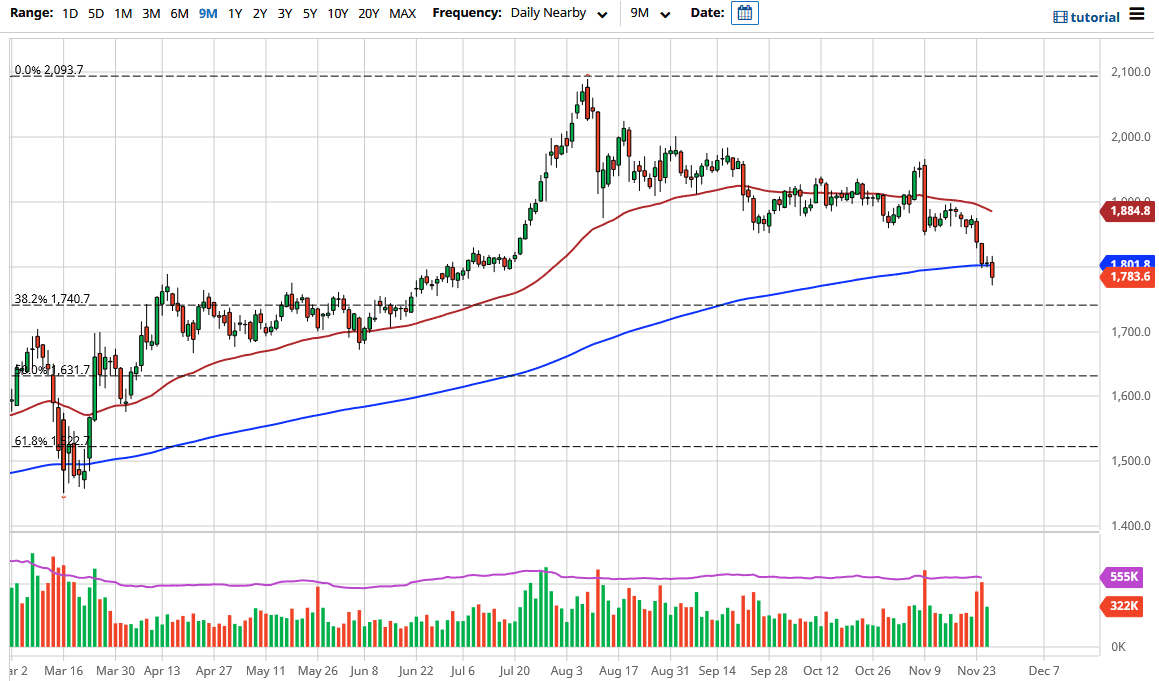

The gold markets initially tried to rally during the trading session on Friday but then broke down significantly. Note how the market turned around a lot during the end of the day, forming a bit of a hammer that sits just below the 200-day EMA. These are going to be a very interesting couple of candlesticks on the daily chart to trade.

If we can break above the candle from both the Thursday and Friday sessions, then gold is likely to continue going higher. At that point, the market would probably go looking towards the $1880 level, possibly even the 50-day EMA. We have had a rather significant pullback from the highs, and a lot of the bullish pressure has been digested. The question now is whether or not there will be a catalyst that will continue to push gold to the upside. I suspect that with the US dollar falling in a “risk on” trade, that may eventually start to push gold back up, despite the fact that the safety trade just unwound. If we get a negative headline, we could see a rush back into gold as well. Let's face it: there are plenty of opportunities for a potential black swan event.

If we break down below the bottom of the candlestick for the Friday session, then gold could continue to go lower, perhaps opening up the possibility of a move down to $1700. That is an area that has been important in the past, so at that juncture we might see buyers come back into the market. The daily close will be important, so I am not simply going to jump into the market as soon as it makes a move. I would rather see a daily close, especially to the upside, as it would be the beginning of what would be a longer-term trade. I do like gold longer term, due to the fact that central banks around the world continue to flood the markets with liquidity. That tends to lift the value of precious metals in general, with gold being the first place people put money to work.