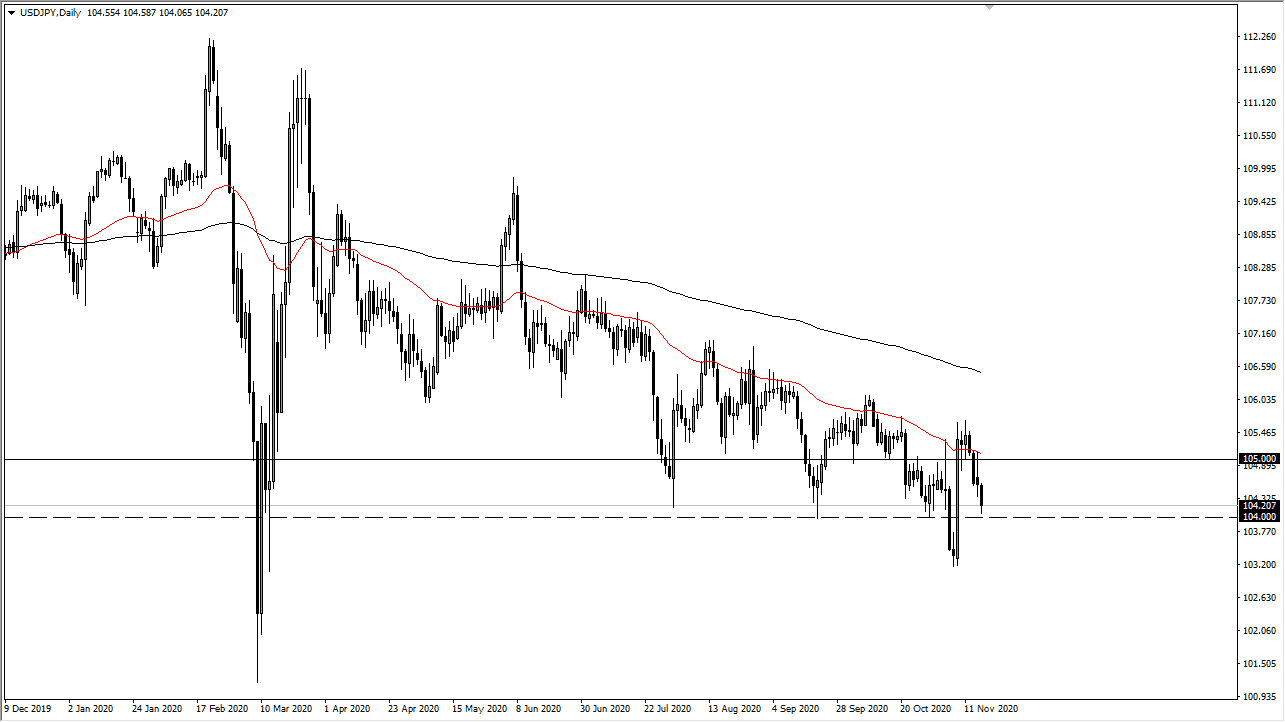

The US dollar was broken down significantly during the course of the session on Tuesday, reaching down towards the ¥104 level. This is a significant area and was previously supported, so it has been watched closely by the market. The market is likely to see a continuation of noise in that area, as it has only broken through there once in the last several months.

The massive candlestick from the Monday session of last week, reacting to the vaccine news, is almost completely engulfed. The market is likely to see more negativity and perhaps more selling off, but it is still in a downtrend and should be looked at as such, as the 50-day EMA has caused significant resistance. In fact, the 50-day EMA has been extraordinarily reliable for several months, so it is not a surprise that we pulled back. The Monday candlestick tried to break above it and then turned around to form an inverted hammer that has now been broken below. This shows signs of continuation, which explains why we're seeing this move.

If we can break down below the ¥104 level - and I think we can - then the market may go looking towards the ¥103.25 level. Breaking down below there then opens up the possibility of a move down to the ¥102 level. I have no interest in buying this market right now, even though I recognize that the US dollar itself could see a bit of strength short term against many other currencies. This is because this pair is very sensitive to the risk appetite around the world, as the Japanese yen is considered to be a very “safe currency.” Regardless of what happens next, this pair finds a reason to go lower, so you should be paying attention to opportunities to short this market. The ¥105 level above should continue to be massive resistance, so I am looking for an opportunity to follow the trend.