Silver dipped a bit during the trading session on Thursday, dropping below the $24 level before turning right back around to form a bit of a hammer. This tells me that we still have plenty of buyers underneath, and that should not be a huge surprise considering that central banks around the world are still looking to flood the markets with liquidity. As they do, that should continue to push precious metals higher, silver of course is included in that scenario.

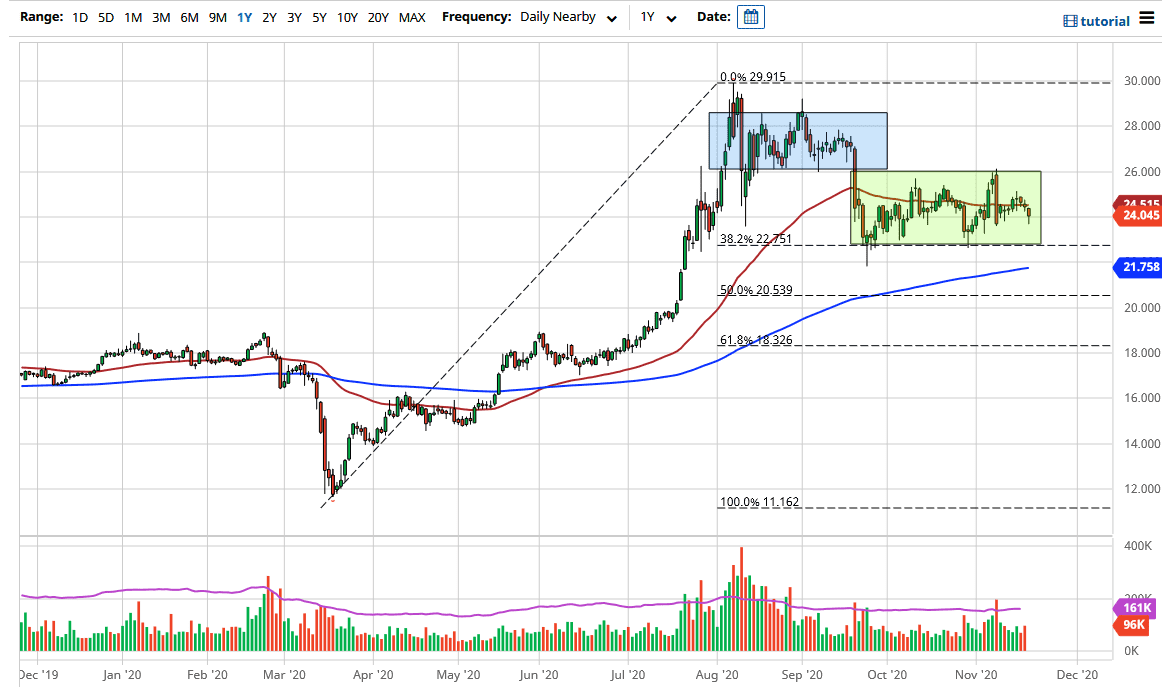

As you can see on the chart, I have a green box that suggests the range that we are in, and at this point in time the $22.75 level is the massive support level underneath that I am paying the most attention to. Not only has it offered support previously, but it is also the 38.2% Fibonacci retracement level. Underneath there, then we have the 200 day EMA near the $21.75 level, so I think that the buyers will probably jump back into the market in that general vicinity as well. Nonetheless, I will be basing this upon daily candlesticks and recognize that silver markets will continue to be very noisy in general.

Looking at this chart, the market is likely to continue to see value hunters going forward not only due to the fact that we have plenty of volume and order flow just underneath, but we also have the fact that the US dollar looks like it may continue to struggle overall, at least in the intermediate term. If that is the case, that should continue to drive the negative correlation between the US Dollar Index and silver, and therefore a falling dollar of course helps this market as it takes less of those greenbacks in order to buy an ounce. That being said, I think you probably have plenty of time to get involved and therefore I am still looking for lower prices before I put money to work. With that in mind I will be taking a look at the daily candlestick before I put money to work. However, we broke above the 50 day EMA it is possible that we could go looking towards the $25 level, and then maybe even the $26 level above. Overall, this is a market that continues to see a little bit of pressure, but it is worth noting that it has held up quite nicely over the last couple of months in the face of it.