The S&P 500 initially pulled back during the trading session on Friday, but then turned around and went to the upside. The market is likely to go looking towards the 3600 level, which is a large, round and psychologically significant figure. The fact that we pierced that level and pulled back on Monday suggests that we will continue to see a lot of resistance above. However, it is worth noting that the market closed towards the top of the range for the day, which is a good sign.

Pay attention to whether or not Wall Street is paying attention to coronavirus figures. The market will continue to fluctuate based on whether or not there will be a significant uptick in lockdowns, about which Joe Biden has suggested he may not be as stringent as once thought, which might be giving Wall Street some hope. Do not worry, there is always a reason for Wall Street to hope, which is why the S&P 500 rises over time. This is also why the “buy-and-hold" strategy produces a positive expectancy eventually.

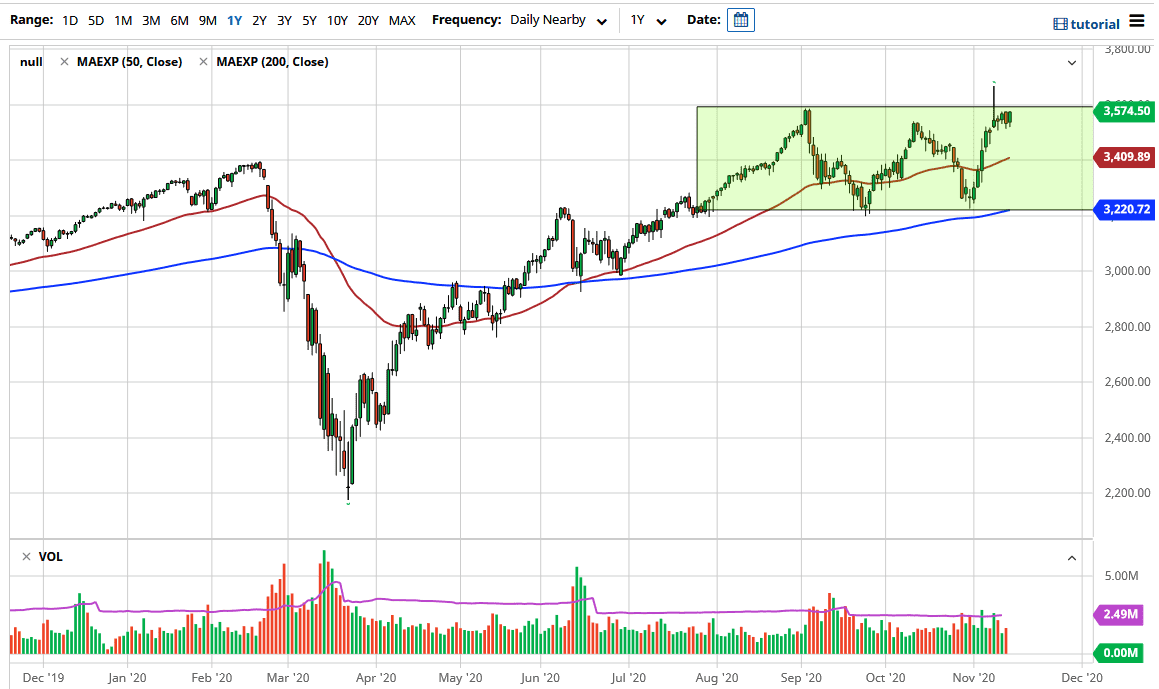

Looking at this chart, we are threatening the possibility of a “rounded top”, so we could pull back towards the 3400 level where we would see a massive amount of support in the form of the 50-day EMA, and it is an area of previous interest. Even if we break down below there, there should be plenty of support at the 3200 level as well. The 200-day EMA sits there, which would also be an area where I might be looking to take advantage of value.

On the other side of the equation is the fact that the Monday candlestick was a reaction to the vaccine announcement. But it then gave back all of the gains, which tells me that the market is still very skittish. You would think that we would have gone straight to the moon based on the overall narrative, but we could not hang on to the gains. That is something to pay attention to because it could be the first tipoff of something uglier coming. Nonetheless, I am not selling, and I am looking for support of bounces to buy.