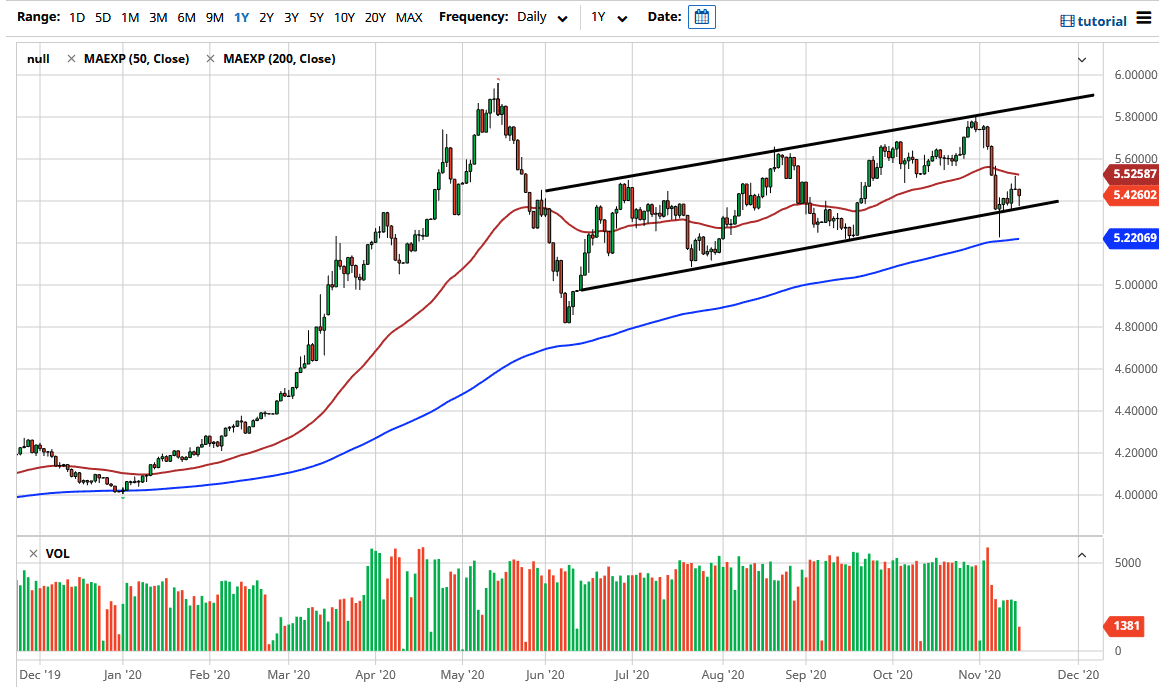

The US dollar pulled back slightly during the trading session on Monday but found enough support at the previous uptrend line that we continue to grind higher in general. The market is still in a well-defined channel, and last week we ended up forming a massive hammer from the 200-day EMA. This is a very bullish sign, and it suggests that we will continue to grind higher for the longer term.

Do not forget that the Brazilian real is considered to be an exotic currency, so you need a certain amount of “risk on” in order for the Brazilian real to strengthen for the longer term. So far, we have not seen that; although there was a wicked spike in value for the Brazilian real last week. The question now is not so much as to whether or not we will be able to rally, but whether or not we will hold the 200-day EMA. That is a massive indicator that many people pay close attention to, so it is likely that that area will attract attention regardless. In and of itself, it should offer a certain amount of support.

Looking at this chart, the uptrend line has clearly defined itself as support and the 50-day EMA above is starting to slope lower. If we can break above there, currently at the 5.52 level, then the market can take off towards the 5.6 level and possibly the 5.8 level after that. A lot of this will come down to coronavirus figures in Latin America, as the Brazilian real is one of the major currencies in that region. Currently, Brazil is still heavily inundated with coronavirus figures, which is one of the major concerns plaguing the Brazilian real. The US dollar could attract a certain amount of attention if we get more of a “risk off” type of trade as well, so pay close attention. However, if we do break down below the 200-day EMA, which is sitting at the 5.22 level, then you have to start thinking about a move towards the 5.00 level, possibly even lower than that.