The NASDAQ 100 has rallied a bit during the trading session on Thursday, which of course was also Thanksgiving in the United States. At this point in time, the market is likely to see buyers on dips, as it has for some time. After all, we need to keep in mind that the NASDAQ 100 is heavily favored towards just a handful of stocks that everybody loves. We have seen this market rally from the “stay at home” trade, and the “work from home” trade. That should continue for the next several months, but it should also be noted that a lot of the companies that have benefited from the pandemic will continue to benefit because of the growth that the pandemic has kicked off.

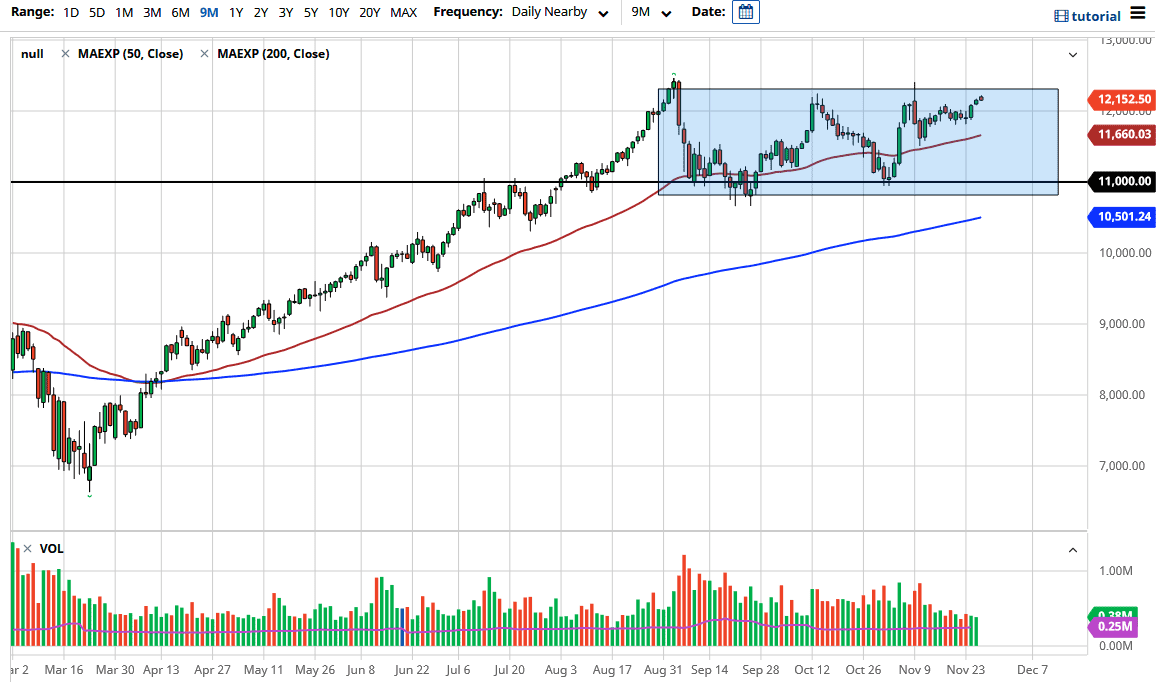

After all, some people are not going back to work in the normal sense, so a lot of these “work from distance” type of situation should continue to attract a certain amount of attention. Ultimately, the 50 day underneath should offer support as well so I think that even if we do get a pullback, there will be plenty of value hunters willing to go into the market. The 50 day EMA has been relatively reliable for some time and I do think that what we are seeing here is an attempt to finally break out above the top of the consolidation area. The 12,500 level has been significant resistance but eventually we should break above there and the fact that the most recent lows continue to get higher, so I think we are building that pressure to finally break out.

All of this being said, it does not mean that we are going to take off straight away, so that is why I like the idea of buying pullbacks as it gives you a little bit of opportunity to find value and make more profit. Eventually once we break above the 12,500 level, then the measured move suggests that we could go to the 14,000 level given enough time. People are starting to price in the idea of a post pandemic world, so that of course will help as well as the general massive amounts of liquidity that continue to be an everyday feature of this market. I have no interest in shorting the NASDAQ 100, because it is far too dangerous in general.