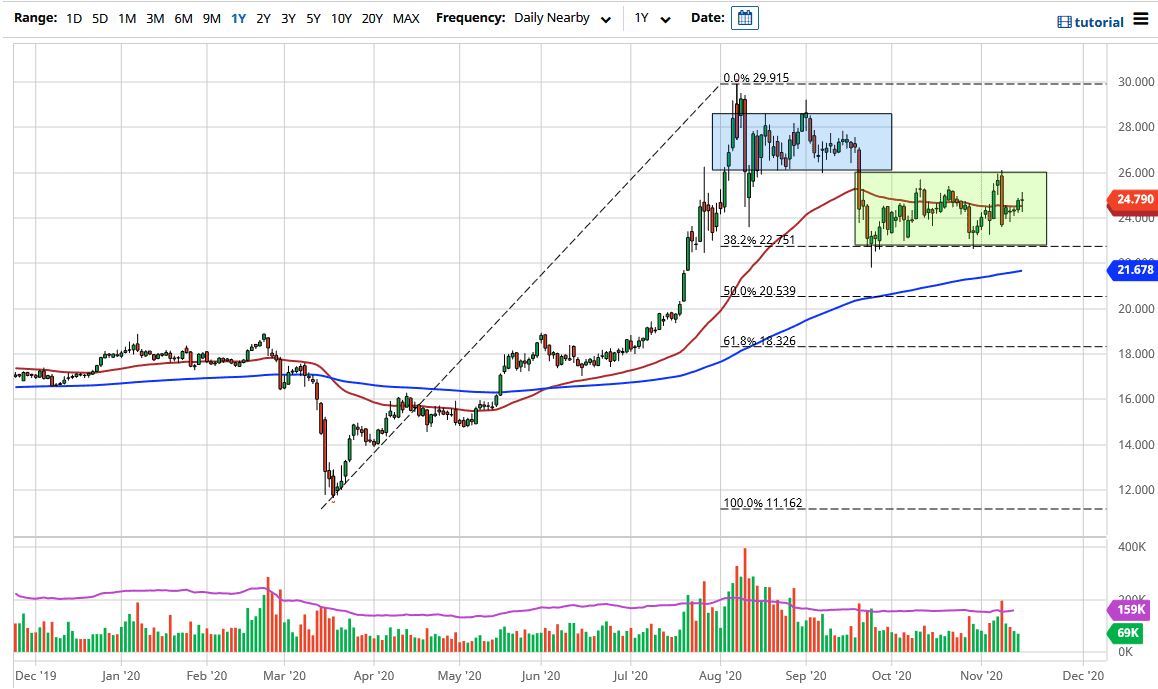

Silver markets have fluctuated during the trading session on Monday, as we continue to bounce around just above the 50-day EMA. Silver is in the middle of a larger consolidation area as you can see marked on the chart, so you are essentially in “no man’s land.”

These types of trades get me into serious trouble. This is because anytime you have a 50% chance of the market moving in one direction or the other, it invariably seems to work against me. The candlestick for the trading session on Monday does give me the impression that we will go higher, but the $26 level above is resistance which would be a target if we break above the highs of the day on Monday. Alternatively, if we break down below the lows then the market will go looking towards the $24 level, perhaps down to the $22.75 level after that, which has shown itself to be important vis-a-vis the 38.2% Fibonacci retracement level.

Looking at this chart, it is only a matter of time before we see a decision made. But the easiest trade is to simply hope for a pullback that you can buy, as silver is a longer-term uptrend. If we do not get that, then signs of exhaustion at the $26 level might be a short-term selling opportunity if you feel comfortable shorting silver, something I am not ready to do. If we do pull back from there, then I will simply look for the pullback as an opportunity to get long again.

Longer term, silver will take off, mainly because central banks around the world will continue to flood the markets with liquidity, and we will start hearing the phrase “quantitative easing” coming from multiple central bankers. What we are seeing here is the possibility of the silver markets rallying significantly over the next several months, if not years. However, you need to be cautious about the overall position size, as this market does tend to move rapidly and can give you extreme bounce of volatility and, needless to say, a headache.