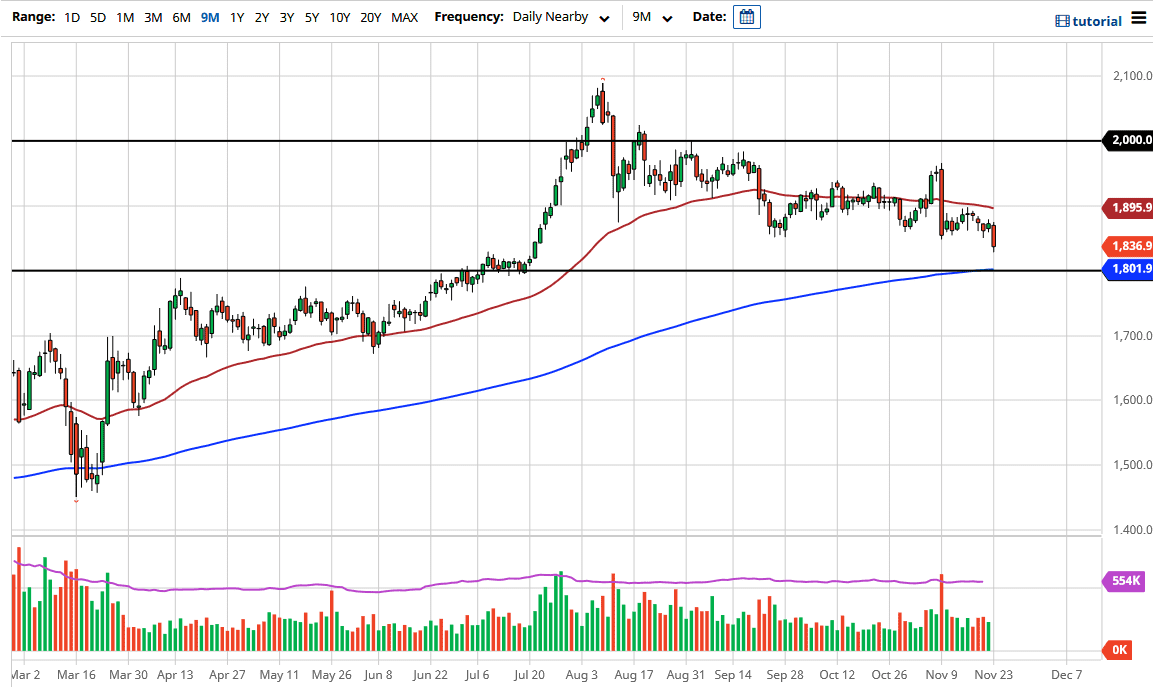

Gold markets have broken down below the recent support at the $1850 level, an area that has been relatively reliable as of late. We are likely to go down towards the $1800 level next as it is a large, round, psychologically significant figure and a place from which we broke out previously.

A large cause of this move during the trading session was a major “risk off event” in the form of the Brexit talks stalling again. This sent people running towards the US dollar, which has a negative correlation with the gold market as of late. Because of this, people got a bit concerned about the possibility of the US dollar weighing on the contract, and money flows out of the gold market and into cash when these moves occur. There is an obvious support level underneath that I think will continue to attract a lot of attention and I will be paying close attention to it myself.

The $1800 level is the scene of a major breakout previously, and it does make sense that we need to retest that area as market memory comes into play. Furthermore, the 200-day EMA sits there as well, and it is a large, round, psychologically significant figure, so there are many things going on at the same time that should continue to move this market. I will be very interested in seeing what the daily candlestick looks like once we get down there and will be paying close attention to it. If we get something along the lines of a hammer or bullish engulfing candlestick, I will jump headfirst into the gold market.

However, if we were to break down below the $1800 level without much in the way of support, that could lead to much darker days for the precious metal. It is difficult to imagine that the gold market would simply fall apart, because there are so many concerns around the world right now that we would continue to see demand for gold as a safe haven play. Yes, the US dollar could get a pickup as well, but this is a market that will offer value given enough time.