Investors are taking risks amid news of developing COVID-19 vaccines and as Trump begins to coordinate a peaceful transition of the US presidency to Biden. Global stock markets have moved to record levels, led by the U.S markets. This enabled the bears to push the gold to psychological support levels on the threshold of support at $1800 an ounce, its lowest level in four months. Gold is trying to avoid a further collapse and has stabilized since yesterday around $1815 an ounce. The financial markets are still pricing on recent updates regarding potential COVID-19 vaccines. Investors are also absorbing a large amount of economic data released yesterday. What contributed to the relatively halting losses in the price of gold was the drop of the US dollar amid prospects of the upcoming US stimulus plan.

As for prices of other metals, silver futures closed trading slightly higher, at $23.36 an ounce, while copper futures settled at $3.3095 a pound.

According to data released by the US Labor Department, claims for US unemployment benefits increased unexpectedly in the week ending November 21, jumping to 778,000, an increase of 30,000 from the previous week's revised level of 748,000. Economists had expected claims to drop. Unemployment is down to 730,000 from 742,000 reported in the previous week.

A report from the US Commerce Department said US durable goods orders jumped 1.3% in October after rising 2.1% in September, while economists had expected durable goods orders to increase 0.9%. Another report showed that the rise in the US GDP growth rate in the third quarter was 33.1%, unedited from the initial estimate. Personal income in the US was reported to drop by -0.7% in October after rising by 0.7%, revised downward from September. Economists had expected personal income to remain unchanged compared to the 0.9% increase originally reported for the previous month. Meanwhile, the report also said that personal spending increased 0.5% in October after jumping by a revised 1.2% in September.

In an impressive positive note, an official report stated that US new home sales unexpectedly declined by 0.3% to an annual rate of 999,000 in October after rising 0.1% to a revised rate of 1.002 million in September. The revised data released by the University of Michigan showed that US consumer confidence deteriorated slightly more than expected in November, as the index came in at 76.9, down from the initial reading of 77.0.

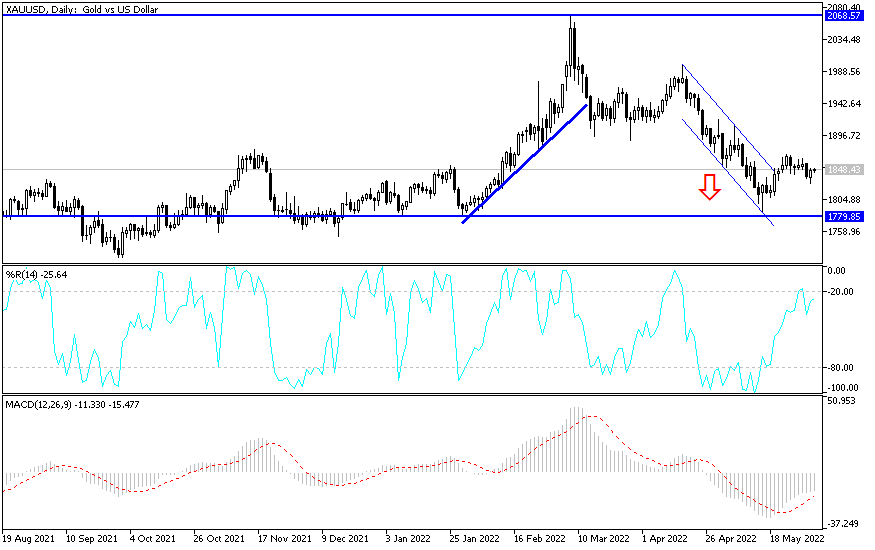

Technical analysis of gold:

The recent collapse of the price of gold, especially if its losses extend below the level of support of $1800 an ounce, will push technical indicators to oversold areas. Therefore, gold investors should think about setting buying at levels that are currently closest to 1785, 1777 and 1760, respectively. Despite market optimism, which reached its peak recently, I still see that buying gold is better than thinking about selling it from its recent drop. According to the performance on the daily chart, breaking through the resistance at $1845 an ounce will be important for the bulls to regain control.

I expect a limited price movement for gold today amid the Thanksgiving holiday, which weakens liquidity in the markets and keeps investors from engaging in adventure.