With the Covid-19 pandemic continuing to pressure the global economy into an extended recession, Brazil faces a decrease in foreign direct investment (FDI). October totaled $1.793 billion in inflows, down from the $8.221 billion reported one year ago. Between January and October, FDI is down by 44.6%. The USD/BRL rejection by its short-term resistance zone stabilized near its support zone, from where a more aggressive sell-off can unfold.

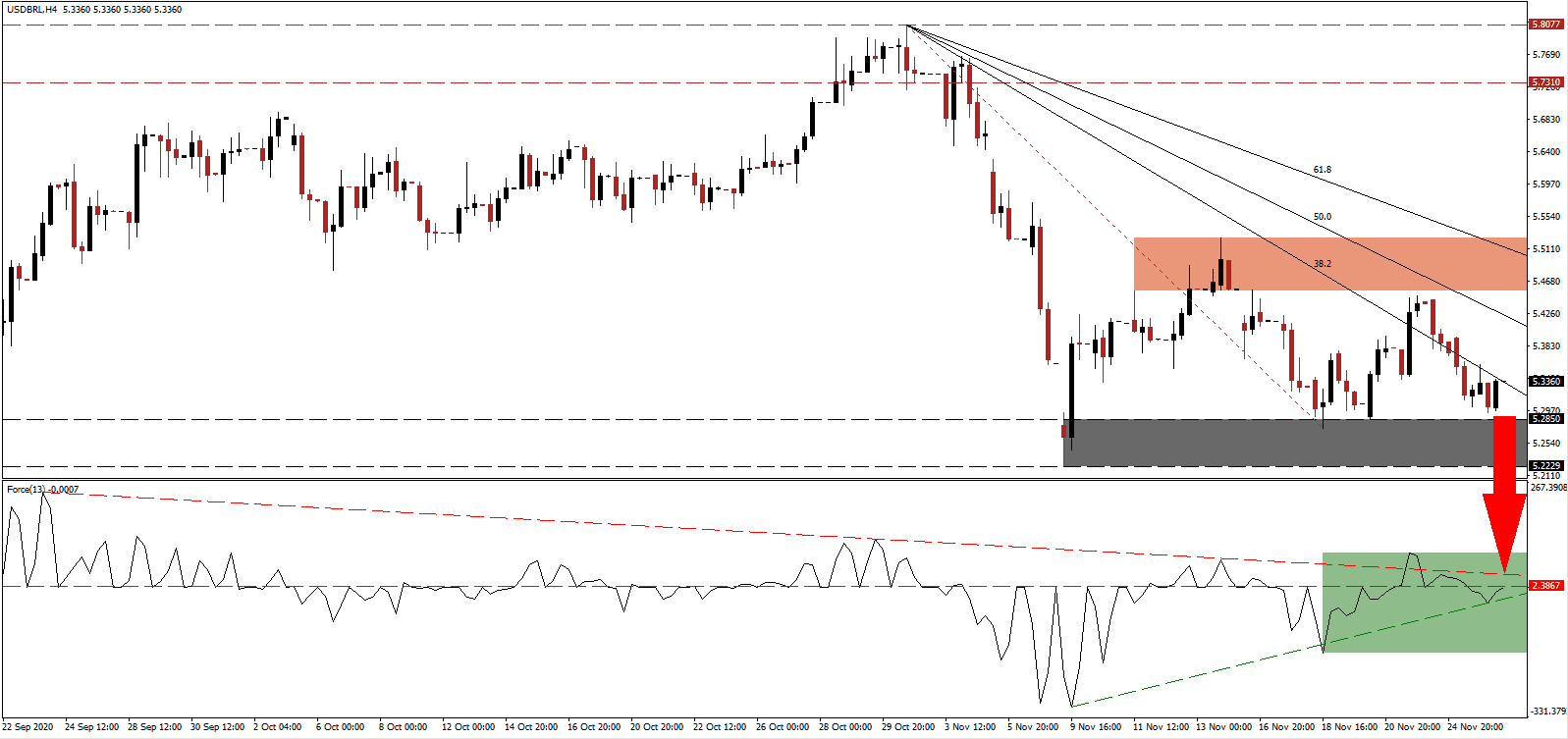

The Force Index, a next-generation technical indicator, reversed a brief spike above its descending resistance level and retreated below its horizontal resistance level. After the ascending support level halted the contraction, as marked by the green rectangle, a renewed push lower will pressure this technical indicator into negative territory. Bears remain in control over the USD/BRL.

Adding to positive progress for the Brazilian Real was the surprising strength in October jobs data. Brazil added 394,989 jobs against expectations for 233,500. It also eclipsed September’s figure of 313,560. The budget deficit clocked in well below the R$20.0 billion forecasted at R$3.6 billion. It does follow the R$76.2 billion deficit in September. Following the rejection in the USD/BRL by its short-term resistance zone between 5.4560 and 5.5257, as marked by the red rectangle, breakdown pressures expanded.

Robert Neto, the President of the Banco Central do Brasil, added to rising bullishness in the currency following his comments about a stabilizing currency easing inflationary pressures. An upbeat outlook on the global commodity market moving forward will further support the Brazilian economy. The descending Fibonacci Retracement Fan Resistance sequence can force a breakdown in the USD/BRL below its support zone between 5.2229 and 5.2850, as identified by the grey rectangle. The next support zone awaits between 5.0151 and 5.0830.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 5.3350

- Take Profit @ 5.0350

- Stop Loss @ 5.3950

- Downside Potential: 3,000 pips

- Upside Risk: 600 pips

- Risk/Reward Ratio: 5.00

A breakout in the Force Index above its descending resistance level may lead to another brief reversal in the USD/BRL. The upside potential remains confined to its 61.8 Fibonacci Retracement Fan Resistance Level. US economic data suggests weakness ahead with the second wave of the Covid-19 pandemic out of control. Forex traders should sell any rallies from current levels.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 5.4400

- Take Profit @ 5.5100

- Stop Loss @ 5.3950

- Upside Potential: 600 pips

- Downside Risk: 450 pips

- Risk/Reward Ratio: 1.33