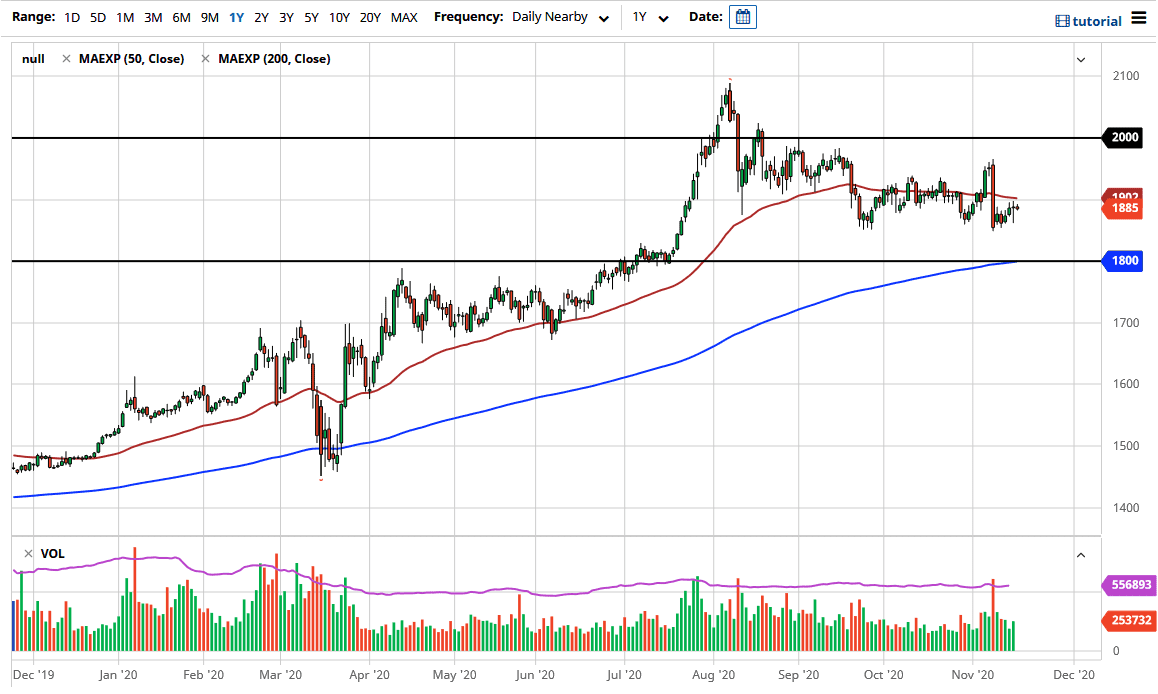

Gold markets continue to grind sideways overall during the trading session on Tuesday, only to see a slight dip lower at the end of the day. We continue to trade right around the $1880 level, sitting on top of significant support underneath. The $1850 level should be massive support, as it has been multiple times. There is also plenty of support below there as well. In other words, no matter how bad gold starts to look, I like the idea of waiting for a pullback in order to take advantage of “cheap gold.” The market is likely to continue to pay close attention to the area underneath, perhaps down to the $1800 level, as it has been so important previously.

Looking at this chart, the 200-day EMA sits at the $1800 level, so it should be watched closely. The $1800 level is an area from which we had broken out previously, so people will pay close attention. Any type of support for the daily candlestick in that area would be a very bullish sign for me, and I would be all over the idea of going long at that point. But I do think that given enough time we will see value hunters come back in and pick up gold.

Gold has plenty of reasons to go higher, not the least of which is the behavior of international central banks who continue to flood the markets with liquidity, which will drive up the value of gold given enough time. This is because they can drive up the asset prices globally, and thereby eventually driving up inflation. The market is likely to continue to drift lower in the short term, but then eventually find buyers once we rebalance the market. We are still a bit overdone, so I am not excited about buying quite yet. However, if we broke above the 50-day EMA I would have to consider going long, as it would clear the large figure. Then I would expect the market to go looking towards $1950 level which is the next big figure that matters psychologically.