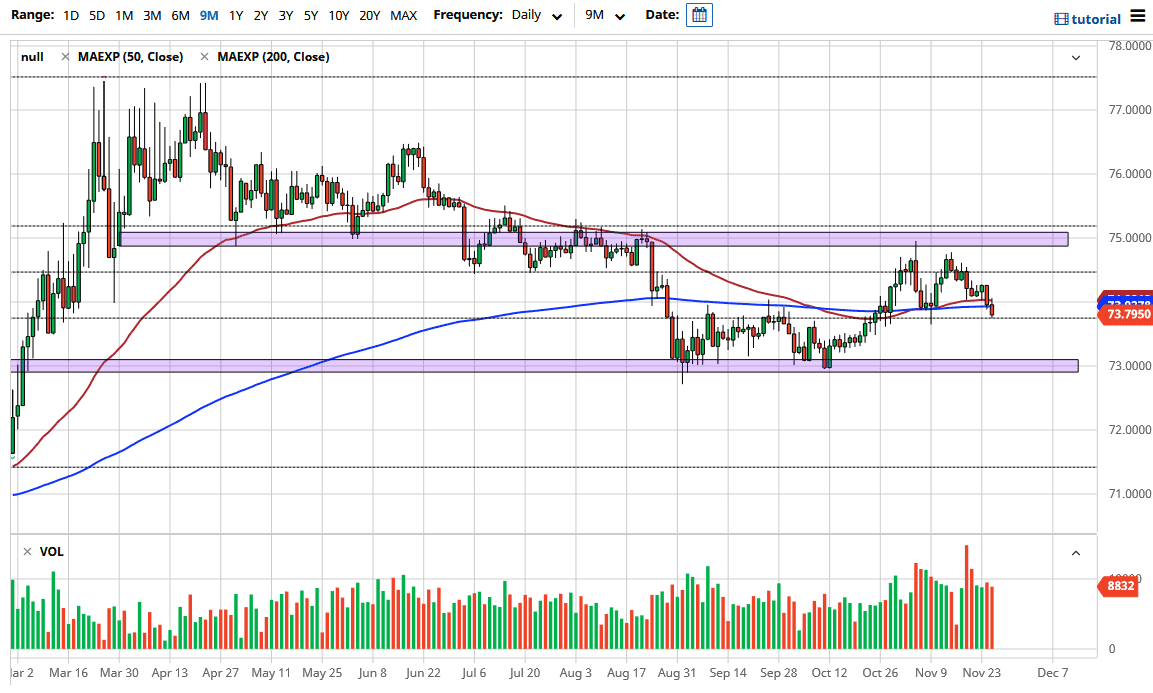

The US dollar initially tried to rally during the trading session on Wednesday, but found enough resistance at the 50-day EMA to pull back. By doing so, we even sliced through the 200-day EMA. But it should be noted that both moving averages are relatively flat, which suggests that the market is still somewhat unconvinced of a bigger move, which makes sense considering that we are talking about an emerging market currency here.

The ₹73 level underneath will continue to be a target if we can break down below the ₹73.68 level. We have seen considerable support in that region over the last several months, and I anticipate that we will see it the next time we return. However, things are a bit different now, as the world is starting to look towards an economy after a vaccine. This would be a huge undertaking in a country like India, but it could send the rupee much higher in value as the Indian economy is highly sensitive to the global trade situation. But the question of whether or not we will get back to normal anytime soon is a longer-term one.

You can make out an “M pattern” forming over the last two months, so if we break down from here we will challenge the ₹73 level again. This area being broken to the downside could open up a move directly towards the ₹72 level next. There is much more of a “risk on" attitude around the world in general, so eventually we could make that move. US dollar rallies are to be sold on signs of exhaustion, which is basically what this chart has shown. However, this pair does tend to move rather slowly, so you should have plenty of opportunity to get involved in a trade if and when it shows up. I am personally looking for a breakdown below the aforementioned ₹73.68 level, or a rally that shows weakness near the ₹74 level on a short-term chart. If we suddenly get a shock to the global economic system, then this pair will go straight back up in the air.