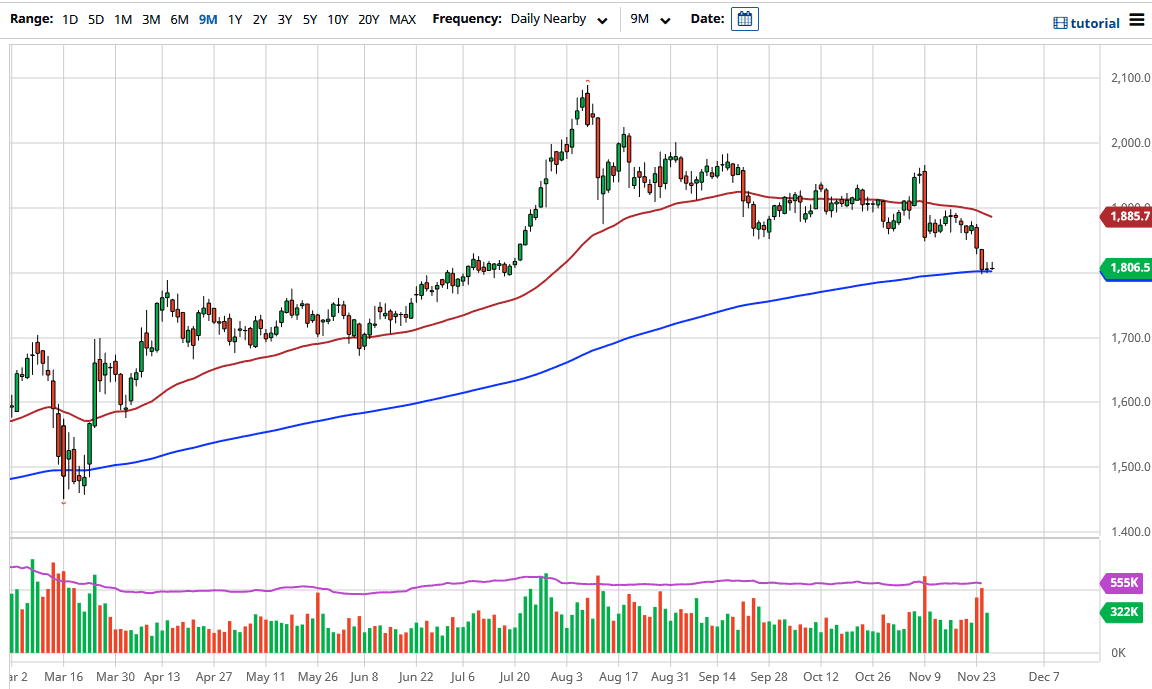

The market is sitting on the 200 day EMA, which of course is an area that a lot of people will pay attention to. Beyond that, the $1800 level is a large, round, psychologically significant figure, which is an area that will attract a certain amount of attention. Furthermore, this is an area where the market had broken out of previously, and now we are starting to retest it to see whether or not it is going to hold.

The candlesticks of the last couple of days have shown a bit of exhaustion every time we rally, but I think at this point in time you have to keep in mind that the volume simply will not have been there. Friday will probably be more of the same, because most traders do not come back until the following week, at least in the United States where the bulk of the gold trading will be done. Ultimately, this is an area that could be very influential as to where we go over the next several weeks.

If we were to break down below the $1800 level, we could go looking toward $1700 rather quickly. That would probably accompany some type of strengthening of the US dollar, but recently we have seen the US dollar get sold into, so if that is the case it could very well be a catalyst for higher gold prices eventually. With all of the central bank liquidity measures out there it would make sense that gold would go higher over the longer term, but we needed to come back down from extreme highs. Now that we have done that, the question is whether or not we can continue the longer-term uptrend. I do believe that eventually we will but at this point in time the market is likely to see some decisions being made. If we can break above the highs of the last couple of sessions, I think that could be the signal that gold starts to go back to the upside. More than likely we would see the $1850 level targeted next, and then eventually the 50 day EMA after that. All things being equal, this pullback could end up being a longer-term buying opportunity.