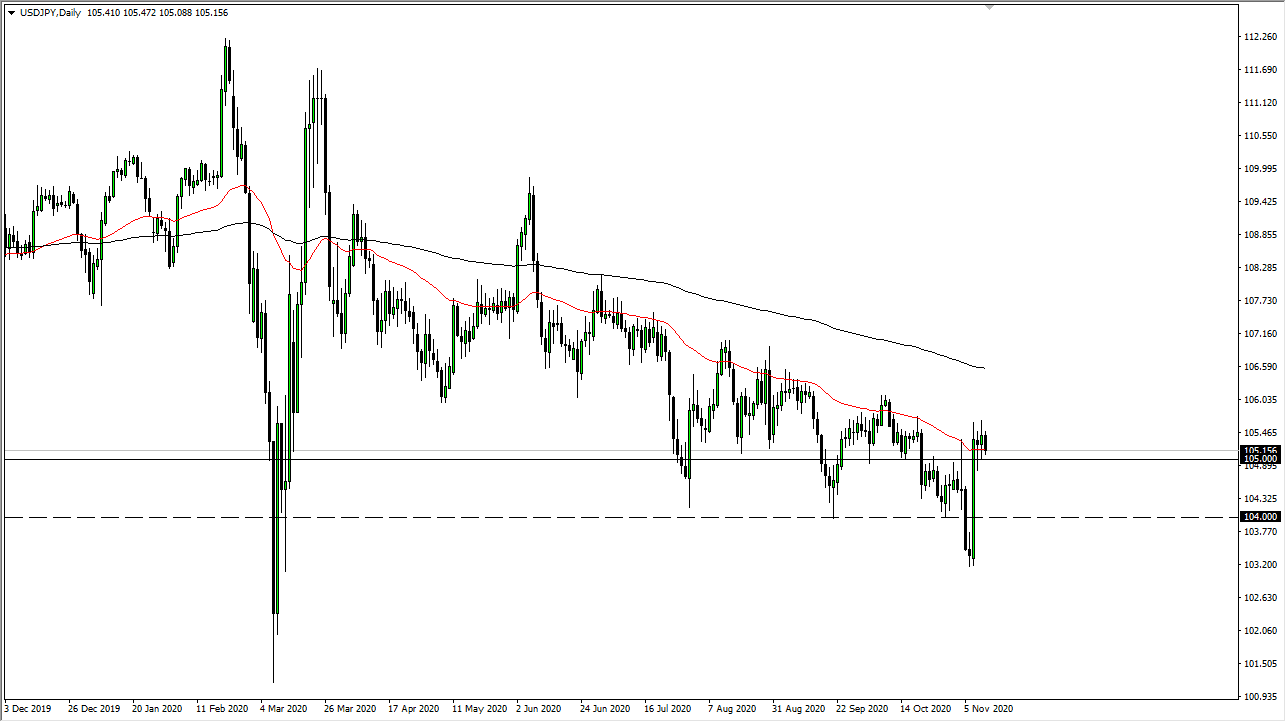

The 50 day EMA is slicing right through the candlestick, so this of course is an area that people will be paying attention to. At this point in time, I have a lot of questions when it comes to this pair and I have not gotten much in the way of clarity.

When I look at the chart, the Monday candlestick has caught my attention but the fact that we have not gone anywhere from that move tells me that the market may not be ready to take off. If we were to break above the ¥106 level, then I think at that time we would probably see some type of trend change and we could go higher. However, if we were to break down below the ¥105 level on a daily close, that could very easily send this market down towards the ¥104 level. That trade is the one that goes with the longer-term trend, but that Monday candlestick certainly is something worth paying attention to, and the fact that we have just sat there since then tells me that there is at least a real chance that this could be a turnaround.

This was a move that was predicated upon the virus vaccine, and traders try to get ahead of a potential economic recovery. At this point, it is very likely that the market will have to make some type of decision and I suspect that by the end of the next couple of days we should see some type of clarity in this pair. I am still leaning towards the downside, but it is obvious that this week has people thinking that we could in fact things could be changing. A little bit of patience is probably needed, and I am simply going to be looking at the daily close outside of this 100 point range in order to get going.This is a market that I think needs to make a decision, but I am going to be very cautious about putting money to work until I get some type of confirmation