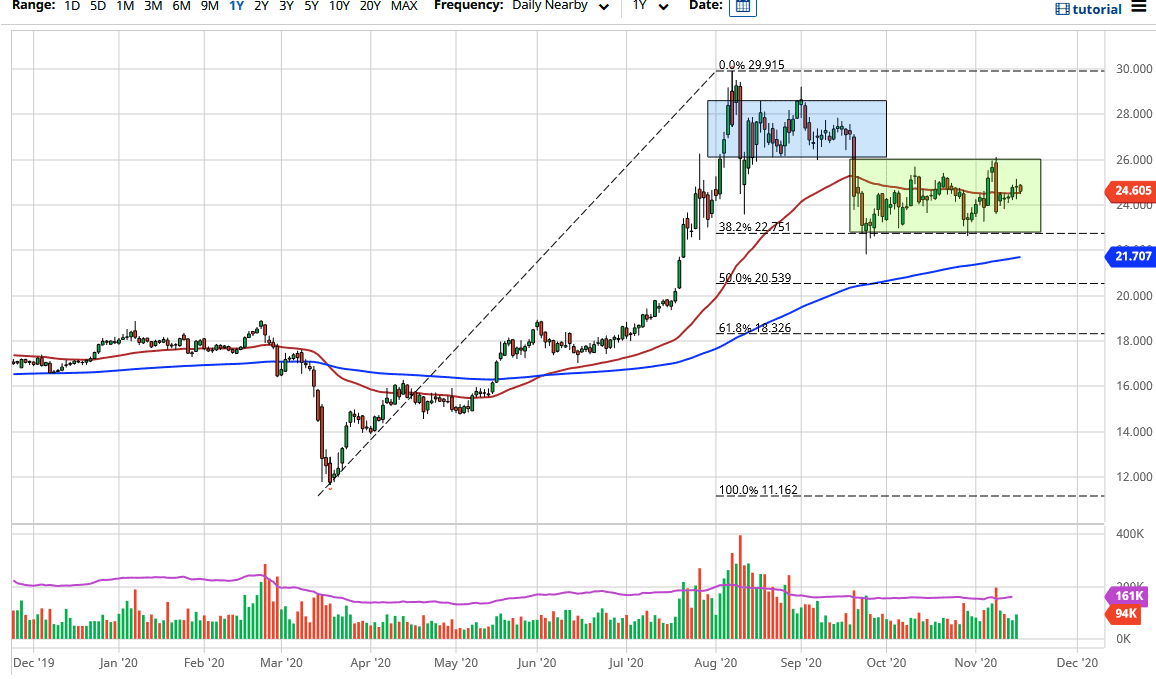

The silver market has fallen after initially trying to gap higher at the open on Wednesday. This market continues to hear a lot of noise; sitting around the 50-day EMA shows just how undecided we have been. There are a few things going on that can push and pull this market in both directions.

To begin with, it very likely that central banks around the world will continue to flood the markets with liquidity, which drives up the value of precious metals in general. We will then continue to see a lot of bullish pressure underneath for most precious metals, not just silver. Furthermore, we have seen the US dollar deteriorate lately, so we may continue to see bullish pressure in the silver market due to the currency situation alone.

Silver is an industrial metal, and we need to pay attention to that. This is a market that will continue to see destruction for that, due to the fact that we simply do not have enough growth out there to demand that much silver. This is purely a play against currency, and in that general vicinity it is typical for gold to continue to go much higher. Even if we do break down below here, the market will find support at the $24 level as well as the $22.75 level. Underneath there, the 200-day EMA is at the $21.70 level, and that also offers a significant amount of support. I like the idea of picking up value if and when we get an opportunity, so we will likely continue to find cheaper silver and get long. The market may continue to be a “buy on the dips” situation. You need to be cautious about your position size initially, but we will eventually take off to the upside and continue the overall uptrend.