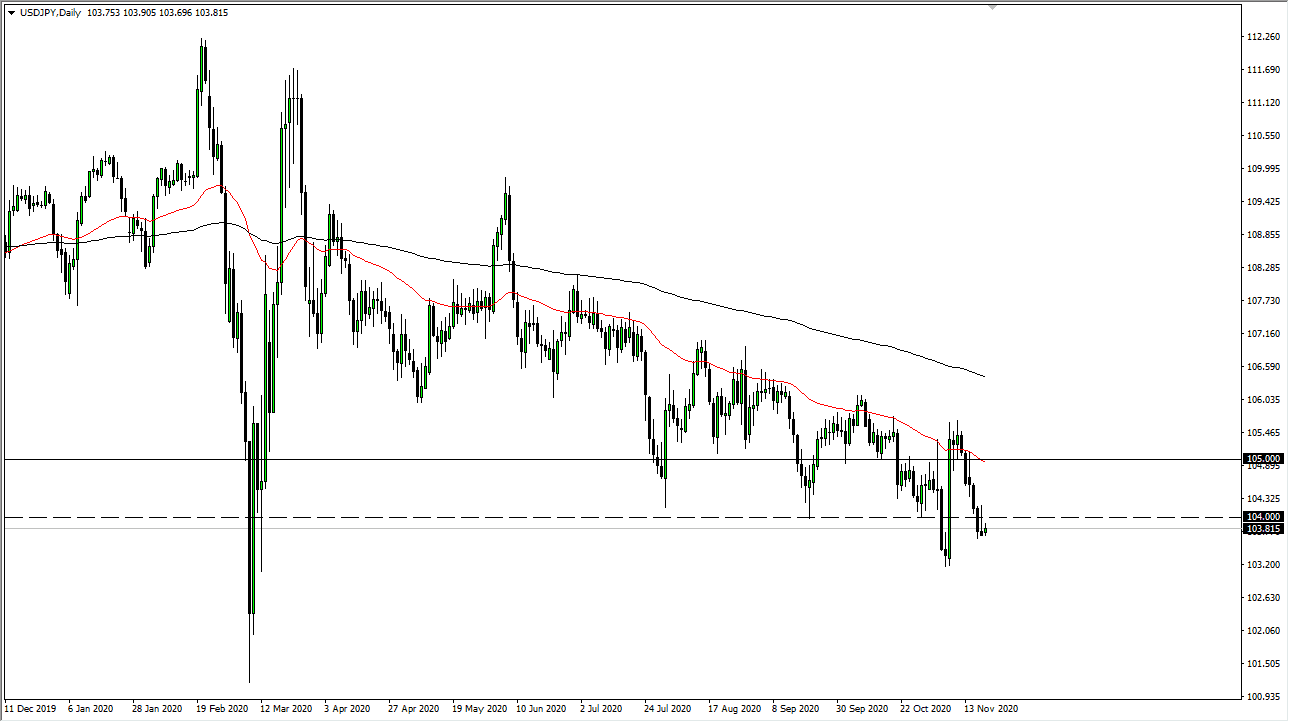

The US dollar rallied slightly during the trading session on Friday, reaching towards the ¥104 level. However, that is an area that has been both support and resistance and, as a result, it is no surprise to see that the market could not rally above there during the day. Furthermore, take a look at the Thursday candlestick to see how much resistance there is based on the massive spike that reversed. The market will continue to face downward pressure and perhaps break down below the bottom of the Thursday session.

On the other hand, if the market were to break above the top of the spike from the trading session on Thursday, that would be a bullish sign. However, that does not mean that I would be a buyer. In fact, I am more than willing to sit on the sidelines if we break above there and wait for a better selling opportunity. The 50-day EMA sits at the ¥105 level, which is an area that has a lot of psychological importance attached to it. Any time we get close to the ¥105 level, there is going to be pushback by sellers. Furthermore, the 50-day EMA is the beginning of resistance that extends all the way to the 200-day EMA, currently trading around the ¥106.50 level. It is likely that we will have to deal with a “zone of resistance”.

I suspect you already know that I am only selling this pair, not buying it. This means that we need to be patient, but I think short-term rallies offer plenty of opportunities. We will not only go down towards the ¥103.25 level, but also possibly break down below there to go towards the ¥102 level. It is a matter of being patient and waiting to pick up “cheap yen.” The US dollar continues to get hammered by the Federal Reserve, so that is a longer-term cyclical issue for this pair and we will continue to see the trend play itself out to the downside. I am not sure where we will end up, but we clearly can go much lower.