The gold performance was disappointing during last week's trading as the sales increased strongly. Last Monday’s session was the most prominent in the downtrend correction path, as the gold price fell in that session by more than $100 an ounce. The price of gold collapsed from $1966 an ounce to $1850 an ounce, its lowest level in nearly two months. Gold investors tried to seize the opportunity to buy back, but the strength of the US dollar prevented the price of gold from not returning to the $1900 psychological resistance again. Therefore, rebound gains did not exceed the resistance by $1897 an ounce and closed the week's trading stable around the $18890, waiting for any developments.

What is the reason for the drop in gold prices? The main and strongest reason was announcing the US election results as well as Pfizer and BioNTech announcing a 90% efficiency rate for the COVID-19 vaccine. While the results are preliminary, they looks promising not only for these companies - but also for three other efforts using the mRNA approach. Then, gold rose in the hope of obtaining additional financial incentives, but with the odds of returning to normal conditions, the desire for additional funds weakened. Therefore, XAU/USD declined in response to below $1850 an ounce.

On the other hand, the epidemic continues to hit the northern hemisphere with rising cases in Japan, an increase in European deaths and a record hospitalization record in the United States of America. This forced Jerome Powell, Chairman of the Federal Reserve, to stress the need for more support from both global central banks and governments.

Democratic Candidate Joe Biden is projected to win the US election, but his party is unlikely to have a majority in the Senate, which is necessary to pass ambitious support for the US economy. Trump has ordered the White House to back off talks on a new relief package, leaving the job to Republican lawmakers, who appear reluctant to strike a deal with Democrats. The stalemate in Washington also limited the rise in gold prices.

After the announcement by Pfizer, international pharmaceutical companies were quick to announce the strength and effectiveness of their vaccines. The spotlight is expected to be on an upcoming advertisement from Massachusetts-based Moderna. If its potency levels are comparable to those of Pfizer/BioNTech, the price of the yellow metal will take another hit, as the company indicated that the rapid spread of the coronavirus in the United States exposed more of the participants in the experiment to the disease.

Gold (XAU/USD) traders should watch the COVID-19 statistics, especially in the US. If cases, hospitalizations, and deaths continue on their upward trajectory, state governors can impose new restrictions. In return, that would prompt lawmakers to come out with an emergency financial relief package - which might boost the price of gold.

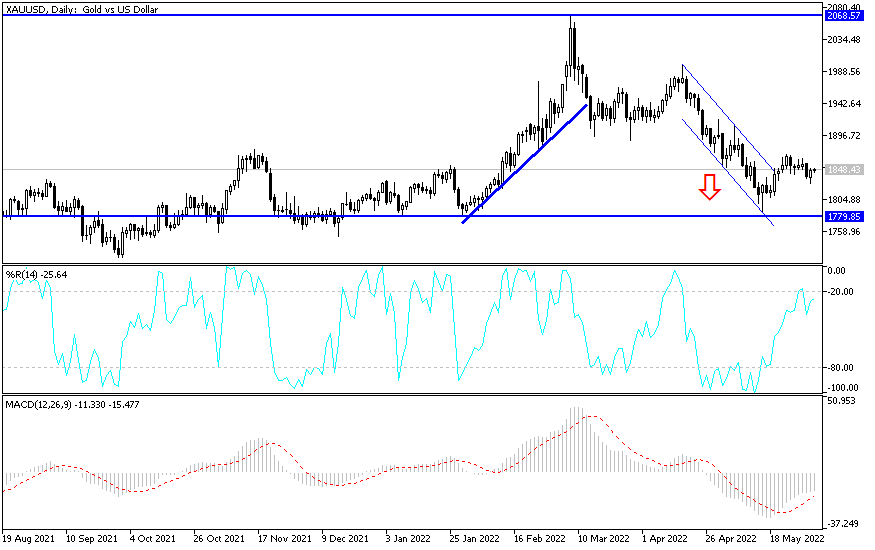

Technical analysis of gold:

The price of gold has fallen below the simple 50-day and 100-day moving averages and is still experiencing some downward momentum - there are still bearish signals. On the other hand, gold is trading above the 200-day simple moving average. Support awaits at $1,860, which was a solid support in late October. The next level to watch is $1,850, which is a double bottom after stopping the decline in November and September, taking into consideration the support levels at 1820 and 1790, respectively.

To the upside, the most prominent resistance is currently located at $1905, which is where the 50-day and 100-day simple moving averages meet. The next maximum is expected at $1935, from which it contributed to the decline in gold prices twice in recent weeks. The next barrier is at $1965, the highest point in November. After that, focus will be on the resistance levels at 1995 and 2025, respectively.

Most Forex analysts expect more pressure in the short term, followed by stability in the medium term and then a rally in the long term. More corporate announcements of competitive successes for coronavirus vaccines will increase the pressure on gold.