Stalled gains in the US dollar and global stock markets contributed to the rebound in gold price from its lowest levels in five weeks at $1851 an ounce to $1890 an ounce. Amid an American holiday yesterday, gains did not exceed $1885, and returned to stability around the support level at $1865 at the time of writing. The yellow metal is awaiting the developments in the hotly contested U.S. elections, developments in the Brexit negotiations, the strength of the second coronavirus wave and the successive announcements of vaccines to confront this epidemic, in addition to the USD performance and the extent of investors’ risk appetite.

Gold price (XAU/USD) bounced higher on stopping sharp gains in global stocks.

Gold is trading on the back of a major news event that affected safe haven investments: a vaccine for COVID-19 with a success rate of 90% has passed clinical trials. This led to the rise in stock prices and the subsequent collapse of gold prices. Pfizer's COVID-19 vaccine has not been approved by the US Food and Drug Administration, but it has already made waves with renewed hope for a return to normal life. Many stocks will benefit from this, which in turn will lower the price of gold.

The price of gold is also affected by the renewed market optimism amid the media's declaration of Joe Biden as the 46th President of the United States. However, incumbent President Donald Trump continues to pursue legal action amid allegations of US election fraud.

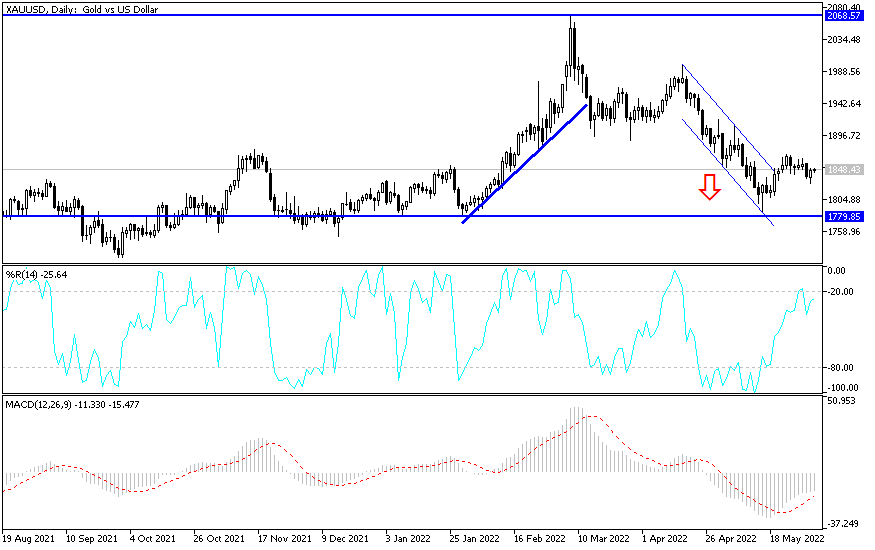

Technical analysis of gold:

In the short term, according to the recent performance of the gold price on the hourly chart, it has recovered from the collapse at the beginning of this week’s transactions. The yellow metal price is now trading away from the 23.60% Fibonacci retracement level on its way up, but is still facing strong downward pressure. Therefore, the bulls will look to build on this bounce by targeting profits at around $1883 or higher at 38.20% Fibonacci at $1895. On the other hand, bears will be looking to maintain control on the short term by targeting profits at around $1864 or below at 0.00% Fibonacci at $1850.

In the long term, and according to the performance on the daily chart, it appears that the price of the yellow metal is trading within a falling wedge. The XAU/USD pair is now locked below the 100-day simple moving average. The 200-day simple moving average is found at several levels below. Accordingly, the bears will look to achieve long-term profits at 50% and 61.80% Fibonacci levels at $1767 and $1696 respectively. On the other hand, the bulls will target profits at 23.60% Fibonacci at $1.926 or higher at $2071.

Today's economic calendar:

The price of gold will be affected today by the announcement of the rate of growth of the British economy and the reaction to the dollar from the announcement of US inflation figures and unemployed claims, followed by statements by Lagarde, Jerome Powell and the governor of the Bank of England.