Gold prices are on their way down for the second week in a row as investors chase stocks again following more news of coronavirus vaccines. The price of gold is trading today around $1803 an ounce at the time of writing, its lowest level in four months. Throughout this year, gold prices gained 25 percent. At the beginning of August, the price of gold jumped to $2075 an ounce, its highest price in history, with the collapse of global stock markets.

However, this rally has slowed in recent weeks as the price of gold fell sharply amid improved investor sentiment, a return to risk appetite and global stock indices going into record areas.

Pharmaceutical company Moderna said on Monday that its coronavirus vaccine has proven to be 95% effective, a week after Pfizer announced its vaccine. Both announcements have pushed financial markets up amid hopes that there will be an end to the disruption caused by the COVID-19 pandemic. Commenting on this, Stephen Innes, Chief Global Market Strategist at Axi, said that optimism about the vaccine will see investors abandoning speculative bets on the yellow metal. "News about another vaccine is very welcome, but it is directly negative for bullion prices, and with many of them in the pipeline, it will support more sales of gold," he said.

In addition, calls by US Treasury Secretary Steve Mnuchin to the Federal Reserve to end epidemic lending programs have affected gold prices. In a letter to Federal Reserve Chairman Jerome Powell, Mnuchin said that the $455 billion allocated to the Treasury should be returned to Congress for spending as it sees fit.

Due to the COVID-19 epidemic outbreak this year, stock dividends from the world's largest companies will decline in 2020 by about 17.5% to 20%, equivalent to $263 billion, though they might bounce back strongly next year. It will be the biggest decline since 2009 at the beginning of the global financial crisis.

Dividends happen to be the main source of profits for both private and public pension financing. Companies trying to deal with COVID-19 split it by at least 11.4%, or $55 billion, during the third quarter. This came after a 22%, or $108 billion, drop between April and June, when hesitation about the evolution of the coronavirus peaked.

But some companies that cut payments have re-instated them, although their levels are lower, while vaccine inventions also gave hope for a recovery in 2021. This was the saddest year since the global financial crisis. However, if life begins to return to normal, even some of the hardest hit companies in the retail, travel and entertainment industries will be in a position to start paying dividends.

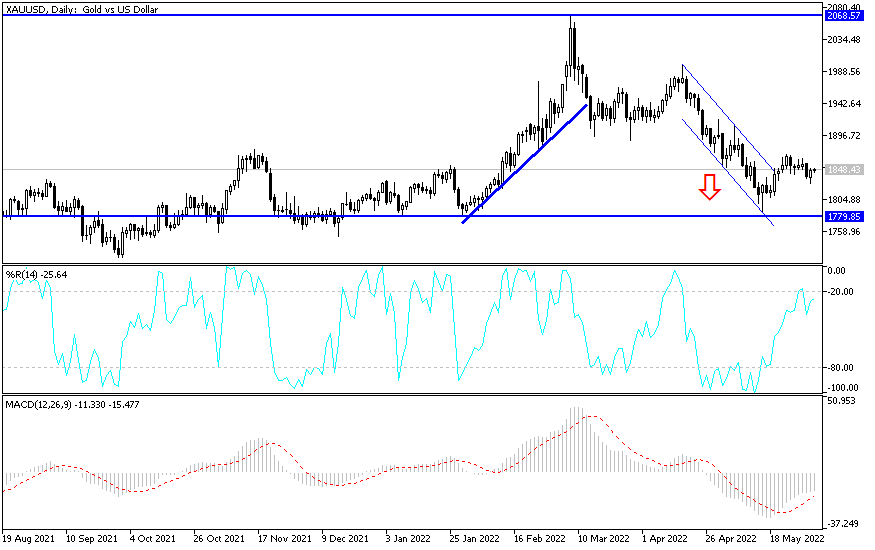

Technical analysis of gold:

As I expected before, the movement of the gold price towards the support at $1800 an ounce will turn the general trend into a downward one, and therefore bears will gain control and prices will move towards stronger support levels. But at the same time, it will be an opportunity for gold investors to start thinking about buying gold again. Accordingly, the most important support levels for gold will be 1795, 1777 and 1760. I still prefer to buy gold from every lower level. Despite the positive news of the vaccines results, production and distribution will take time. Pricing for the US election results and coronavirus vaccines is nearing completion. Investors in the coming period will focus on the economic reaction from the closure due to the second wave of COVID-19. On the upside, bulls will have a better opportunity to control performance again in the event that the gold price moves towards 1833, 1845 and 1880 levels, respectively.

In addition to the extent of investors' risk appetite, the price of gold will be affected today by the US economic calendar data, as the US GDP growth rate, unemployment claims, durable goods orders, consumer confidence, new US home sales, and the content of the last Federal Reserve Bank meeting will be announced before tomorrow’s Thanksgiving holiday.