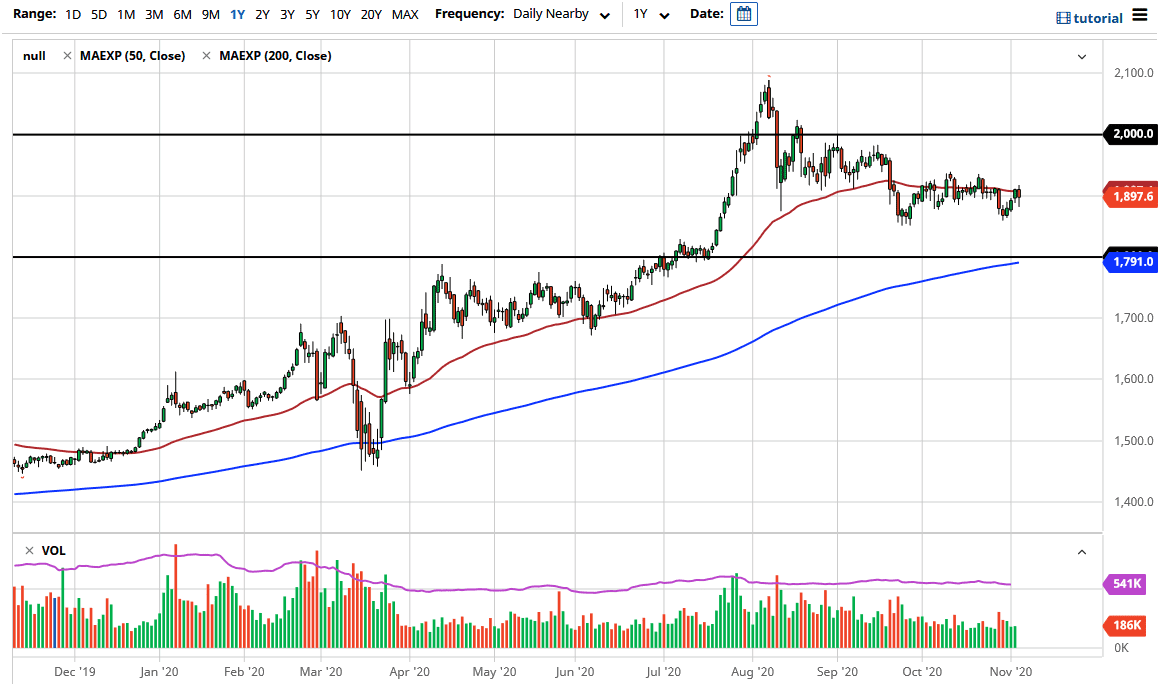

Gold markets have fluctuated during the trading session on Tuesday, as the $1900 level continues to be a magnet for price. You could consider that to be “fair value”, as we continue to go back and forth from that level multiple times. The candlestick for the trading session on Wednesday does look like a hammer, and I think we will hear a lot of noise. The $1850 level underneath is support based upon the last couple of bounces. If we can break down below there, then start looking towards the” ultimate buying area”.

To the downside, the 200-day EMA is reaching towards the $1800 level, which is a large, round and psychologically significant figure, as well as the scene of a major breakout previously. It is likely that we continue to see action with some type of stability before we can start buying. The market is paying close attention to the idea of stimulus, since the US dollar will be moved by that. After the mess that has been the US election, the House of Representatives, although Democrat, has become a bit more Republican. The Senate has remained a Republican majority, and it looks as if Joe Biden might be the president. (At this point, nothing has been completely decided.) In that case, stimulus is going to be smaller than people originally thought.

In hindsight, gold markets probably need to go back towards the 200-day EMA anyway, so this might be the excuse that we need. However, if we break above the $1950 level, then it is possible that we could go looking towards the $1975 level. After that, the market looks like it could go to the $2000 level. Gold markets have been in a slide for a while, but we had also recently seen a massive bullish market. If the US dollar falls, that should help the gold market; but the question now is whether or not we have enough stimulus - or perhaps fear - to drive gold higher. I think it may take some time to get there.