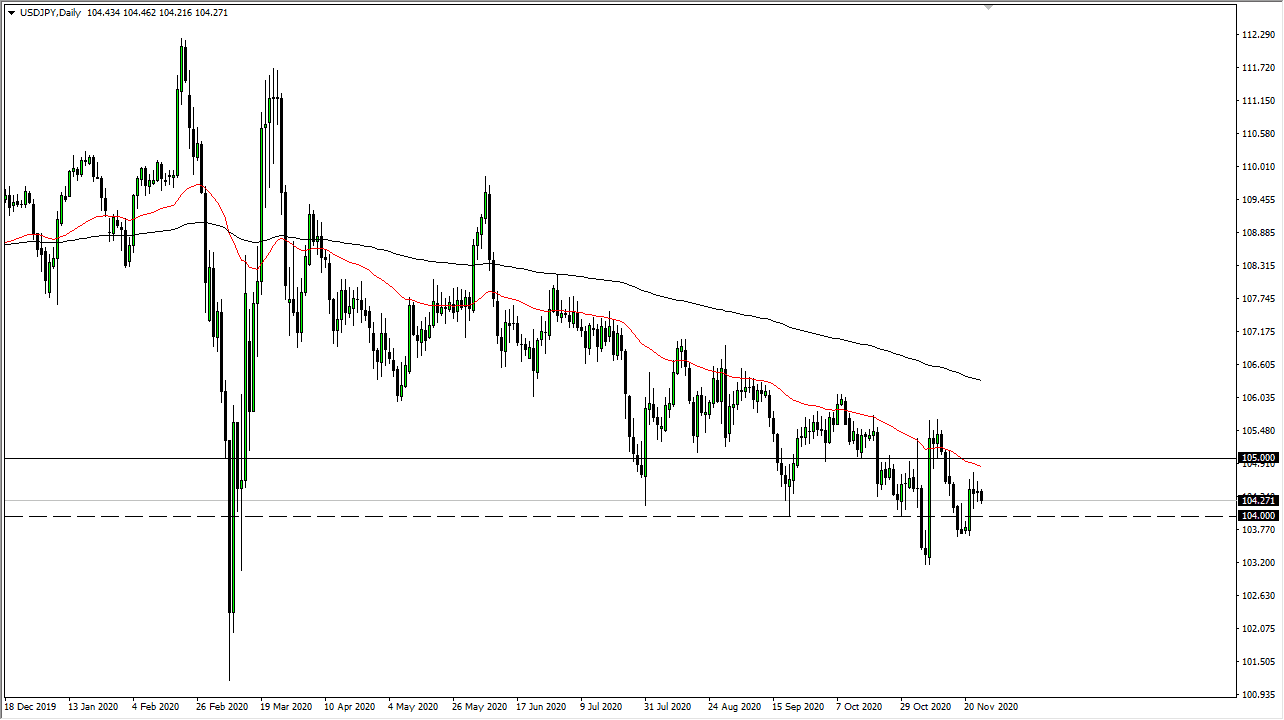

The US dollar has pulled back just a bit during the trading session on Thursday, but you should keep in mind that it was Thanksgiving in the United States so liquidity could have been a major issue. This is a market that I think continues to see a lot of negativity though, and therefore I think the most important thing to take away from this is that we are continuing the downtrend. Rallies at this point in time continue to be sold into and I think that it is only a matter of time before sellers jump back in to continue the overall trend.

Just above, the 50 day EMA is sloping lower, and breaking below the ¥105 level. This is an area that of course would make a significant amount of sense, due to the fact that it is a large, round, psychologically significant figure. Furthermore, the 50 day EMA extends all the way to the 200 day EMA to form a “wall of selling pressure.” At this point in time, I think that we continue to go lower due to the Federal Reserve out there flooding the markets with liquidity. Furthermore, I think that we have a destination underneath. After all, we had recently reached towards the ¥102 level, which is where we bounce from quite drastically. Overall, this is the area where we had seen a massive reversal and we have not necessarily retested it yet. Quite often you will see it happen, so it does make quite a bit of sense that the market will try to retest it.

At this point, I think that you look for short-term rallies that show signs of exhaustion that you can take advantage of. Furthermore, this is a market that I think remains choppy due to the fact that not only do we have the Federal Reserve out there flooding the markets, but we also have the possibility that people will be looking towards the Japanese yen for more of a “risk off” type of trade. Because of this, I think what we are looking at is a perfect situation where we could continue further to the downside. As far as buying is concerned, I have no interest in doing so, because quite frankly that would involve a major shift in attitude. If I want to buy the US dollar, I will probably buy it against the Euro or the British pound, assuming that we even get to that point.