The majority of the large money out there would have been on the sidelines, and therefore it makes sense that nothing actually came from the session. This is a market that has had a couple of days’ worth of thin trading. This is a market that should continue to see a lot of indecision in this area, and quite frankly Friday will be more of the same. We will have limited electronic trading, and most of the large commodity trading houses in the United States will be focusing more on the holiday again.

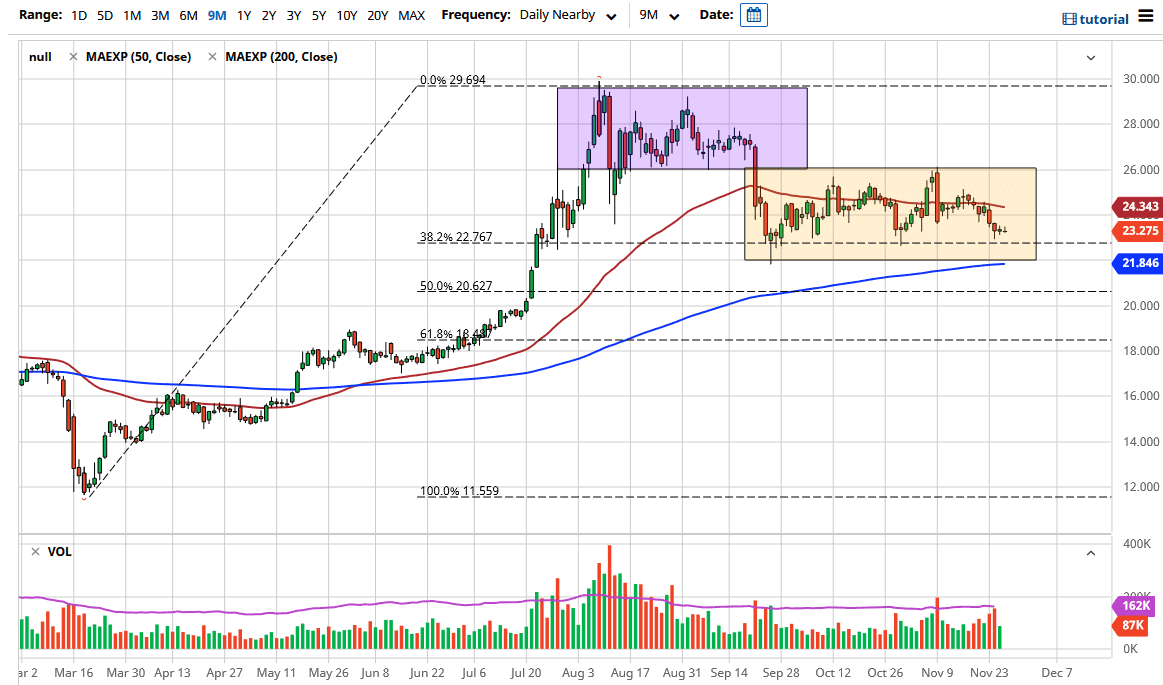

The 200 day EMA sits just below at the $21.84 level, so there is more or less going to be a “zone of support” underneath that should continue to keep this market somewhat elevated. This is a market that I think it does go higher over the longer term, due to the fact that central banks around the world continue to flood the world with liquidity and of course people will look towards “hard assets” such as gold and silver in order to preserve wealth. The 50 day EMA above is showing signs of resistance, and it is likely that the market is probably going to go back and forth in this general vicinity, perhaps trying to build up a bit of a base before we can continue the longer-term uptrend.

After all, you can see that the market shot straight up towards the $30 level before pulling back. On the chart I have a couple of rectangles drawn, as they are essentially levels that people are going to be trading in, and they serve as a little bit of a guide as where we may go. I believe that the market will eventually start looking towards the upside if the US dollar continues to get sold off. I would not read too much into the Wednesday, Thursday, and Friday candlesticks, because the volume will have been a major issue. If we did break down below the 200 day EMA, then I would have to rethink some things, and perhaps buying closer to the $20 level.