Brazil remains the third country in the world most infected by COVID-19, with more than 6,000,000 confirmed cases. President Jair Bolsonaro relied on debt to bridge the first wave of the pandemic, but will not be able to repeat it during the second wave. The Independent Fiscal Institution, affiliated with the Brazilian Senate, revised its projection that debt will reach 100% of GDP. It now predicts it will occur in 2024 rather than in 2022, but added that the trajectory is troubling. The USD/BRL nears the end of a short-covering rally favored to ignite the next breakdown.

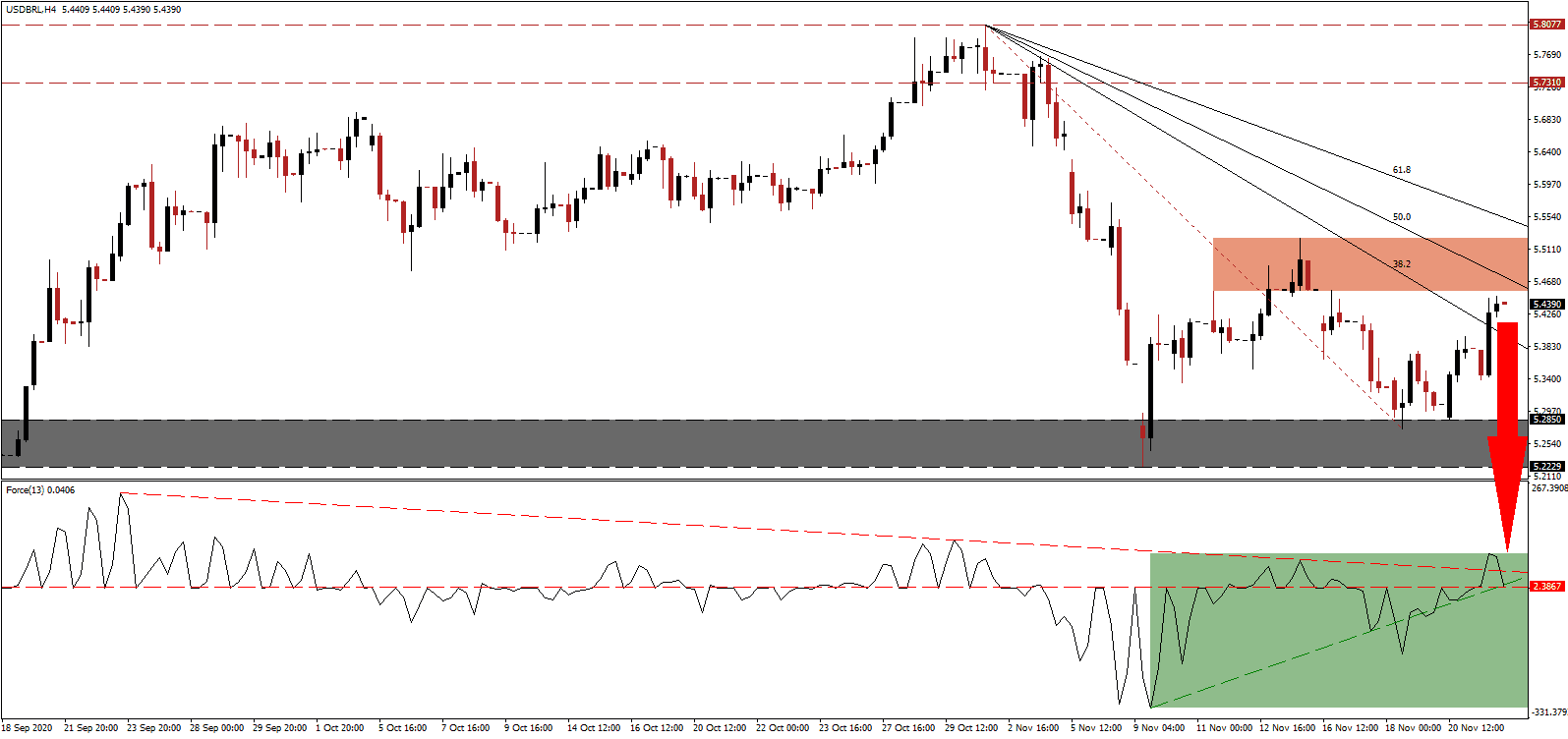

The Force Index, a next-generation technical indicator, reversed from a brief push above its descending resistance level, as marked by the green rectangle, and has moved below its ascending support level. It is on track to move below its horizontal resistance level and into negative territory. Bears wait for this technical indicator to slide below the 0 center-line to regain full control over the USD/BRL.

President Bolsonaro supported a proposed World Trade Organization (WTO) reform at the G20 summit. He also welcomed an agreement to suspend debt payments to assist economies in their recovery efforts from the COVID-19 pandemic. Brazil secured $3 billion in capital from the New Development Bank (NDB) created in 2016 by BRICS. The short-term resistance zone between 5.4560 and 5.5257, as identified by the red rectangle, is well-positioned to reject the counter-trend advance in the USD/BRL.

Adding to bullish pressures on the Brazilian real are expectations for an interest rate increase in 2021 to 3.00% amid rising inflationary pressures. Paulo Guedes, the Minister of Economy, suggested the sell-off in the currency overshot, giving an exchange rate of 5.00 in the USD/BRL as appropriate. The descending Fibonacci Retracement Fan Resistance Level magnifies bearish momentum, set to force the USD/BRL into its support zone between 5.2229 and 5.2850, as marked by the grey rectangle. An extension into its next support zone located between 5.0151 and 5.0830 remains a distinct possibility.

USD/BRL Technical Trading Set-Up - Reversal and Breakdown Scenario

Short Entry @ 5.4350

Take Profit @ 5.0350

Stop Loss @ 5.5300

Downside Potential: 4,000 pips

Upside Risk: 950 pips

Risk/Reward Ratio: 4.21

Should the Force Index move above its descending resistance level, the USD/BRL could attempt to seek more upside. It will present Forex traders with an opportunity to add new net short positions. The outlook for the US dollar continues to weaken, and monetary policy is unfavorable versus an improved outlook for Brazil. The upside potential remains reduced to its resistance zone located between 5.7310 and 5.8077.

USD/BRL Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 5.6300

Take Profit @ 5.7600

Stop Loss @ 5.5300

Upside Potential: 1,300 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.30