Silver markets did very little during the trading session on Wednesday, as one would expect the day before Thanksgiving in the United States. After all, this market is very centralized in the United States and the biggest futures exchange there drive global liquidity. There will be some trading on Thursday, but it will be in the Globex session, meaning that it will be all electronic and relatively thin.

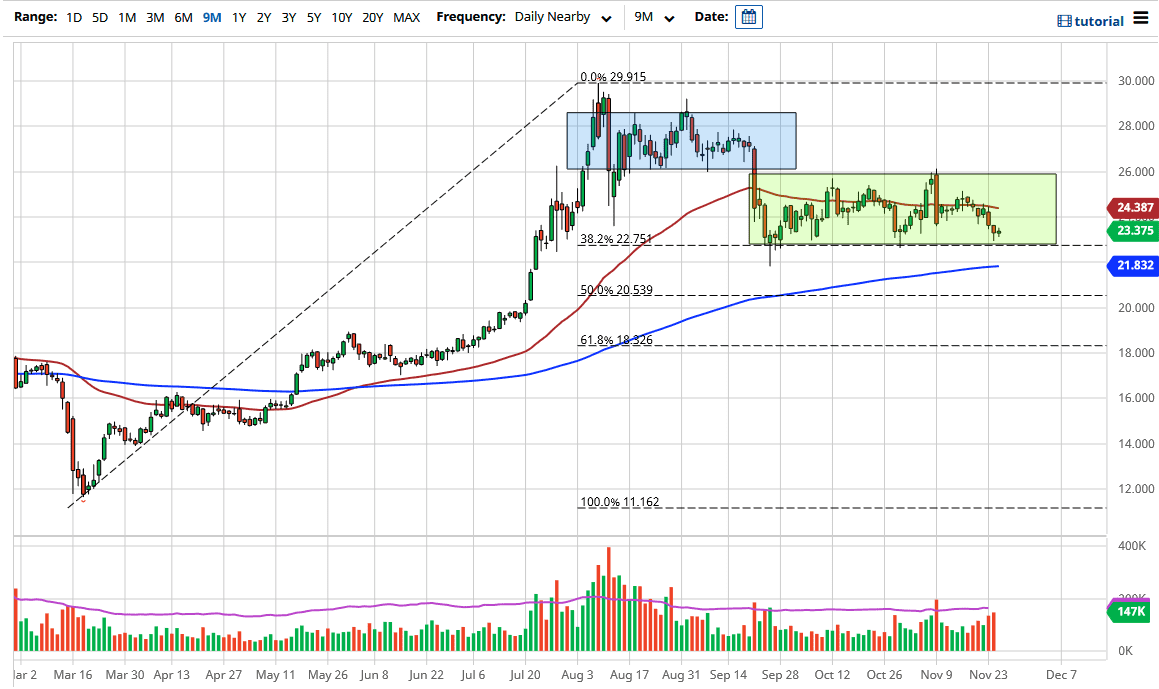

This is one of the biggest problems I have with analyzing this market right now, because clearly we are in an area that should provide support based on the green box that I have drawn on the chart. Eventually we have to make a decision, but the next day or two might be relatively quiet. This is because even after Thanksgiving it's Friday, which is traditionally a holiday for most people anyway, and there will be shortened hours. In other words, nobody is going to be really working when it comes to some of the bigger players.

The $22.75 level is an area that has been supportive several times, so it is not a huge surprise to see that we have stabilized there. It is the scene of the 38.2% Fibonacci retracement level and has the 200-day EMA rapidly approaching it. These are all reasons to think that perhaps there should be buyers sooner rather than later, but we need to pay attention to the US Dollar Index. The negative correlation between the two markets has been relatively high as of late and, depending on your timeframe, has been as high as -0.9 which is a pretty strong reading.

So if the US dollar rises, the silver market falls, and vice-versa. There is the question as to whether or not we are going to have a pickup in the demand for silver when it comes to its industrial use as we get the vaccine. My feeling is that longer-term, between the central bank liquidity measures and other factors, silver should continue to go higher. But it is obvious to me that we have gotten far too ahead of ourselves with the whole reflation trade. I look at silver as an investment and try not to leverage my position too much; meaning, I actually prefer physical. However, if you find yourself trading a leveraged position, just make sure that it is not too big; because while the fundamentals are good for silver longer-term, we have a lot of noise to chew through. I do like the market in general and will continue to buy dips going forward.