While the COVID-19 pandemic continues to depress global economic activity, India entered a recession after printing a 7.5% drop in GDP in the third quarter of 2020. It followed a 23.9% collapse in the second quarter, which resulted in the first-ever recession for India since record-keeping began. Rahul Gandhi, the President of the Indian National Congress, blamed Prime Minister Narendra Modi. The USD/INR paused its breakdown sequence, but a pending rejection can accelerate the sell-off.

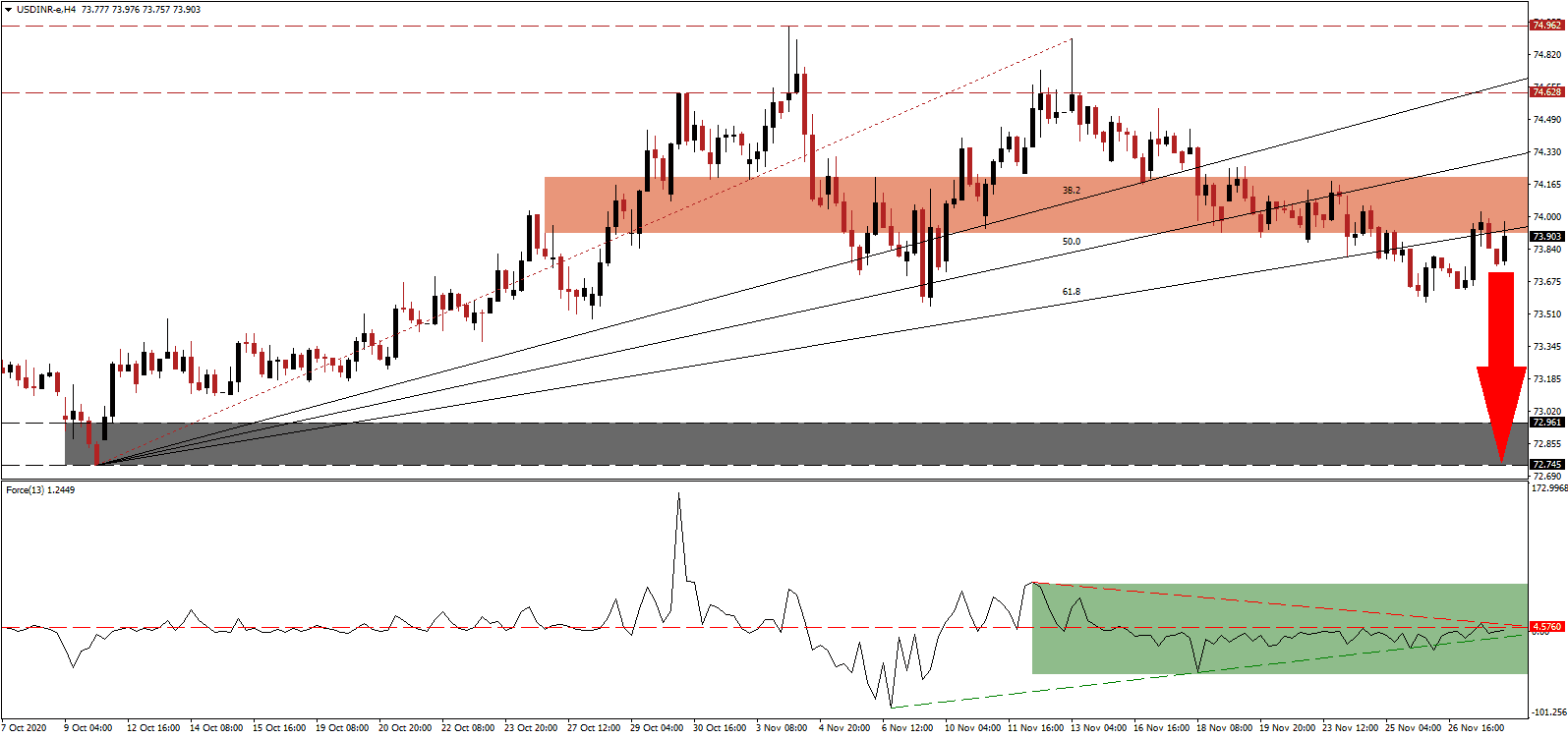

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, confirming the dominance of bearish momentum. Adding to downside pressures is the descending resistance level, as marked by the green rectangle, expected to pressure this technical indicator through its ascending support level. Bears wait for the Force Index to move below the 0 center-line to claim complete control over the USD/INR.

Despite the recession, foreign direct investment (FDI) rose to $28.1 billion in the third quarter, compared to $14.06 billion one year ago. Piyush Goyal, Minister of Consumer Affairs, Food and Public Distribution, credited the policies of Prime Minister Modi for doubling FDI. The USD/INR retraced a breakdown below its short-term resistance zone located between 73.916 and 74.200, as identified by the red rectangle, but a pending rejection will set it on course to extend to the downside.

One bright spot during the COVID-19 pandemic remained the agricultural sector. While GDP dropped 7.5%, agriculture output increased by 3.4%. Ashok Gehlot, the Chief Minister of Rajasthan, urged Prime Minister Modi to reconsider proposed legal changes to the agricultural law to protect farmers. The breakdown in the USD/INR below its ascending 61.8 Fibonacci Retracement Fan Support Level increased the risk for a collapse into its support zone located between 72.745 and 72.961, as identified by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 73.900

Take Profit @ 72.750

Stop Loss @ 74.250

Downside Potential: 11,500 pips

Upside Risk: 3,500 pips

Risk/Reward Ratio: 3.29

A breakout in the Force Index above its descending resistance level may result in a temporary price spike in the USD/INR. Forex traders should consider it as a secondary selling opportunity. Conditions in the US continue to deteriorate, adding ongoing downside momentum on the US dollar. The upside potential remains reduced to its resistance zone between 74.628 and 74.962.

USD/INR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 74.550

Take Profit @ 74.900

Stop Loss @ 74.250

Upside Potential: 3,500 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 1.17