Whipsaw trading conditions continue to make the USD/BRL difficult for some short-term speculators. However, the traders who are likely being hurt by the movement within the Forex pair are those who may be attempting to predict only one direction for the Brazilian real instead of contemplating the notion that both sides of the trading spectrum can be pursued.

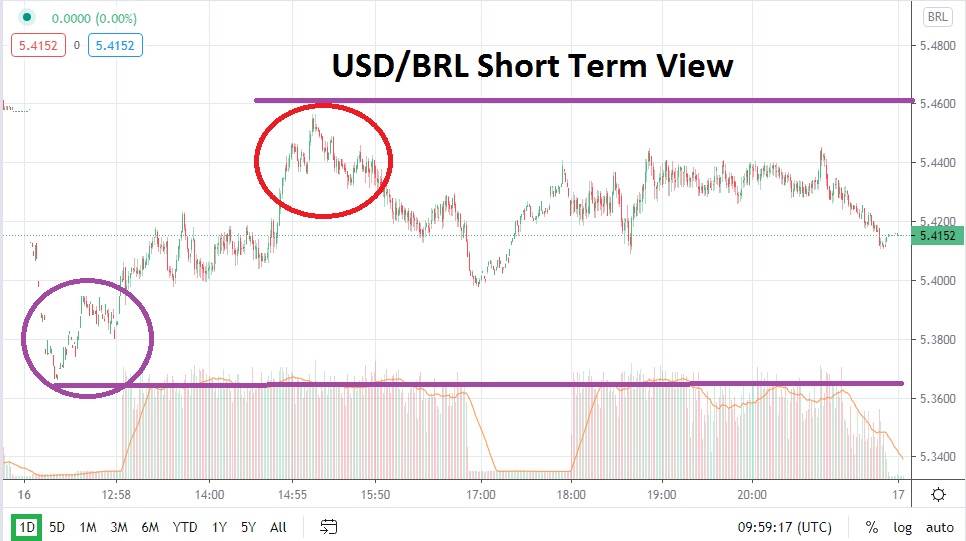

While the USD/BRL swims in turbulent, short-term waters with a seemingly endless display of testing support and resistance levels, the question that speculators who have had problems with the pair should ask is if it is time to reconsider tactics. Resistance levels between 5.5000 and 5.6000 have proven fairly solid since the 5th of November. Support levels have proven fairly consistent during the same time period with a range of 5.3000 to 5.4000. These numbers can be used by traders as a potential launching pad for placing long and short positions until one trend establishes itself in a stronger manner.

Yes, speculators may believe the USD/BRL needs to actually be enjoying a strong bearish trend than it has, but the market has not demonstrated this reality for a long time. Clearly, economic concerns in Brazil seem to be influencing the value of the USD/BRL even as many other emerging market currencies do produce stronger results. Perhaps the Brazilian real may eventually reignite a demonstrative bearish trend against the USD, but until support levels near the 5.2000 level are punctured lower and trading sustains itself below this mark, speculators should be wary of trying to pursue a downward trend with thoughts of a longer path to follow.

Selling the USD/BRL on slight reversals higher near the 5.4500 to 5.5000 marks and looking for short-term downside pressure seems like a reasonable position. And buying the USD/BRL when the Forex pair traverses towards the 5.4000 to 5.3600 support levels also seems like the right decision. Take profit needs to be used accordingly to take advantage of these relatively small moves.

Global risk appetite is optimistic, which may make an eventual bearish trend take place that is strong, but until the USD/BRL displays this ability from a technical perspective traders should be conservative with their decisions. The USD/BRL remains a challenging Forex pair and one which has produced choppy trading conditions. Speculators need to consider being flexible and testing both sides of its range in order to take advantage of the Brazilian real short term.

Brazilian Real Short Term Outlook:

- Current Resistance: 5.4550

- Current Support: 5.3900

- High Target: 5.5100

- Low Target: 5.3300