Silver markets rallied significantly during the trading session on Friday, breaking above the 50-day EMA in a push higher. The previous two sessions were slight hammers, which suggests that we may go to the upside. Nonetheless, we are still in a range that we have been in for some time, so it is going to continue to be a very noisy market.

Pay attention to the US dollar, because if the US dollar starts to strengthen, then precious metals tend to underperform, and vice-versa. The market is likely to continue to see a lot of volatility because there are concerns out there and central banks continue to flood the market with liquidity, while there are a lot of major headwinds killing any type of industrial demand. This is a market that is trying to find its way, but in the long term the buyers will come in and push everything higher.

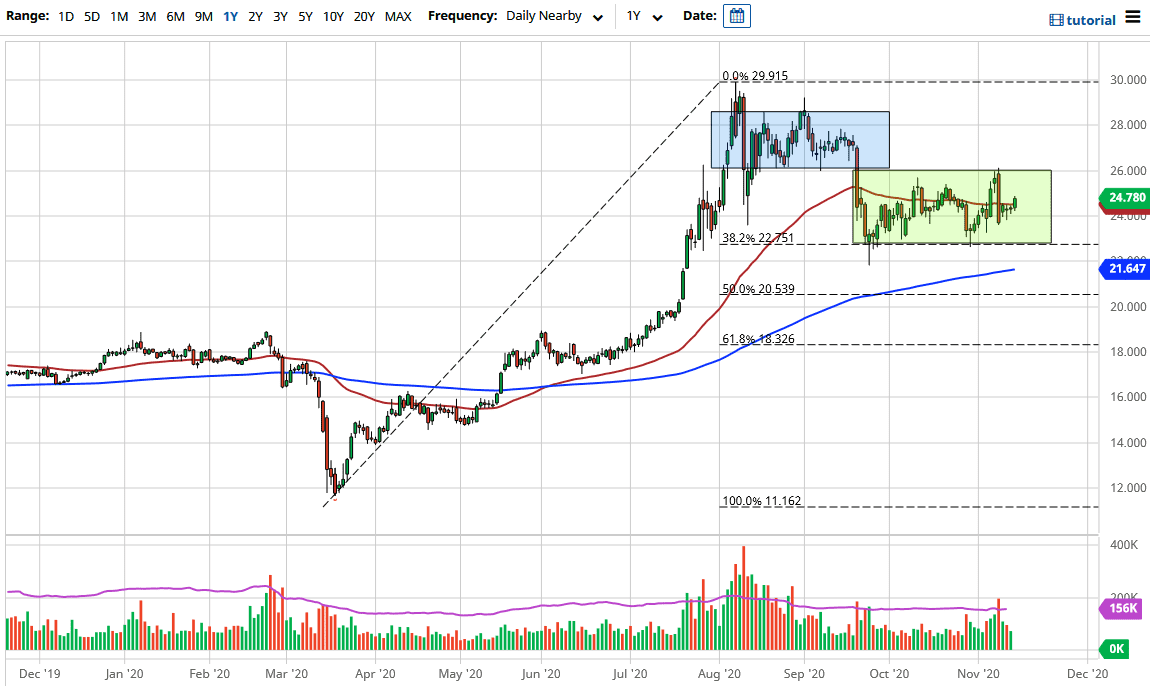

We may continue to see short-term pullbacks as opportunity, as the 200-day EMA sits at the $21.64 level and rising. The 38.2% Fibonacci retracement level sits near the $22.75 level, which is something that also could attract some support as well. We will eventually go looking towards the highs again, but it does not mean that we will get there easily or that it will not take a significant amount of effort.

Over the longer term, the US dollar and silver can both right themselves at the same time, because both of them can be used as a safety trade. If the economy expands, that is typically good for silver as well, because it has such a high demand for industrial uses. I have no interest in shorting now and I believe the longer-term fundamentals will eventually work out in silver's favor. But right now we are fighting with a lot of moving pieces, so things are choppy.