The NASDAQ 100 has fluctuated during the trading session on Monday to show signs of volatility again. The reality is that the market has shown itself to be in a conundrum, because the biggest problem we have is that with vaccine news, people start to think about the idea of getting rid of the “stay-at-home” trade, which is the bulk of the NASDAQ 100, or at least the bigger companies that move the index.

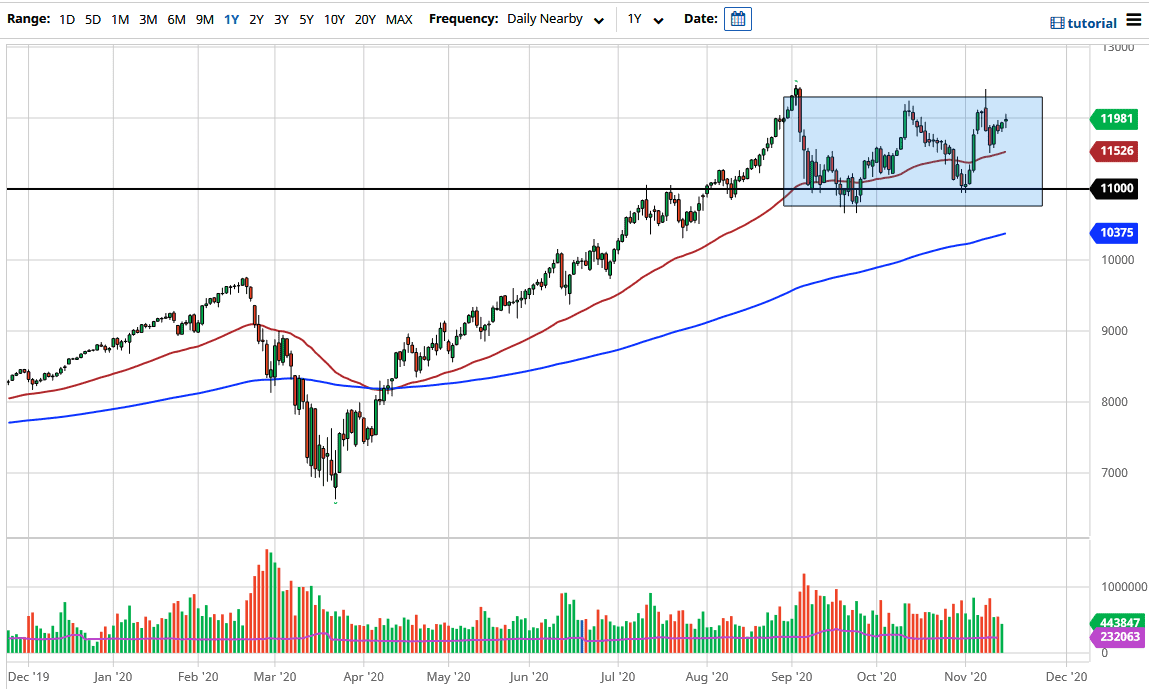

The 50-day EMA underneath should continue to offer a lot of support, so if we pull back to somewhere around there we would see buyers coming back in. The 11,500 level is where it is, which is a very interesting place to get long if we get an opportunity. However, even if we break down below there, there is a lot of support near the 11,000 handle, which is a big round number that many people will be paying attention to as usual and we have seen previous action in that same area.

On the other hand, we could break out to the upside, but we need to clear the 12,500 level in order to continue to go higher. If we break above there, then we could go looking towards the 13,000 level, possibly even further than that. I have no interest in trying to short this market, because it has been so strong for so long. The NASDAQ 100 is an area of the equity markets where we would see a lot of growth stocks, so it comes down to what rotation we are currently in. The markets have been fluctuating for several days trying to figure out whether or not we are in a growth or a value phase. This will continue to make the NASDAQ 100 difficult, but it is really no market to be shorting anytime soon, because there is always a narrative to turn things around. I continue to buy dips at the first signs of support. I fully expect that this market will eventually break out.