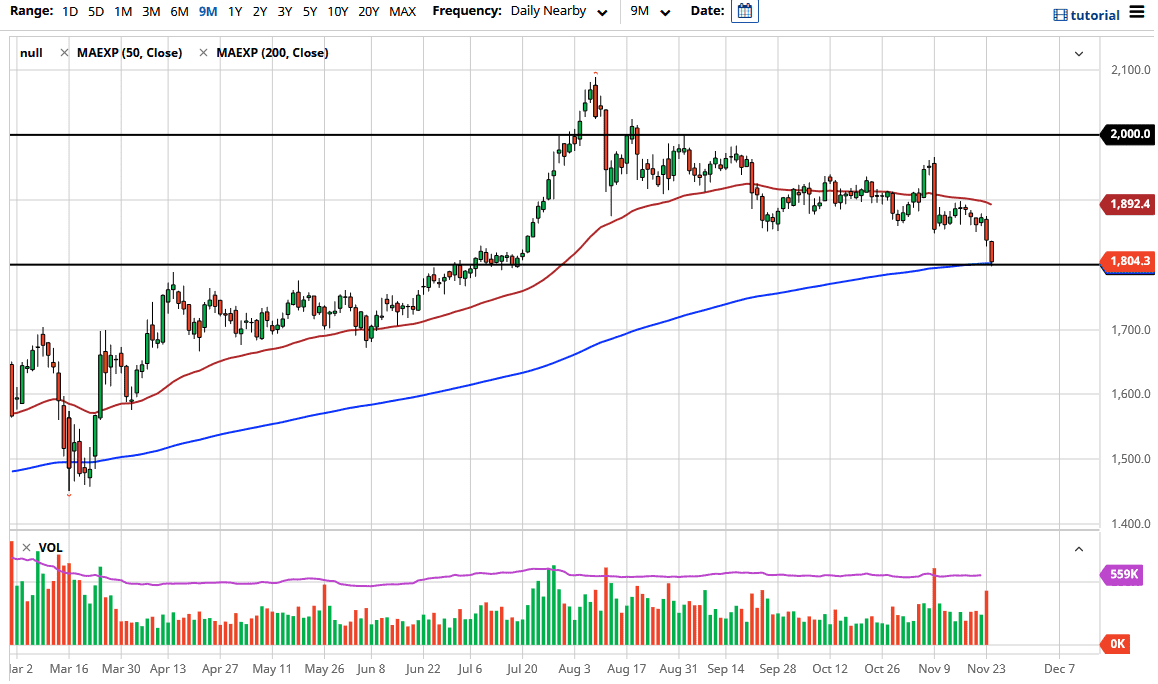

Gold markets got absolutely crushed during the trading session on Tuesday as we reached down towards the $1800 level. That is a large, round, psychologically significant figure, but if you have been following my analyses for some time you know that this is an area in which I was very interested.

Looking at this chart, it is obvious that many people will be paying attention to this region because we had broken out from it to reach towards the highs and now are testing it again for support. Furthermore, it is not only a large, round, psychologically significant figure, but it is also where we see the 200-day EMA, which is one of the most widely followed longer-term indicators. As long as we can stay above the 200-day EMA, then you can make an argument for being in a longer-term uptrend. However, I am in no rush to jump in with both feet.

Over the longer term we will see central bank intervention continue to push gold markets higher, but the question is whether or not we will find that push here. After all, this market is thinner than some of the other currencies out there - yes, gold is a currency - so it does tend to overexaggerate from time to time. The markets will eventually return to the idea of central bank liquidity causing an issue, but right now it is likely that the US dollar will possibly be one of the main drivers. If the US dollar starts to take off to the upside, that could continue to weigh on gold in the short term. If we break down below the 200-day EMA on a daily close, we could go down to the $1700 level next. After that, it is hard to tell where we will end up. One thing is for certain: the US dollar will be front and center when it comes down to what happens with the gold markets next. Keep in mind that this is Thanksgiving week, and we are now getting very close to the holiday; meaning, liquidity may come into the picture, and as a result some of the moves may have been exaggerated.