Silver markets were hammered by Pfizer during the trading session on Monday, breaking through the 50-day EMA from far above. The market was extraordinarily affected by Pfizer's announcement that they have a coronavirus vaccine which could work over 90% of the time. So we are going to hear noisy trading, and markets that are thinner such as silver will continue to be difficult at times.

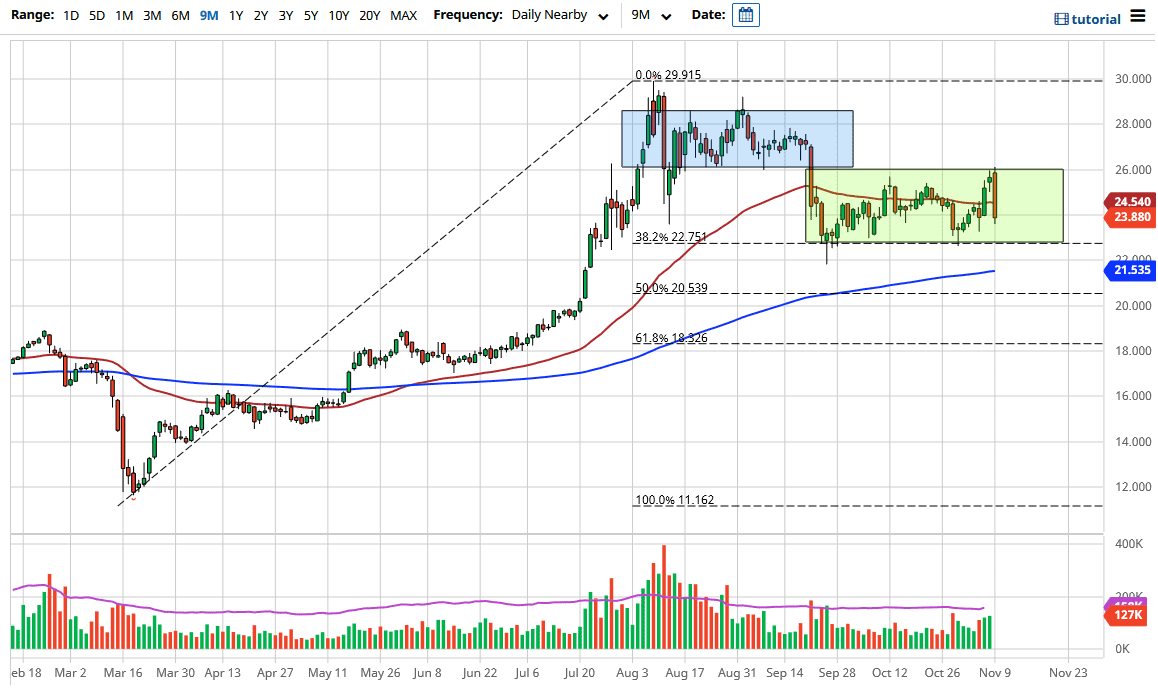

The silver market formed a large candlestick, reaching down below the $24 level. However, we are starting to find some support, so we will turn things back around. Looking at this chart, it is only a matter of time before the buyers return, even if we drop down below the $22.75 level which has been massive support. The 200-day EMA underneath could offer support near the $21.50 level, but even below there we would see a lot of support at the $20 level.

This ultimately comes down to the central banks and whether or not they will flood the markets with liquidity, which will result in people running back towards precious metals. We had a larger move with the “risk off” traders covering positions because we had the possibility of a vaccine, and those traders have clearly left the market. However, the longer-term trend still favors the upside, and we have bounced from the 38.2% Fibonacci retracement level at least twice, which is typically a sign that you are going to have strength. When you only drop that far, it means you have an extended run ahead of you. You can make a longer-term argument for precious metals to go higher under a lot of scenarios, so it will be interesting to see how this plays out. But I remain bullish and am looking for dips as potential buying opportunities on short-term charts.