Silver markets broke down slightly during the trading session on Monday, as the US dollar got a bump higher. Part of this may have been due to profit-taking, and part of it may be due to the US dollar seeing inflow from the Brexit situation getting sour yet again.

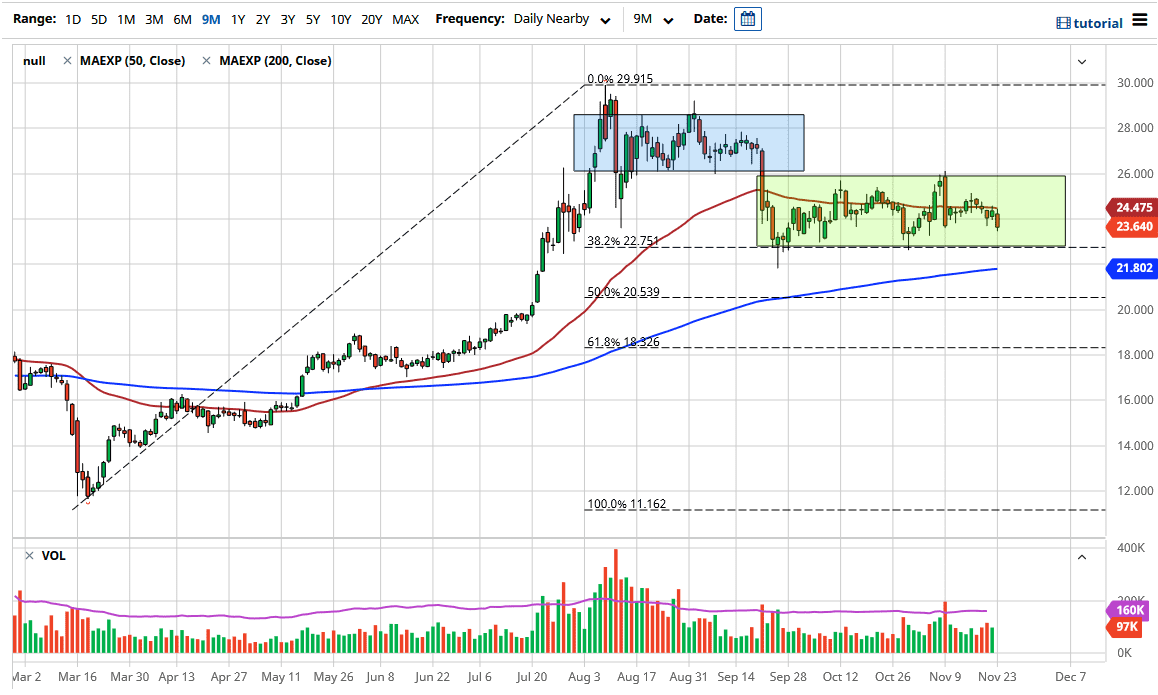

You can clearly see on the chart that I have a green box strong, and that the support level is down near the $22.75 level. At that level, I do believe that there will be buyers willing to jump into the marketplace and take advantage of “cheap silver.” I am waiting to see what the market does once we get down there, and I will be paying close attention to daily candlesticks. It is difficult to imagine how this will turn out - at least in the short term - because there are so many different things that the markets are watching.

Remember that the silver market tends to move counter to the US Dollar Index as of late, but it does not have to follow that exact pattern. The US dollar getting a boost during the trading session on Monday had its influence on silver. You can see that the candlestick is closing towards the bottom of it, which suggests that perhaps the market could continue lower. In that case, I will be looking for the $22.75 level to cause a certain amount of support. I am cautious because I recognize that we could see a bit more negativity in the short term. Even if we break down below there though, I think the 200-day EMA, which is currently sitting at the $21.80 level, could offer support as well. After that, we are talking about the possibility of a return to the $20 level.

Regardless of what happens next, I have no interest whatsoever in shorting this market, and eventually we will be able to find support underneath of which we can take advantage. I will take this day by day and simply wait for the right daily candlestick. Central bank liquidity measures will continue to push silver higher, but it may take a while for the markets to come back down. On top of that, with Thanksgiving this Thursday, one has to wonder about liquidity and volume as well.