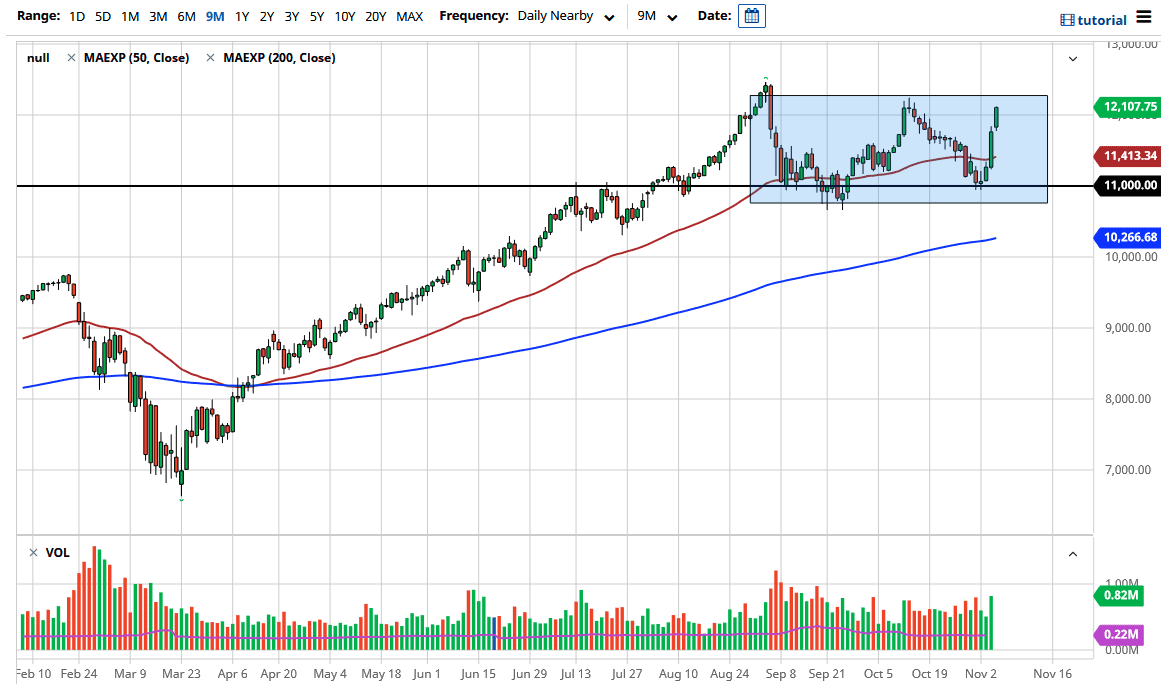

The NASDAQ 100 looks like it is a little bit stretched, and it is probably worth noting that we are at the top of the overall recent trading range. If that is the case, then the fact that we have the jobs number coming on Friday of course will capture a lot of attention. We could get the market breaking out from this point and if we do make a fresh, new high it opens up the possibility of a move towards the 13,000 level rather quickly.

Pullbacks at this point will probably continue to find plenty of buyers at the first signs of support, and beyond that I see plenty of areas where we would probably continue to find it. Having said that, if we go into the weekend without some type of resolution to the US election ballot count, that could cause some issues, at least in the short term. As far as I can tell, this thing could drag out a while, much like the election in 2000.

All things being equal, the NASDAQ 100 is getting a bit of a boost due to the same handful of stocks again, as people start to focus on the fact that economies around the world locking down and it is assume that we will go back into the “work from home” stocks. As you know, the index has nothing to do with trading 100 stocks, and everything to do with the trading something like seven. Those are all the usual stocks, so pay attention Netflix, Facebook, Alphabet, Microsoft, and so on. As long as everybody is buying those cult stocks again, this market will continue to go higher. Having said that, we are a bit of her stretched so do not be surprised at all to see some type of pullback, and quite frankly I think the market will probably look at that as a potential buying opportunity. At this point though, you would be chasing the trade so at the very least you need to see whether or not we can break out. If we do break out, then you look for short-term pullback. Covering 1100 points in just three days typically means that exhaustion is coming.